730 Precompilato 2024, the Italian tax authority’s pre-filled tax return, is here to make tax filing easier than ever. This comprehensive guide provides an overview of the key features, changes, and benefits of the 730 Precompilato 2024, empowering you to navigate the tax declaration process with confidence.

The 730 Precompilato 2024 streamlines the tax filing process by automatically populating your tax return with data from various sources, reducing the risk of errors and ensuring accuracy. With its user-friendly interface and step-by-step instructions, filing your taxes has never been so convenient.

– Explain the purpose and significance of the 730 Precompilato 2024.

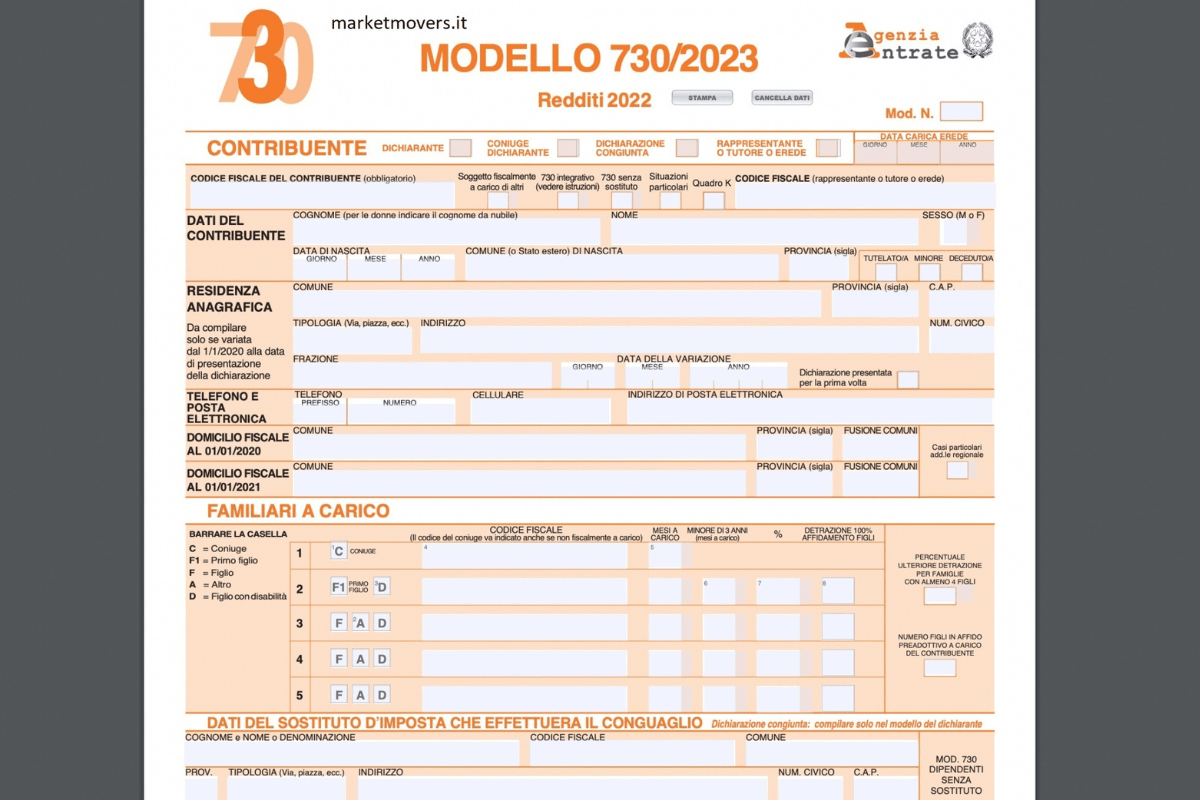

The 730 Precompilato is an annual tax declaration form in Italy that is pre-filled with information from various sources, such as employers, banks, and government agencies. It is designed to simplify the tax filing process and reduce errors.

The 730 Precompilato 2024 is the latest version of the form, and it includes several key changes that are intended to make it even easier to use. These changes include:

- A new simplified interface that makes it easier to navigate the form.

- The addition of new fields that allow taxpayers to declare additional income and deductions.

- Improved error checking that helps to identify and correct errors before the form is submitted.

The 730 Precompilato 2024 is a valuable tool that can help taxpayers to file their taxes accurately and efficiently. It is important to understand the purpose and significance of the form, as well as the key changes that have been introduced in the 2024 version.

Timeline for the submission process.

The 730 Precompilato 2024 can be submitted from April 15, 2024 to September 30, 2024. The deadline for submitting the form is different for taxpayers who are required to file a tax return and those who are not required to file a tax return.

- Taxpayers who are required to file a tax return must submit the 730 Precompilato 2024 by July 31, 2024.

- Taxpayers who are not required to file a tax return can submit the 730 Precompilato 2024 by September 30, 2024.

It is important to note that the deadline for submitting the 730 Precompilato 2024 is different for taxpayers who live abroad. Taxpayers who live abroad must submit the 730 Precompilato 2024 by October 31, 2024.

– Income Declaration

The 730 Precompilato 2024 is a pre-filled tax return that includes information about your income, deductions, and tax credits. This information is gathered from various sources, such as your employer, bank, and investment companies.

The purpose of the 730 Precompilato is to make it easier for you to file your taxes. By providing you with pre-filled information, you can avoid the hassle of gathering all of your tax documents and manually entering the data into your tax return.

It is important to review the information in the 730 Precompilato carefully and make sure that it is accurate. If you find any errors, you can correct them before you file your tax return.

Types of Income

The following types of income must be declared in the 730 Precompilato 2024:

* Employment income

* Self-employment income

* Investment income

* Rental income

* Other sources of income

Employment Income

Employment income includes wages, salaries, bonuses, commissions, and other forms of compensation that you receive from your job. This information is typically reported on your Form 1040.

Self-Employment Income

Self-employment income includes income that you earn from your own business or trade. This information is typically reported on your Schedule C.

Investment Income

Investment income includes interest, dividends, and capital gains. This information is typically reported on your Form 1099-INT and Form 1099-DIV.

Rental Income

Rental income includes income that you earn from renting out property. This information is typically reported on your Schedule E.

Other Sources of Income

Other sources of income include income that you earn from sources other than employment, self-employment, investments, or rental property. This could include income from gambling, prizes, or awards.

Reporting Income Not Included in the 730 Precompilato

If you have income that is not included in the 730 Precompilato, you will need to report it on your tax return. This could include foreign income or income from occasional work.

Consequences of Failing to Declare Income Correctly

Failing to declare income correctly can result in penalties and interest charges. In some cases, you could also be subject to criminal prosecution.

Deductions and Tax Credits

Deductions and tax credits are valuable tools that can reduce your taxable income and increase your tax refund. Understanding the different types of deductions and credits available can help you maximize your tax savings.

There are two main types of deductions: above-the-line deductions and itemized deductions. Above-the-line deductions are subtracted from your gross income before you calculate your taxable income. Itemized deductions are subtracted from your taxable income after you calculate your gross income.

There are also two main types of tax credits: refundable tax credits and nonrefundable tax credits. Refundable tax credits are paid to you even if you do not owe any taxes. Nonrefundable tax credits reduce your tax liability dollar for dollar, but they cannot be refunded to you.

Eligible Deductions

Some common eligible deductions include:

- Medical expenses that exceed 10% of your adjusted gross income (AGI)

- State and local income taxes

- Property taxes

- Mortgage interest

- Charitable contributions

Eligible Tax Credits

Some common eligible tax credits include:

- Earned income tax credit (EITC)

- Child tax credit (CTC)

- Adoption credit

- Saver’s credit

- Lifetime learning credit

The table below summarizes the deductions and credits discussed above, including eligibility criteria and potential tax savings.

| Deduction/Credit | Eligibility Criteria | Potential Tax Savings |

|---|---|---|

| Medical expenses | Medical expenses that exceed 10% of your AGI | Varies depending on your medical expenses and AGI |

| State and local income taxes | State and local income taxes paid | Varies depending on your state and local tax rates |

| Property taxes | Property taxes paid | Varies depending on your property taxes |

| Mortgage interest | Mortgage interest paid on a qualified home | Varies depending on your mortgage interest and loan amount |

| Charitable contributions | Charitable contributions made to qualified organizations | Varies depending on your charitable contributions and AGI |

| EITC | Low- and moderate-income working individuals and families | Up to $6,935 (2023) |

| CTC | Parents and guardians of qualifying children | Up to $2,000 per qualifying child (2023) |

| Adoption credit | Individuals who adopt eligible children | Up to $14,890 per eligible child (2023) |

| Saver’s credit | Low- and moderate-income individuals who save for retirement | Up to $1,000 (2023) |

| Lifetime learning credit | Individuals who pay qualified education expenses | Up to $2,500 (2023) |

Deductions and tax credits can significantly reduce your taxable income and increase your tax refund. By understanding the different types of deductions and credits available, you can make sure you are taking advantage of all the tax savings you are entitled to.

For more information about deductions and credits, you can visit the IRS website or speak with a tax professional.

Tax Calculation

The 730 Precompilato calculates your tax liability based on your income and deductions. The tax calculation process involves several steps:

1. Determine your taxable income by subtracting allowable deductions from your total income.

2. Apply the appropriate tax rates to your taxable income to calculate your gross tax liability.

3. Deduct any tax credits from your gross tax liability to arrive at your final tax liability.

Taxable Income

Your taxable income is your total income minus any allowable deductions. Allowable deductions include:

- Personal expenses, such as medical expenses, interest on mortgages, and charitable donations

- Business expenses, such as travel expenses, equipment costs, and depreciation

Tax Rates

The Italian tax system uses a progressive tax rate structure, which means that the higher your taxable income, the higher the percentage of tax you pay.

| Taxable Income | Tax Rate |

|---|---|

| Up to €15,000 | 23% |

| €15,001 to €28,000 | 27% |

| €28,001 to €55,000 | 38% |

| €55,001 to €75,000 | 41% |

| Over €75,000 | 43% |

Tax Credits

Tax credits are amounts that you can deduct from your gross tax liability. Common tax credits include:

- Child tax credit

- Dependent care credit

- Earned income tax credit

Calculating Your Tax Liability

To calculate your tax liability, follow these steps:

- Determine your taxable income.

- Apply the appropriate tax rates to your taxable income to calculate your gross tax liability.

- Deduct any tax credits from your gross tax liability to arrive at your final tax liability.

For example, if your taxable income is €30,000 and you have no tax credits, your gross tax liability would be €8,100 (30,000 x 0.27). If you have a child tax credit of €1,000, your final tax liability would be €7,100 (8,100 – 1,000).

Find out further about the benefits of Pauline Hanson Faruqi that can provide significant benefits.

– Provide a detailed list of payment options, including online, bank transfer, and postal options.

To ensure the smooth and timely payment of your taxes, various payment options are available. Each option offers its own advantages and disadvantages, catering to different preferences and circumstances. Let’s explore these options in detail:

Online Payment

- Convenience: Pay anytime, anywhere, from the comfort of your home or office.

- Efficiency: Instant processing, eliminating delays associated with traditional methods.

- Security: Secure online gateways protect your financial information.

- Transaction Records: Digital receipts provide easy access to payment details.

Bank Transfer

- Control: Allows for direct transfer from your bank account, providing a sense of control over the payment process.

- Widely Accepted: Most banks and financial institutions offer bank transfer services.

- Proof of Payment: Bank statements serve as official documentation of the transaction.

Postal Payment, 730 precompilato 2024

- Traditional Method: Familiar and accessible for those who prefer a more conventional approach.

- Physical Proof: Postal receipts offer tangible evidence of payment.

Errors and Amendments

The 730 Precompilato 2024 provides mechanisms for taxpayers to identify and rectify errors, ensuring the accuracy of their tax declarations. Understanding the process for error correction and amendment filing is crucial for maintaining compliance and avoiding penalties.

Errors in the pre-filled declaration can arise due to various reasons, such as incorrect data transfer from the tax authority’s database or mistakes made by the taxpayer during the initial submission. It is essential to carefully review the pre-filled information and identify any discrepancies.

Error Identification

Taxpayers can identify errors by comparing the pre-filled data with their own records, such as income statements, expense receipts, and tax documents. Discrepancies or missing information should be noted for further action.

Error Correction

Once errors are identified, taxpayers can make corrections directly through the online platform provided by the tax authority. The platform allows taxpayers to modify pre-filled data, add missing information, and rectify any inaccuracies.

Amendment Filing

In cases where errors are discovered after the initial submission, taxpayers can file an amendment to correct the declaration. The amendment process involves submitting a revised tax return that includes the corrected information.

Amendments can be filed electronically through the tax authority’s online portal or by submitting a paper form. The specific requirements and procedures for filing amendments may vary depending on the tax jurisdiction.

– the potential penalties for late filing or incorrect submissions, including fines, interest, and other administrative sanctions.

Failure to comply with the 730 Precompilato 2024 requirements can result in penalties and consequences. These may include:

– Fines for late filing or incorrect submissions

– Interest on unpaid taxes

– Suspension of tax benefits

– Initiation of legal proceedings

The table below summarizes the penalties and consequences for different types of violations:

| Violation | Penalty |

|—|—|

| Late filing | Fine of up to 250 euros |

| Incorrect submission | Fine of up to 500 euros |

| Failure to file | Fine of up to 1,000 euros |

If you receive a penalty or consequence, you have the right to appeal. The appeal process varies depending on the type of penalty or consequence.

To appeal a fine, you must file a written request to the tax authorities within 60 days of receiving the notice of penalty. The request must state the reasons for the appeal and provide any supporting documentation.

To appeal a suspension of tax benefits, you must file a written request to the tax authorities within 30 days of receiving the notice of suspension. The request must state the reasons for the appeal and provide any supporting documentation.

To appeal the initiation of legal proceedings, you must contact a lawyer.

It is important to file your 730 Precompilato 2024 on time and accurately to avoid penalties and consequences. Complying with the requirements can also help you to:

– Avoid paying unnecessary fines and interest

– Maintain your tax benefits

– Avoid the risk of legal proceedings

Comparison to Previous Years

The 730 Precompilato 2024 is the latest version of the pre-filled tax return provided by the Italian Revenue Agency. Compared to previous versions, it features several notable changes and updates:

Firstly, the 2024 version includes an updated database of income and deduction information. This means that the pre-filled return will be more accurate and comprehensive than in previous years. Additionally, the user interface has been redesigned to make it easier to navigate and complete the return.

Some of the specific changes in the 730 Precompilato 2024 include:

- The addition of a new section for reporting income from cryptocurrencies.

- The inclusion of a new tax credit for energy efficiency improvements.

- An increase in the standard deduction for medical expenses.

- A decrease in the tax rate for certain types of income.

These changes are designed to make the 730 Precompilato 2024 more user-friendly and accurate. Taxpayers should carefully review the changes and make sure that they are reporting all of their income and deductions correctly.

Impact on Taxpayers

The introduction of the 730 Precompilato 2024 is expected to have a significant impact on taxpayers in Italy. The new system aims to simplify the tax filing process and reduce errors, but it also presents certain challenges and may affect specific groups of taxpayers differently.

Benefits and Challenges

One of the main benefits of the 730 Precompilato 2024 is the potential for increased accuracy and efficiency in tax filing. By pre-populating the tax return with data from various sources, such as employers, banks, and government agencies, the system reduces the risk of errors and omissions. This can save taxpayers time and effort, as well as reduce the likelihood of penalties for incorrect submissions.

However, the new system also presents some challenges. Taxpayers may need to familiarize themselves with the new interface and features of the online platform, and they may encounter technical issues or errors during the filing process. Additionally, the pre-populated data may not always be complete or accurate, and taxpayers will need to carefully review and verify the information before submitting their return.

Specific Groups of Taxpayers

The 730 Precompilato 2024 may have a particularly significant impact on certain groups of taxpayers, such as:

* Low-income taxpayers: The new system may make it easier for low-income taxpayers to file their returns and claim eligible tax credits and deductions.

* Self-employed individuals: Self-employed individuals may find it more challenging to use the pre-populated data, as their income and expenses may not be reported to the tax authorities in the same way as employees.

* Taxpayers with complex financial situations: Taxpayers with complex financial situations, such as those with multiple income sources or investments, may need to spend more time reviewing and verifying the pre-populated data to ensure accuracy.

Potential Impact on Tax Returns and Tax Liability

The 730 Precompilato 2024 has the potential to impact tax returns and tax liability in several ways:

* Reduced errors: By reducing errors in tax returns, the new system may lead to more accurate tax assessments and fewer disputes with the tax authorities.

* Increased tax liability: For taxpayers who have not been claiming all eligible deductions and credits, the pre-populated data may reveal additional tax liability.

* Reduced tax liability: Conversely, taxpayers who have been overpaying taxes may find that the pre-populated data results in a reduced tax liability.

Need for Taxpayer Education and Outreach

To ensure the successful implementation of the 730 Precompilato 2024, it is essential to provide taxpayers with clear and comprehensive information about the new system. Tax authorities and other stakeholders should engage in taxpayer education and outreach campaigns to explain the benefits and challenges of the new system, provide guidance on how to use the online platform, and address any concerns or questions that taxpayers may have.

Case Studies: 730 Precompilato 2024

The 730 Precompilato 2024 will have a significant impact on taxpayers, both individuals and businesses. The following case studies provide real-world examples of how the new rules and regulations will affect different types of taxpayers:

Case Study 1:

Impact on Self-Employed Individuals

- The 730 Precompilato 2024 will make it easier for self-employed individuals to file their taxes. The pre-filled tax return will include information on income, expenses, and deductions, which will save taxpayers time and effort.

- The new rules will also make it easier for self-employed individuals to claim tax credits and deductions. The pre-filled tax return will include a list of eligible tax credits and deductions, which will help taxpayers maximize their tax savings.

Best Practices for Compliance

Ensuring compliance with the 730 Precompilato 2024 is crucial to avoid penalties and ensure accurate tax reporting. Here are some best practices to follow:

Gather Necessary Documentation

Collect all necessary documents, such as income statements, expense receipts, and investment records, to support your tax return. Keep them organized and easily accessible.

Meet Deadlines

Adhere to the established deadlines for filing your 730 Precompilato. Late submissions may result in penalties and interest charges.

Consequences of Non-Compliance

Failure to comply with the 730 Precompilato requirements can lead to:

- Fines

- Interest charges

- Administrative sanctions

Key Deadlines and Requirements

| Deadline | Requirement |

|---|---|

| May 31, 2024 | Submit your 730 Precompilato |

| June 30, 2024 | Pay any outstanding taxes |

Checklist of Required Documents

- Income statements

- Expense receipts

- Investment records

- Proof of deductions and tax credits

Sample Letter for Requesting Missing Documentation

Dear [Client Name],

I am writing to request the following missing documentation for your 730 Precompilato 2024:

- [List of missing documents]

Please provide these documents as soon as possible. Your cooperation is greatly appreciated.

In this topic, you find that Humza Yousaf is very useful.

Sincerely,

[Your Name]

Resources for Further Information

Resources and Support

The Italian Revenue Agency (Agenzia delle Entrate) provides various resources and support services to assist taxpayers with questions or concerns about the 730 Precompilato 2024.

Taxpayer Assistance Centers

Taxpayers can visit their local Taxpayer Assistance Center (Centro di Assistenza Fiscale, CAF) for personalized guidance and support. CAFs are staffed by trained professionals who can provide information, answer questions, and assist with the 730 Precompilato submission process.

Online Resources

The Agenzia delle Entrate website offers a comprehensive range of online resources, including:

– FAQs and user guides

– Video tutorials

– Online chat support

– Interactive simulations

Contact Information

Taxpayers can contact the Agenzia delle Entrate by phone, email, or post:

– Phone: 800-909696

– Email: [email protected]

– Postal Address: Agenzia delle Entrate, Via Cristoforo Colombo, 416, 00144 Rome, Italy

Professional Advisors

Taxpayers may also seek professional advice from accountants, tax advisors, or lawyers who specialize in Italian tax matters. These professionals can provide tailored guidance and assist with complex tax situations.

FAQs

The 730 Precompilato 2024 has been designed to simplify the tax filing process for Italian taxpayers. To assist with any queries you may have, we have compiled a list of frequently asked questions (FAQs) and their corresponding answers.

This comprehensive guide will provide you with clear and concise information to help you navigate the 730 Precompilato 2024 process seamlessly.

How to access the 730 Precompilato 2024?

- Through the dedicated online platform of the Italian Revenue Agency (Agenzia delle Entrate).

- Via an intermediary, such as a tax professional, accountant, or commercialist.

What documents do I need to have before filing the 730 Precompilato 2024?

- Your codice fiscale (tax identification number).

- Proof of income, such as payslips, pension statements, or investment income statements.

- Details of any deductions or tax credits you are claiming.

What are the deadlines for filing the 730 Precompilato 2024?

The deadline for submitting the 730 Precompilato 2024 is typically in late September or early October of each year. The exact deadline may vary slightly from year to year, so it is advisable to check the official website of the Italian Revenue Agency for the most up-to-date information.

What are the benefits of using the 730 Precompilato 2024?

- Convenience and ease of use.

- Reduced risk of errors.

- Faster processing times.

- Potential for tax savings.

Final Review

Embrace the 730 Precompilato 2024 and simplify your tax declaration journey. By leveraging its pre-filled data, clear instructions, and streamlined process, you can save time, minimize errors, and ensure compliance with Italy’s tax regulations. Take advantage of this valuable tool and make tax filing a breeze.