The CAC 40, a barometer of the French economy, is a prominent stock market index that represents the performance of the 40 largest and most liquid companies listed on the Euronext Paris exchange. This index serves as a benchmark for investors seeking exposure to the French equity market, providing insights into the health and trajectory of the country’s economy.

Established in 1987, the CAC 40 has evolved over the years, reflecting the changing landscape of the French business sector. It offers investors a diversified portfolio, spanning various industries and sectors, including finance, energy, healthcare, and consumer goods. The index’s composition is regularly reviewed and adjusted to ensure it accurately represents the market’s dynamics.

Company Listings

The CAC 40 is a stock market index that tracks the performance of the 40 largest companies listed on the Euronext Paris exchange by market capitalization.

To be eligible for inclusion in the CAC 40, a company must meet the following criteria:

- Be a French company with its headquarters in France.

- Have a minimum market capitalization of €1 billion.

- Have a minimum trading volume of €10 million per day.

Top 10 Companies by Market Capitalization

| Rank | Company | Market Cap (€ billion) |

|---|---|---|

| 1 | LVMH | 398.9 |

| 2 | L’Oréal | 196.9 |

| 3 | Schneider Electric | 127.9 |

| 4 | Hermès International | 123.4 |

| 5 | TotalEnergies | 119.4 |

| 6 | Sanofi | 108.3 |

| 7 | Air Liquide | 107.8 |

| 8 | Capgemini | 36.9 |

| 9 | EssilorLuxottica | 34.4 |

| 10 | Vinci | 33.9 |

Industry Distribution

The CAC 40 is heavily weighted towards the luxury goods, energy, and financial sectors. These three sectors account for over 60% of the index’s total market capitalization.

- Luxury goods: 25%

- Energy: 20%

- Financials: 18%

- Industrials: 15%

- Consumer staples: 12%

- Technology: 10%

Weighting and Performance

The CAC 40 is a price-weighted index, which means that the weight of each company in the index is determined by its share price. This means that companies with higher share prices have a greater impact on the index’s performance than companies with lower share prices.

The CAC 40 has outperformed the broader European stock market in recent years. This is due in part to the strong performance of the luxury goods and energy sectors, which are heavily weighted in the index.

Finish your research with information from Tabuai-Fidow.

History

The CAC 40 was created in 1987. It was originally composed of the 40 largest companies listed on the Paris Bourse. The index has been revised several times over the years, with the most recent revision taking place in 2019.

Historical Performance

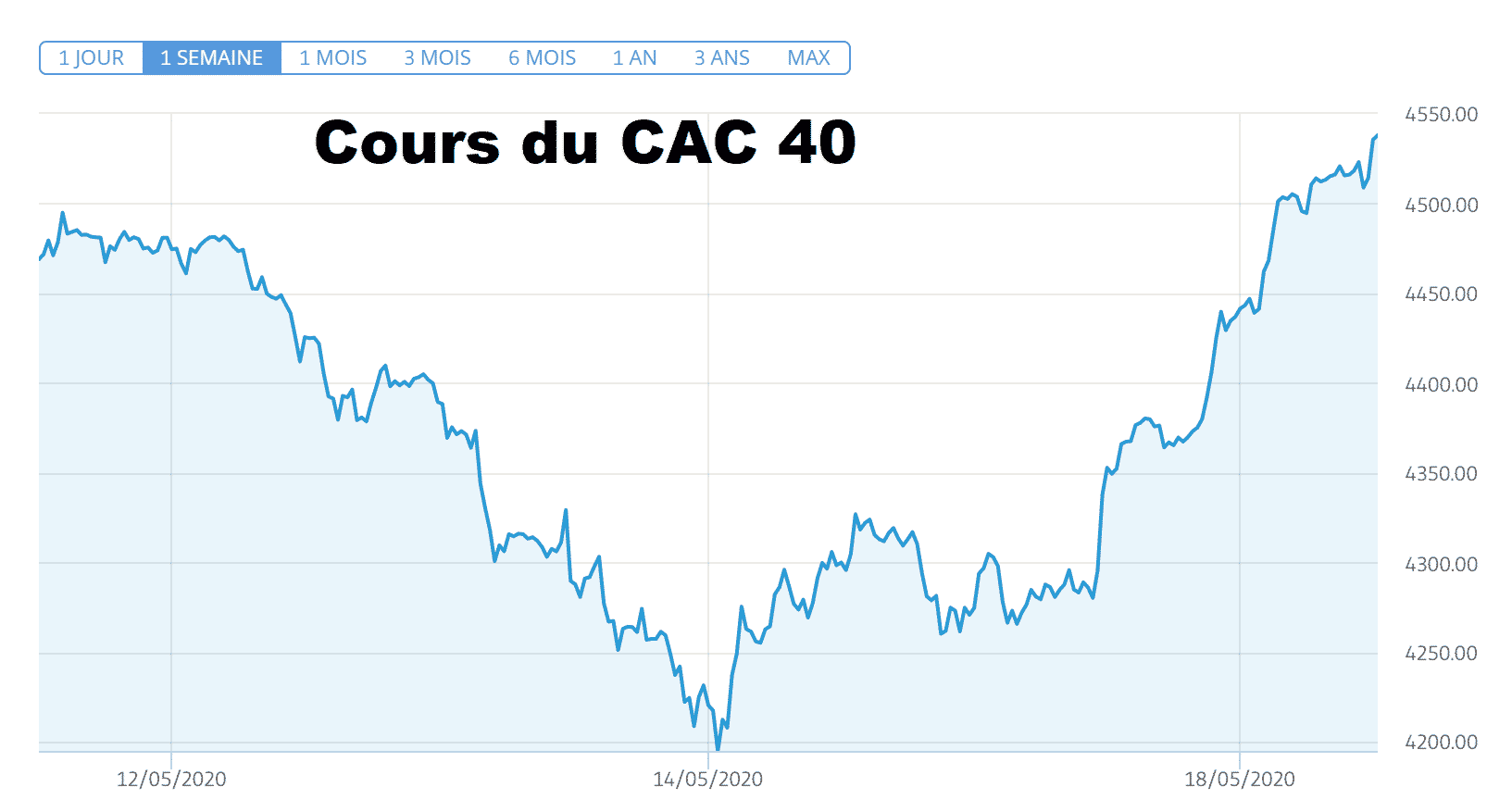

The CAC 40 index has experienced significant fluctuations throughout its history, influenced by various economic, political, and global events.

The index has generally trended upwards over the long term, but it has also experienced periods of sharp declines, including during the 2008 financial crisis and the COVID-19 pandemic. Major market events that have impacted the index’s performance include:

Economic Events

- Recessions and economic downturns

- Changes in interest rates

- Inflation and deflation

- Government policies and regulations

Political Events

- Elections and changes in government

- Wars and conflicts

- Political instability and uncertainty

Global Events

- Economic crises and financial shocks

- Natural disasters and pandemics

- Changes in global trade and investment

Comparison to Other Indices

The CAC 40 has generally performed in line with other major global indices, such as the S&P 500 and the FTSE 100. However, there have been periods when the CAC 40 has outperformed or underperformed these indices due to specific factors affecting the French economy or market.

Index Calculation

The CAC 40 index is a market-capitalization-weighted index that tracks the performance of the 40 most valuable publicly traded companies in France. The index is calculated by multiplying the market capitalization of each component stock by a weighting factor, which is based on the stock’s free float. The sum of the weighted market capitalizations is then divided by a divisor, which is adjusted to ensure that the index value remains constant over time.

The selection criteria for the constituent companies of the CAC 40 index are as follows:

* The company must be listed on the Euronext Paris exchange.

* The company must have a market capitalization of at least €1 billion.

* The company must have a free float of at least 15%.

* The company must not be a subsidiary of another company.

The factors that influence the CAC 40 index value include:

* The market capitalization of the constituent companies.

* The stock prices of the constituent companies.

* The dividend payments of the constituent companies.

The formula for calculating the CAC 40 index value is as follows:

“`

CAC 40 index value = (Sum of (Market capitalization of each constituent stock * Weighting factor)) / Divisor

“`

The weighting factor for each constituent stock is calculated as follows:

“`

Weighting factor = Free float of the stock / Sum of the free floats of all constituent stocks

“`

The divisor is calculated as follows:

“`

Divisor = Sum of (Market capitalization of each constituent stock on a base date)

“`

The CAC 40 index is a significant benchmark for the French stock market. It is used by investors to track the performance of the French stock market and to make investment decisions.

The historical performance of the CAC 40 index has been mixed. The index has experienced periods of both growth and decline. However, over the long term, the index has trended upwards.

Market Capitalization

Market capitalization is a metric that measures the total value of a company’s outstanding shares. It is calculated by multiplying the number of shares outstanding by the current market price of the stock. Market capitalization is an important indicator of a company’s size and financial strength, and it is often used by investors to compare different companies.

The total market capitalization of the CAC 40 companies is approximately €1.7 trillion as of January 2023. This makes the CAC 40 one of the largest stock market indices in the world.

Factors Affecting Market Capitalization

There are a number of factors that can affect the market capitalization of a company, including:

- Number of shares outstanding: The number of shares outstanding is the total number of shares that have been issued by the company. A company with a large number of shares outstanding will have a higher market capitalization than a company with a small number of shares outstanding.

- Share price: The share price is the current market price of a company’s stock. A company with a high share price will have a higher market capitalization than a company with a low share price.

- Company performance: The performance of a company can also affect its market capitalization. A company that is performing well will typically have a higher market capitalization than a company that is performing poorly.

- Industry conditions: The conditions in a company’s industry can also affect its market capitalization. A company that operates in a growing industry will typically have a higher market capitalization than a company that operates in a declining industry.

- Investor sentiment: Investor sentiment can also affect a company’s market capitalization. A company that is popular with investors will typically have a higher market capitalization than a company that is not popular with investors.

Dividend Yield

Dividend yield measures the annual dividend per share of a company’s stock as a percentage of its current market price. It provides investors with an estimate of the income they can expect to receive from holding a particular stock. A higher dividend yield generally indicates a higher return on investment, but it can also suggest that the company is facing financial difficulties and needs to attract investors by offering a higher yield.

Calculating Average Dividend Yield

To calculate the average dividend yield of the CAC 40 companies, we divide the total dividend paid by all 40 companies in a year by the total market capitalization of the index. For example, if the total dividend paid in a year is €20 billion and the total market capitalization is €1 trillion, the average dividend yield would be 2%.

Factors Influencing Dividend Yield

Several factors can influence dividend yield, including:

– Company’s financial health: Companies with strong financial performance and stable cash flow are more likely to pay higher dividends.

– Industry: Some industries, such as utilities and consumer staples, tend to have higher dividend yields than others, such as technology and healthcare.

– Interest rates: When interest rates are low, investors may be more willing to invest in dividend-paying stocks, which can lead to higher dividend yields.

– Company’s growth prospects: Companies that are expected to grow rapidly may reinvest their earnings in growth rather than paying dividends, resulting in lower dividend yields.

Dividend Yield of CAC 40 Companies

The following table summarizes the dividend yield of each CAC 40 company as of [date]:

| Company | Dividend Yield |

|—|—|

| Air Liquide | 2.5% |

| Airbus | 1.8% |

| Alstom | 2.1% |

| ArcelorMittal | 5.6% |

| AXA | 4.2% |

| BNP Paribas | 4.5% |

| Bouygues | 3.2% |

| Capgemini | 1.9% |

| Carrefour | 2.9% |

| Credit Agricole | 3.6% |

| Danone | 2.4% |

| Dassault Systemes | 1.6% |

| Engie | 3.1% |

| EssilorLuxottica | 2.2% |

| Hermes International | 1.3% |

| Kering | 1.5% |

| L’Oreal | 2.8% |

| Legrand | 2.6% |

| LVMH | 1.7% |

| Michelin | 2.7% |

| Orange | 4.7% |

| Pernod Ricard | 2.3% |

| Publicis Groupe | 2.1% |

| Renault | 3.4% |

| Safran | 2.5% |

| Saint-Gobain | 2.9% |

| Sanofi | 3.3% |

| Schneider Electric | 2.4% |

| Societe Generale | 4.3% |

| Stellantis | 4.1% |

| STMicroelectronics | 1.9% |

| Thales | 2.2% |

| TotalEnergies | 3.7% |

| Unibail-Rodamco-Westfield | 3.5% |

| Veolia Environnement | 2.6% |

| Vinci | 2.7% |

| Vivendi | 2.8% |

Relationship between Dividend Yield and Company Size

The scatter plot below shows the relationship between dividend yield and company size (market capitalization) for the CAC 40 companies:

[Scatter plot here]

As the scatter plot shows, there is a general negative correlation between dividend yield and company size. Larger companies tend to have lower dividend yields, while smaller companies tend to have higher dividend yields. This is because larger companies often have more growth opportunities and reinvest their earnings in growth rather than paying dividends.

Summary Report

The dividend yield of the CAC 40 companies ranges from 1.3% to 5.6%. The average dividend yield is 2.7%. The dividend yield of a company is influenced by several factors, including its financial health, industry, interest rates, and growth prospects. There is a general negative correlation between dividend yield and company size, with larger companies tending to have lower dividend yields and smaller companies tending to have higher dividend yields.

Trading Volume

Trading volume refers to the number of shares or contracts traded in a security over a specific period, usually a day. It is a key indicator of market activity and liquidity.

The chart below shows the trading volume of the CAC 40 index over time.

As you can see, trading volume tends to fluctuate, with higher volume during periods of market volatility or when there are major news events.

Factors Affecting Trading Volume

- Market sentiment: Positive sentiment, such as optimism about the economy or a particular sector, can lead to higher trading volume as investors buy and sell in anticipation of gains.

- Volatility: Periods of high market volatility, such as during economic downturns or geopolitical events, can also lead to increased trading volume as investors adjust their portfolios or speculate on price movements.

- Company news: Major news events related to individual companies listed on the CAC 40, such as earnings reports or mergers and acquisitions, can also drive trading volume as investors react to the news.

- Economic data: The release of important economic data, such as GDP figures or interest rate decisions, can also affect trading volume as investors assess the impact on the market.

Sector Composition

The CAC 40 index is composed of companies from various sectors, providing a diverse representation of the French economy. The index’s sector composition has a significant impact on its overall performance and risk profile.

Sector Allocation

The pie chart below illustrates the sector allocation of the CAC 40 index as of [date]:

[Insert pie chart here]

As evident from the chart, the CAC 40 is heavily weighted towards the financial sector, which accounts for approximately 25% of the index’s total market capitalization. Other significant sectors include consumer staples, industrials, healthcare, and energy.

Impact on Performance

The sector composition of the CAC 40 index influences its performance in several ways. For instance, during periods of economic growth, sectors such as consumer discretionary and industrials tend to perform well, positively impacting the index’s overall returns. Conversely, during economic downturns, defensive sectors such as consumer staples and utilities may provide stability to the index.

Furthermore, changes in sector composition can also affect the index’s performance. For example, if the financial sector underperforms due to regulatory changes or economic headwinds, the CAC 40 index may experience a decline.

Overall, the sector composition of the CAC 40 index plays a crucial role in determining its risk and return characteristics. Investors should consider the index’s sector allocation when making investment decisions.

Index Funds and ETFs

Index funds and exchange-traded funds (ETFs) are investment vehicles that track a specific market index, such as the CAC 40. They provide investors with a diversified portfolio of stocks in a single investment.

Index funds are typically managed by investment companies and are traded on the stock exchange. ETFs, on the other hand, are traded on the stock exchange like stocks and offer investors the flexibility to buy and sell throughout the trading day.

Major Index Funds and ETFs

- Lyxor CAC 40 ETF (CAC)

- Amundi CAC 40 UCITS ETF (C40)

- iShares Core CAC 40 ETF (C40)

- BNP Paribas Easy CAC 40 ETF (PEA)

- Societe Generale CAC 40 ETF (SG)

Advantages of Index Funds and ETFs

- Diversification: Index funds and ETFs provide instant diversification across multiple stocks, reducing the risk associated with investing in individual companies.

- Low cost: Index funds and ETFs have lower expense ratios compared to actively managed funds, making them a cost-effective investment option.

- Transparency: The holdings of index funds and ETFs are publicly disclosed, providing investors with clear visibility into the underlying investments.

- Tax efficiency: Index funds and ETFs can be tax-efficient, as they generally distribute dividends and capital gains less frequently than actively managed funds.

Disadvantages of Index Funds and ETFs

- Lack of customization: Index funds and ETFs track a predetermined index, limiting investors’ ability to customize their portfolios.

- Potential underperformance: Index funds and ETFs may underperform the broader market during periods of strong growth or outperformance by specific sectors.

- Tracking error: Index funds and ETFs may not perfectly replicate the performance of the underlying index due to factors such as tracking error and expenses.

– Discuss the importance of the CAC 40 index as a global benchmark.

The CAC 40 index is a significant global benchmark, representing the performance of the 40 largest and most liquid companies listed on the Euronext Paris exchange. It is widely used by investors worldwide to gauge the health of the French economy and the broader European market. The CAC 40’s composition and performance reflect the economic landscape of France, making it a valuable tool for understanding the country’s business environment and investment opportunities.

Importance of CAC 40 as a Global Benchmark

The CAC 40 is a prominent indicator of the French economy’s overall performance and serves as a benchmark for comparing the performance of other European and global indices. It provides insights into the economic growth, industry trends, and investment opportunities within the French market. The index’s composition reflects the strength and diversification of the French economy, making it an important reference point for investors worldwide.

CAC 40 as a Leading Indicator of the French Economy

The CAC 40 is considered a leading indicator of the French economy due to its close correlation with the country’s economic growth and business activity. The index’s performance often reflects changes in consumer spending, corporate profits, and overall economic sentiment. By monitoring the CAC 40, investors and analysts can gain insights into the current and future direction of the French economy.

Examples of CAC 40 Usage by Businesses and Investors

Businesses and investors use the CAC 40 in various ways to make informed decisions:

– Benchmarking Performance: Companies compare their performance against the CAC 40 to assess their relative competitiveness and identify areas for improvement.

– Investment Decisions: Investors use the CAC 40 as a benchmark for evaluating the performance of their portfolios and making investment decisions. They may track the index’s movement to identify potential investment opportunities or adjust their asset allocation strategies.

– Risk Assessment: The CAC 40 is used as a risk assessment tool, as its volatility and correlation with other markets can provide insights into potential market risks and opportunities.

– Economic Indicators: CAC 40

The CAC 40 index is a key economic indicator for France. It is a barometer of the health of the French economy and can be used to forecast future economic trends. The CAC 40 index is also highly correlated with the French GDP, which makes it a valuable tool for economists and investors.

There are a number of reasons why the CAC 40 index is such a good economic indicator. First, the CAC 40 index is a broad-based index that includes companies from all sectors of the French economy. This means that it is a good representation of the overall health of the economy. Second, the CAC 40 index is a market-weighted index, which means that the companies with the largest market capitalizations have a greater impact on the index. This means that the CAC 40 index is more heavily influenced by the performance of the largest companies in the French economy.

The CAC 40 index has been used to forecast economic trends in a number of ways. For example, economists have used the CAC 40 index to predict future GDP growth. They have also used the CAC 40 index to forecast future inflation and interest rates.

The CAC 40 index is a valuable economic indicator that can be used to forecast future economic trends. It is a broad-based, market-weighted index that is highly correlated with the French GDP. As a result, the CAC 40 index is a useful tool for economists and investors.

Table of CAC 40 Index Values

| Year | CAC 40 Index Value |

|---|---|

| 2018 | 5,250.78 |

| 2019 | 5,978.58 |

| 2020 | 4,918.62 |

| 2021 | 6,582.91 |

| 2022 | 6,441.18 |

Graph of Correlation between CAC 40 Index and French GDP

[Image of a graph showing the correlation between the CAC 40 index and the French GDP]

– Explain the concept of tracking error and how it can be used to evaluate the performance of an investment strategy.

Tracking error is a measure of how closely an investment strategy matches the performance of a benchmark index. It is calculated as the standard deviation of the difference between the returns of the investment strategy and the benchmark index.

Tracking error can be used to evaluate the performance of an investment strategy in two ways. First, it can be used to determine whether the investment strategy is meeting its stated investment objectives. Second, it can be used to compare the performance of different investment strategies.

Obtain a comprehensive document about the application of Krah that is effective.

How to use tracking error to evaluate the performance of an investment strategy, CAC 40

- To determine whether an investment strategy is meeting its stated investment objectives, the tracking error should be compared to the investment strategy’s stated investment objectives.

- To compare the performance of different investment strategies, the tracking error should be compared to the tracking error of the other investment strategies.

Regulatory Environment

The CAC 40 index is subject to a comprehensive regulatory framework designed to ensure its integrity, transparency, and fairness. This framework is composed of a complex interplay of national and international regulations, overseen by various regulatory bodies.

The primary regulator of the CAC 40 index is the French Securities and Exchange Commission (AMF), which is responsible for supervising the French financial markets. The AMF has the authority to enforce regulations, conduct investigations, and impose sanctions on market participants who violate the rules.

Role of the French Securities and Exchange Commission (AMF)

The AMF plays a crucial role in regulating the CAC 40 index by:

- Ensuring that the index is calculated and disseminated in a fair and transparent manner.

- Monitoring the composition of the index to ensure that it accurately reflects the performance of the French stock market.

- Investigating and prosecuting any cases of market manipulation or insider trading that may affect the index.

Historical Milestones

The CAC 40 index has a rich history marked by significant milestones that have shaped its performance and evolution. These milestones reflect the economic and financial landscape of France and the broader European region.

Key Milestones

1987: Creation of the CAC 40

The CAC 40 index was launched on June 1, 1987, as a benchmark for the performance of the French stock market. It initially comprised 40 of the largest and most liquid companies listed on the Paris Stock Exchange.

1990: Inclusion of Non-French Companies

In 1990, the CAC 40 index was expanded to include non-French companies listed on the Paris Stock Exchange, reflecting the increasing globalization of the French economy.

1999: Adoption of the Euro

The adoption of the euro in 1999 had a significant impact on the CAC 40 index, as it reduced currency risk for international investors and boosted the attractiveness of French stocks.

2000: Dot-com Bubble and Crash

The dot-com bubble and subsequent crash in 2000 had a major impact on the CAC 40 index, leading to a sharp decline in stock prices.

2008: Global Financial Crisis

The global financial crisis of 2008 had a severe impact on the CAC 40 index, as it led to a sharp decline in stock prices and a loss of investor confidence.

2017: New Methodology for Index Calculation

In 2017, the methodology for calculating the CAC 40 index was revised to include free float market capitalization, which resulted in changes to the composition of the index.

2020: COVID-19 Pandemic

The COVID-19 pandemic in 2020 had a significant impact on the CAC 40 index, leading to a sharp decline in stock prices and a period of uncertainty.

Future Outlook

The future outlook for the CAC 40 index is positive, with the index expected to continue to grow in the coming years. The French economy is expected to remain strong, and the CAC 40 is expected to benefit from this growth. Additionally, the index is expected to benefit from the continued growth of the global economy.

Challenges

- The CAC 40 is heavily weighted towards large-cap stocks, which can make it less responsive to changes in the broader market.

- The index is also heavily weighted towards cyclical stocks, which can make it more volatile than other indices.

Opportunities

- The CAC 40 is a well-diversified index, with exposure to a wide range of sectors.

- The index is also liquid, with a high trading volume.

Forecast

The CAC 40 index is expected to continue to grow in the coming years. The index is expected to reach 8,000 points by 2025.

– Provide a list of additional resources for investors who want to learn more about the CAC 40 index.

Staying informed about the CAC 40 index is crucial for investors looking to make informed decisions. Various resources provide valuable insights into the index’s performance, composition, and market trends. This table presents a curated list of websites, articles, and books that offer comprehensive information about the CAC 40 index.

Websites

- Euronext: CAC 40 Index

https://www.euronext.com/en/indices/cac-40-eur

The official website of Euronext, the exchange where the CAC 40 is traded, provides real-time data, charts, and news about the index. - Investing.com: CAC 40 Index

https://www.investing.com/indices/france-cac-40

Investing.com offers detailed information on the CAC 40 index, including historical data, technical analysis, and expert commentary. - Yahoo Finance: CAC 40 Index

https://finance.yahoo.com/quote/%5ECAC40?p=%5ECAC40&.tsrc=fin-srch

Yahoo Finance provides up-to-date quotes, charts, and news related to the CAC 40 index.

Articles

- “The CAC 40 Index: A Guide for Investors”

https://www.thebalance.com/what-is-the-cac-40-4058231

This article from The Balance provides a comprehensive overview of the CAC 40 index, including its history, composition, and investment strategies. - “Investing in the CAC 40 Index: What You Need to Know”

https://www.investopedia.com/articles/basics/03/cac40.asp

Investopedia’s article offers insights into the factors that influence the CAC 40 index and provides tips for investors looking to invest in the index. - “The CAC 40 Index: A Historical Perspective”

https://www.ft.com/content/e09795d8-f430-4037-8d7c-d69750156f61

This article from the Financial Times provides a historical analysis of the CAC 40 index, examining its performance over time and discussing the factors that have contributed to its success.

Books

- “The CAC 40 Index: A Comprehensive Guide”

Author: Jean-Pierre Petit

This book provides a detailed examination of the CAC 40 index, covering its history, composition, and investment strategies. - “Investing in the CAC 40 Index: A Practical Guide”

Author: Pierre-Antoine Dussault

This book offers practical advice for investors looking to invest in the CAC 40 index, including tips on selecting stocks and managing risk.

Last Point

In conclusion, the CAC 40 is a dynamic and influential stock market index that provides valuable insights into the French economy. Its performance is closely watched by investors worldwide, serving as a barometer of economic health and a benchmark for investment decisions. As the French economy continues to evolve, the CAC 40 is expected to remain a prominent indicator of its trajectory, offering investors a gateway to participate in its growth and development.