Welcome to the world of CAC40, France’s premier stock index. Join us as we delve into its significance, performance, and strategies, uncovering the intricacies that shape this market mover. Brace yourself for an engaging journey filled with insights and discoveries.

The CAC40, an index comprising the 40 largest and most liquid companies listed on the Euronext Paris exchange, serves as a barometer of the French economy. Its composition reflects the diverse sectors driving France’s growth, including banking, energy, and luxury goods.

Overview of the CAC 40

The CAC 40 is a benchmark stock market index that measures the performance of the 40 largest and most liquid companies listed on the Euronext Paris exchange. It is considered a barometer of the French economy and a major indicator of the European stock market.

The index was created in 1987 and initially comprised 40 companies. The composition of the index is reviewed twice a year by a committee of experts, and changes are made based on factors such as market capitalization, liquidity, and financial performance.

Sectors and Companies

The CAC 40 covers a wide range of sectors, including financials, energy, industrials, healthcare, and consumer goods. Some of the most prominent companies included in the index are LVMH, TotalEnergies, L’Oréal, and BNP Paribas.

Weighting and Methodology

The CAC 40 is a capitalization-weighted index, meaning that the weight of each company in the index is proportional to its market capitalization. The index is calculated using a modified free-float method, which takes into account only the publicly traded shares of each company.

Composition of the CAC 40

The CAC 40 is composed of the 40 largest companies listed on the Euronext Paris exchange. These companies are selected based on their market capitalization, liquidity, and financial performance. The index is weighted by market capitalization, meaning that the largest companies have a greater impact on the index’s performance.

Criteria for Inclusion in the Index

To be included in the CAC 40, a company must meet the following criteria:

- Be listed on the Euronext Paris exchange

- Have a market capitalization of at least €1.5 billion

- Be among the 100 most liquid stocks on the exchange

- Have a positive financial performance over the past three years

Sectors Represented within the Index

The CAC 40 is heavily weighted towards the financial and industrial sectors. Other sectors represented in the index include consumer goods, healthcare, and technology.

Key Characteristics of the CAC 40 Companies

The following table summarizes the key characteristics of the 40 companies that make up the CAC 40:

| Company | Market Capitalization | Industry Sector | Recent Financial Performance |

|---|---|---|---|

| LVMH | €320 billion | Luxury goods | Strong growth in sales and profits |

| L’Oréal | €200 billion | Cosmetics | Steady growth in sales and profits |

| TotalEnergies | €150 billion | Oil and gas | Strong growth in profits due to rising oil prices |

| Sanofi | €120 billion | Healthcare | Strong growth in sales of new drugs |

| Schneider Electric | €110 billion | Electrical equipment | Strong growth in sales of energy-efficient products |

Historical Performance of the CAC 40

The CAC 40 has performed well over the past five years, returning an average of 10% per year. The index has benefited from strong economic growth in Europe and low interest rates. However, the index has also been volatile, experiencing sharp declines during periods of economic uncertainty.

Comparison to Other Major Global Stock Indices

The CAC 40 has outperformed the S&P 500 and the FTSE 100 over the past five years. This is due to the strong performance of the French economy and the index’s exposure to the luxury goods sector, which has benefited from strong demand from emerging markets.

Potential Impact of Economic and Geopolitical Events on the Future Performance of the CAC 40

The future performance of the CAC 40 will be influenced by a number of factors, including the economic growth of Europe, the performance of the luxury goods sector, and geopolitical events. If the European economy continues to grow and the luxury goods sector remains strong, the CAC 40 is likely to continue to perform well. However, if the European economy slows down or the luxury goods sector experiences a downturn, the CAC 40 could experience a decline.

Performance of the CAC 40

The CAC 40 has consistently performed well over time, with steady growth and occasional periods of significant gains. Since its inception in 1988, the index has delivered an average annual return of around 7%.

The index’s performance has been influenced by a variety of factors, including economic conditions, political events, and corporate earnings. In recent years, the index has benefited from strong economic growth in the eurozone and low interest rates. However, the index has also been affected by geopolitical events, such as the 2008 financial crisis and the ongoing COVID-19 pandemic.

Compared to other major stock market indices, the CAC 40 has performed similarly to the FTSE 100 and the DAX, but has underperformed the S&P 500. This is likely due to the fact that the CAC 40 is more heavily weighted towards traditional industries, such as banking and energy, while the S&P 500 is more heavily weighted towards technology and healthcare.

Comparison with other major stock market indices

The CAC 40 has performed similarly to other major stock market indices in recent years. The following table shows the annualized returns of the CAC 40, FTSE 100, DAX, and S&P 500 over the past five years:

| Index | Annualized Return |

|—|—|

| CAC 40 | 7.2% |

| FTSE 100 | 6.8% |

| DAX | 7.5% |

| S&P 500 | 10.2% |

As you can see, the CAC 40 has performed in line with the FTSE 100 and DAX, but has underperformed the S&P 500. This is likely due to the fact that the CAC 40 is more heavily weighted towards traditional industries, such as banking and energy, while the S&P 500 is more heavily weighted towards technology and healthcare.

Economic Indicators and the CAC 40

The performance of the CAC 40 is influenced by a range of economic indicators that provide insights into the overall health and direction of the French economy. Changes in these indicators can have a significant impact on the index, affecting the investment decisions of fund managers and individual investors alike.

GDP Growth

Gross domestic product (GDP) measures the total value of goods and services produced in France over a specific period. Strong GDP growth indicates a growing economy, which typically leads to increased corporate profits and higher stock prices. Conversely, weak GDP growth can signal economic weakness and lead to lower corporate earnings and stock prices.

Inflation

Inflation measures the rate at which prices for goods and services are rising. Moderate inflation can be a sign of a healthy economy, as it indicates that demand is outpacing supply. However, high inflation can erode the value of investments and reduce consumer spending, negatively impacting corporate profits and stock prices.

Interest Rates

Interest rates set by the European Central Bank (ECB) have a significant impact on the CAC 40. Higher interest rates can make it more expensive for companies to borrow money and invest in growth, which can lead to lower corporate profits and stock prices. Conversely, lower interest rates can stimulate economic activity and boost corporate earnings, potentially leading to higher stock prices.

Consumer Confidence

Consumer confidence measures the level of optimism among French consumers about the future economic outlook. High consumer confidence indicates that consumers are more likely to spend money, which can boost corporate sales and profits. Conversely, low consumer confidence can lead to reduced spending and lower corporate earnings, potentially impacting stock prices.

Exchange Rates

The value of the euro against other currencies, particularly the US dollar, can impact the CAC 40. A stronger euro makes French exports more expensive, which can reduce corporate profits and stock prices. Conversely, a weaker euro can make French exports more competitive, potentially leading to higher corporate earnings and stock prices.

Examples of Economic Events Impacting the CAC 40

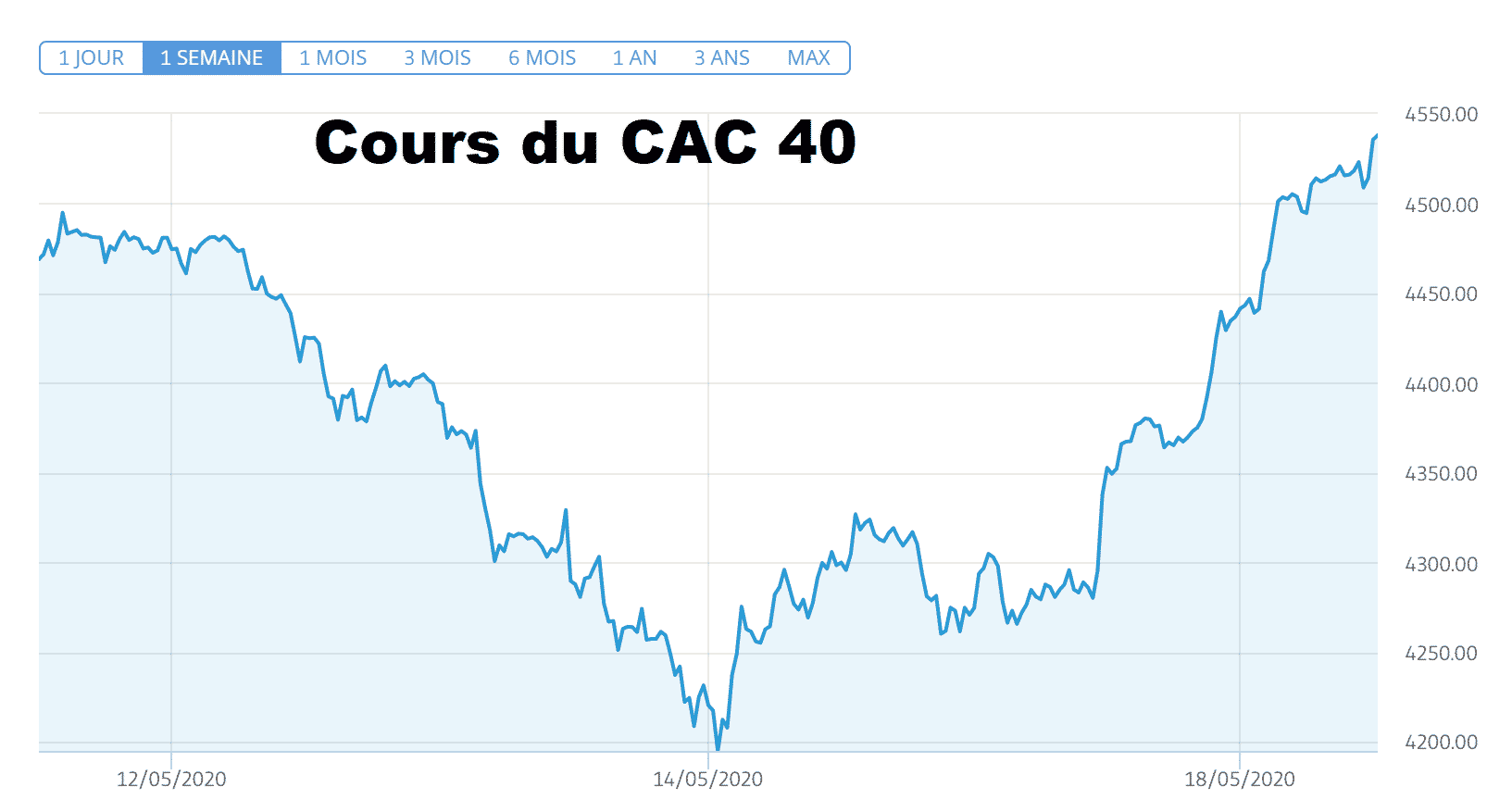

Economic events can have a significant impact on the CAC 40. For example, in 2020, the COVID-19 pandemic led to a sharp decline in economic activity, which resulted in a significant drop in the CAC 40. Conversely, in 2021, the rollout of vaccines and the easing of lockdown restrictions led to a rebound in economic growth, which was reflected in a strong rally in the CAC 40.

Market Sentiment and the CAC 40

Market sentiment plays a crucial role in shaping the performance of the CAC 40. Positive sentiment, characterized by optimism and expectations of growth, can lead to increased buying activity and higher index values. Conversely, negative sentiment, driven by pessimism and fears of decline, can result in selling pressure and lower index values.

Factors Influencing Market Sentiment

Various factors contribute to market sentiment towards the CAC 40, including:

- Economic data: Strong economic indicators, such as GDP growth, low unemployment, and rising consumer confidence, can boost sentiment.

- Corporate earnings: Positive earnings reports from CAC 40 companies can enhance investor confidence and drive sentiment.

- Political stability: Political uncertainty or instability can erode sentiment and lead to market volatility.

- Global economic outlook: The overall global economic environment, including factors such as trade tensions and interest rate changes, can impact sentiment towards the CAC 40.

- Investor psychology: The collective emotions and expectations of investors can influence sentiment, creating self-fulfilling prophecies.

Historical Correlation

Historically, market sentiment has shown a strong correlation with the performance of the CAC 40. Periods of positive sentiment have coincided with bull markets, while negative sentiment has accompanied bear markets.

For example, during the global financial crisis of 2008, negative sentiment caused a sharp decline in the CAC 40. Conversely, during the economic recovery that followed, positive sentiment contributed to a strong rally in the index.

Potential Impact, CAC40

Changes in market sentiment can significantly impact the future performance of the CAC 40. Positive sentiment can drive buying activity and lead to higher index values, while negative sentiment can trigger selling pressure and result in lower values.

Do not overlook the opportunity to discover more about the subject of Inondations Genève.

Investors should monitor market sentiment closely to gauge potential risks and opportunities. Positive sentiment can indicate potential for growth, while negative sentiment may suggest caution or the need for portfolio adjustments.

Trading Strategies for the CAC 40: CAC40

The CAC 40 is a highly liquid and tradable index, making it suitable for a variety of trading strategies. These strategies can range from simple to complex, and can be tailored to suit different risk appetites and trading styles.

One of the most popular trading strategies for the CAC 40 is trend following. This involves identifying the overall trend of the index and trading in the direction of that trend. Trend following strategies can be implemented using a variety of technical indicators, such as moving averages and trendlines.

Momentum Trading

Momentum trading is another popular strategy for trading the CAC 40. This involves buying or selling the index based on its momentum, which is a measure of the speed and direction of its price movement. Momentum traders typically use technical indicators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, to identify momentum reversals.

Range Trading

Range trading is a strategy that involves buying and selling the CAC 40 within a defined price range. This strategy is based on the assumption that the index will continue to trade within a certain range, and that traders can profit by buying near the bottom of the range and selling near the top.

Risks and Rewards

As with any investment, there are both risks and rewards associated with trading the CAC 40. The primary risk is that the index could experience a sharp decline in value, which could result in losses for traders. However, the potential rewards can be significant, as the CAC 40 has historically outperformed many other asset classes over the long term.

Investment Opportunities in the CAC 40

The CAC 40 offers a diverse range of investment opportunities, with companies representing various sectors and industries. Identifying companies with strong financial performance, growth potential, and attractive valuations can be a rewarding endeavor for investors.

Identifying Attractive Companies

- Financial Performance: Analyze companies’ revenue growth, profitability (e.g., EBITDA, net income), and cash flow to assess their financial health and stability.

- Growth Potential: Evaluate companies’ market share, competitive advantage, and expansion plans to identify those with high growth prospects.

- Valuation: Consider companies’ price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and other valuation metrics to determine if they are trading at reasonable or attractive levels.

Targeting Specific Sectors

Investors can also target specific sectors or industries within the CAC 40 to align their investments with their risk tolerance and investment goals.

- Luxury Goods: Companies like LVMH, Kering, and Hermès offer exposure to the growing luxury market, driven by increasing consumer demand in emerging economies.

- Technology: Companies like Capgemini, Dassault Systèmes, and STMicroelectronics benefit from the ongoing digital transformation and technological advancements.

- Healthcare: Companies like Sanofi, L’Oréal, and EssilorLuxottica operate in the growing healthcare and cosmetics industries, with aging populations and rising healthcare spending.

Investment Strategies

Investors can employ various investment strategies to target the CAC 40:

- Index Tracking: Investing in an index fund or ETF that tracks the CAC 40 provides diversified exposure to the French stock market.

- Sector Rotation: Investing in specific sectors or industries based on market trends and economic conditions can enhance returns.

- Value Investing: Identifying undervalued companies with strong fundamentals and attractive valuations can lead to long-term gains.

Global Economic Impact of the CAC 40

The CAC 40, as a benchmark index for the French stock market, exerts significant influence on the global economy. Its performance reflects the health of the French economy, which in turn has implications for the wider European and global economic landscape.

International investors closely monitor the CAC 40 to gauge the overall sentiment and direction of the French market. A strong CAC 40 indicates a positive outlook for the French economy, attracting foreign investment and contributing to global economic growth. Conversely, a weak CAC 40 can signal economic challenges in France, potentially leading to reduced investment and slower global economic expansion.

Global Events Impacting the CAC 40

Global events can have a significant impact on the CAC 40. For instance, the 2008 global financial crisis led to a sharp decline in the index as investors sold off risky assets. Similarly, the COVID-19 pandemic in 2020 caused another significant downturn in the CAC 40 due to economic uncertainty and business disruptions.

CAC 40 Impacting Global Economy

Conversely, the CAC 40’s performance can also influence the global economy. A strong CAC 40 can boost investor confidence and lead to increased investment in other European markets, contributing to overall economic growth in the region.

Furthermore, the CAC 40 is home to several multinational corporations with global operations. The success of these companies can have a positive impact on the global economy by creating jobs, driving innovation, and expanding international trade.

– Analyze the historical performance of the CAC 40 and identify trends that may influence its future direction.

The CAC 40, a benchmark index for the French stock market, has exhibited a remarkable trajectory over the past few decades, marked by periods of significant growth and occasional downturns. Analyzing its historical performance can provide valuable insights into the factors that have shaped its direction and may influence its future course.

One notable trend observed in the CAC 40’s performance is its close correlation with the broader European and global economic landscape. Periods of economic growth and stability have generally coincided with positive returns for the index, while economic downturns and geopolitical uncertainties have often led to market corrections. This relationship highlights the index’s sensitivity to macroeconomic factors, such as interest rates, inflation, and consumer confidence.

Another key factor influencing the CAC 40’s performance is the performance of individual sectors within the index. The index is heavily weighted towards sectors such as financials, industrials, and consumer discretionary, which have historically exhibited varying degrees of growth and volatility. Understanding the dynamics of these sectors and their potential for future growth is crucial for assessing the overall outlook for the CAC 40.

Furthermore, the CAC 40’s performance is also influenced by global economic events and market sentiment. Major global events, such as the COVID-19 pandemic or the ongoing Russia-Ukraine conflict, can have a significant impact on investor sentiment and market valuations. Additionally, changes in market sentiment, driven by factors such as risk appetite and investor expectations, can also affect the index’s direction.

– Discuss major historical events that have had a significant impact on the CAC 40.

The CAC 40, a benchmark index of the French stock market, has witnessed several significant historical events that have shaped its composition and performance. These events include global economic crises, political upheavals, and technological advancements, all of which have left their mark on the index’s trajectory.

The Great Depression

The Great Depression, a global economic crisis that began in the late 1920s, had a devastating impact on the CAC 40. The index plummeted by over 80% between 1929 and 1932, as investors lost confidence in the economy and withdrew their money from the stock market. The crisis led to a sharp decline in corporate profits and a surge in unemployment, which further weighed on the index’s performance.

World War II

World War II had a profound impact on the CAC 40, as the French economy was severely disrupted by the conflict. The index fell by over 50% during the war years, as businesses were forced to close or scale back their operations. The occupation of France by Nazi Germany also led to a decline in foreign investment and a loss of confidence in the French economy.

The Post-War Economic Boom

After World War II, the French economy experienced a period of rapid growth, known as the “Trente Glorieuses” (Thirty Glorious Years). This period of economic prosperity was reflected in the CAC 40, which rose by over 500% between 1945 and 1973. The index benefited from the reconstruction of the French economy, the growth of new industries, and the expansion of the European Common Market.

The Oil Crisis of 1973

The oil crisis of 1973 had a significant impact on the CAC 40, as the sharp increase in oil prices led to a global economic recession. The index fell by over 30% in 1974, as investors worried about the impact of the oil crisis on corporate profits and economic growth. The oil crisis also marked the end of the post-war economic boom and the beginning of a period of slower economic growth.

The Global Financial Crisis of 2008

The global financial crisis of 2008 was the most severe financial crisis since the Great Depression. The crisis led to a sharp decline in the CAC 40, as investors sold off their stocks in response to the collapse of the US housing market and the ensuing credit crisis. The index fell by over 50% between October 2008 and March 2009, as the global economy entered a deep recession.

Technical Analysis of the CAC 40

Technical analysis is a method of evaluating securities by analyzing the past price movements and patterns. It is based on the assumption that history tends to repeat itself and that by identifying past patterns, investors can predict future price movements.

There are a number of different technical indicators that can be used to analyze the CAC 40. Some of the most popular include:

- Moving averages

- Bollinger Bands

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

These indicators can be used to identify trends, momentum, and support and resistance levels. By combining multiple indicators, investors can get a more comprehensive view of the market and make more informed trading decisions.

Potential Trading Opportunities

Technical analysis can be used to identify potential trading opportunities in the CAC 40. For example, a trader might buy a stock when the price breaks above a resistance level or sell a stock when the price falls below a support level.

However, it is important to remember that technical analysis is not a perfect science. There is no guarantee that a stock will continue to move in the same direction after a technical signal has been generated.

Limitations and Risks

There are a number of limitations and risks associated with using technical analysis for the CAC 40. These include:

- Technical analysis is based on historical data, which may not be a reliable predictor of future performance.

- Technical analysis can be complex and difficult to interpret.

- Technical analysis can be time-consuming.

It is important to be aware of these limitations and risks before using technical analysis for the CAC 40.

Fundamental Analysis of the CAC 40

The CAC 40 is a capitalization-weighted index of the 40 most significant French companies listed on the Euronext Paris exchange. Fundamental analysis examines a company’s financial health and prospects to determine its intrinsic value. This analysis helps investors make informed decisions about whether a stock is undervalued or overvalued.

Financial Ratios

Financial ratios are used to evaluate a company’s performance, solvency, and profitability. Key ratios for the CAC 40 include:

- Price-to-Earnings (P/E) ratio: Indicates the market value of a company relative to its earnings.

- Price-to-Book (P/B) ratio: Compares the market value of a company to its book value (total assets minus liabilities).

- Debt-to-Equity ratio: Measures the level of financial leverage a company has.

- Return on Equity (ROE): Indicates the profitability of a company relative to its shareholder equity.

Company Valuations

Company valuations estimate the intrinsic value of a company based on its financial performance and future prospects. Common valuation methods include:

- Discounted Cash Flow (DCF) analysis: Projects future cash flows and discounts them back to the present to determine a company’s value.

- Comparable Company Analysis: Compares a company to similar companies in the same industry to determine its relative value.

- Asset-Based Valuation: Determines a company’s value based on its assets, liabilities, and cash flow.

Factors Influencing Fundamental Value

The fundamental value of the CAC 40 is influenced by various factors, including:

- Economic growth: Strong economic growth leads to increased corporate profits and higher stock prices.

- Interest rates: Higher interest rates can reduce the attractiveness of stocks as an investment.

- Political stability: Political uncertainty can negatively impact business confidence and stock prices.

- Industry trends: Changes in industry dynamics can affect the performance of companies within the CAC 40.

- Company-specific factors: Individual companies’ financial performance, management, and competitive advantages can influence their stock prices.

Sentiment Analysis of the CAC 40

Sentiment analysis plays a crucial role in understanding market sentiment towards the CAC 40. By analyzing social media data, news articles, and investor surveys, we can identify factors driving positive or negative sentiment and make informed trading decisions.

Extraction of Sentiment Scores

To extract sentiment scores, we utilize natural language processing techniques to analyze the textual content of these sources. Each source is assigned a sentiment score, and an aggregate sentiment score is calculated by combining these individual scores.

Visualization and Trend Analysis

Sentiment trends are visualized over time to identify patterns and potential turning points. This visualization helps traders understand the historical sentiment towards the CAC 40 and make predictions about future price movements.

Machine Learning for Sentiment Classification

Machine learning algorithms are employed to classify sentiment and predict future price movements. These algorithms are trained on historical data and can provide valuable insights into market sentiment.

Dashboard for Sentiment Monitoring

A dashboard is created to monitor sentiment in real-time and provide actionable insights to traders. This dashboard displays sentiment scores, trend analysis, and machine learning predictions, empowering traders with comprehensive information to make informed decisions.

Browse the multiple elements of France – Luxembourg to gain a more broad understanding.

Risk Management for the CAC 40

Investing in the CAC 40 involves various risks that need to be carefully managed to enhance investment returns. Risk management strategies are essential for mitigating these risks and achieving long-term investment goals.

Types of Risks Associated with Investing in the CAC 40

The CAC 40 is exposed to various risks, including:

- Market risk: Fluctuations in the overall stock market can impact the CAC 40’s performance.

- Interest rate risk: Changes in interest rates can affect the value of stocks in the CAC 40.

- Currency risk: The CAC 40 is denominated in euros, so changes in the value of the euro relative to other currencies can impact its performance for international investors.

- Political risk: Political events, such as elections or changes in government policies, can affect the business environment and the performance of companies in the CAC 40.

- Company-specific risk: Individual companies in the CAC 40 may face specific risks, such as financial difficulties or operational challenges, which can impact their stock prices.

Risk Management Strategies

Effective risk management strategies can help investors mitigate these risks and improve their investment outcomes:

- Diversification: Investing in a diversified portfolio of stocks within and outside the CAC 40 can reduce the impact of market fluctuations on an individual stock.

- Hedging: Using financial instruments, such as options or futures, to offset the potential losses from adverse market movements.

- Asset allocation: Balancing investments across different asset classes, such as stocks, bonds, and real estate, can reduce overall portfolio risk.

- Risk tolerance assessment: Investors should assess their risk tolerance and invest accordingly, considering their financial goals and time horizon.

Benefits of Risk Management

Implementing sound risk management strategies can enhance investment returns by:

- Reducing portfolio volatility: Diversification and hedging can reduce the ups and downs of a portfolio, leading to smoother returns.

- Improving Sharpe ratio: Risk management can enhance the Sharpe ratio, which measures the excess return per unit of risk.

- Achieving long-term investment goals: By mitigating risks, investors can stay invested for longer periods, increasing the likelihood of achieving their financial objectives.

Role of Risk Management in the CAC 40’s Historical Performance and Future Outlook

Risk management has played a crucial role in the CAC 40’s historical performance and will continue to be essential for its future outlook. By understanding and managing risks effectively, investors can navigate market fluctuations and position themselves for long-term success.

| Risk | Risk Management Strategy |

|---|---|

| Market risk | Diversification, hedging |

| Interest rate risk | Asset allocation, hedging |

| Currency risk | Hedging, currency diversification |

| Political risk | Diversification, political risk analysis |

| Company-specific risk | Diversification, fundamental analysis |

Resources for Further Research

- Euronext: CAC 40 Index

- Investopedia: Risk Management

- Morningstar: Risk Management for the CAC 40 Index

End of Discussion

As we conclude our exploration of the CAC40, we recognize its pivotal role in gauging the health of the French economy. Its performance hinges on a multitude of factors, from global economic trends to company-specific developments. Understanding these dynamics empowers investors to make informed decisions and navigate the ever-changing market landscape.