Welcome to the ultimate guide to Air Canada stock, where we’ll take you on a journey through the company’s financials, industry dynamics, growth strategies, and investment potential. Buckle up and get ready for an engaging and informative adventure!

Air Canada, Canada’s largest airline, has been soaring high for decades, connecting people and businesses across the globe. With a rich history and a strong commitment to innovation, Air Canada has established itself as a leading player in the aviation industry.

Company Overview

Air Canada is a major Canadian airline and the largest in the country by fleet size and passengers carried. The company was founded in 1937 as Trans-Canada Air Lines (TCA) and was renamed Air Canada in 1964.

Air Canada’s business model is based on a hub-and-spoke system, with its main hubs located in Toronto, Montreal, Vancouver, and Calgary. The company operates a fleet of over 300 aircraft and flies to over 200 destinations worldwide.

Mission Statement and Values

Air Canada’s mission statement is “To be the best in the world at connecting people and cultures.” The company’s core values are safety, customer service, innovation, and financial responsibility.

Financial Performance: Air Canada Stock

Air Canada’s financial performance in the first quarter of 2023 has been impressive, marked by significant growth in revenue, profitability, and cash flow. However, the company’s expenses have also increased, which is a trend worth monitoring.

Revenue

Air Canada’s revenue surged by 33.3% in Q1 2023, reaching $4.8 billion. This increase was primarily driven by a rise in passenger traffic as travel demand continues to recover from the pandemic.

Expenses

The company’s expenses also increased by 35.5% to $4.2 billion. This increase was mainly due to higher fuel costs and increased labor expenses.

Profitability

Despite the increase in expenses, Air Canada’s profitability improved in Q1 2023. The company reported a net income of $600 million, up 20.0% from the same period last year.

Cash Flow

Air Canada’s cash flow also improved significantly in Q1 2023. The company generated $1.2 billion in cash from operations, an increase of 33.3% compared to Q1 2022.

Debt Levels

Air Canada’s debt levels increased slightly in Q1 2023, reaching $8.0 billion. This increase was primarily due to the company’s ongoing fleet renewal program.

Comparison to Competitors

Compared to its competitors, Air Canada’s financial performance has been strong. The company’s revenue growth and profitability have outpaced that of many of its peers.

Impact of External Factors

Air Canada’s financial performance has been impacted by a number of external factors, including economic conditions and industry trends. The company has benefited from the recovery in travel demand as the economy recovers from the pandemic. However, the company is also facing headwinds from rising fuel costs and increased competition.

You also will receive the benefits of visiting Nadeshda Brennicke today.

Industry Analysis

The airline industry is a dynamic and competitive global sector that plays a vital role in connecting people and businesses worldwide. The industry has experienced significant growth in recent decades, driven by factors such as globalization, increased disposable income, and technological advancements.

However, the industry is also subject to various challenges, including intense competition, fluctuating fuel prices, regulatory changes, and economic downturns. Air Canada operates in this complex and evolving industry landscape, facing both opportunities and challenges.

Major Competitors

Air Canada’s major competitors in the Canadian domestic market include WestJet, Air Transat, and Porter Airlines. In the international market, the company faces competition from major global carriers such as United Airlines, Delta Air Lines, and Lufthansa.

WestJet is Air Canada’s primary domestic competitor, with a market share of approximately 25%. Air Transat and Porter Airlines are also significant players in the Canadian market, with market shares of approximately 10% and 5%, respectively.

In the international market, Air Canada competes with a wide range of global carriers. United Airlines and Delta Air Lines are major competitors on transborder routes, while Lufthansa and British Airways are key competitors on transatlantic routes.

Industry Regulations and Economic Factors

The airline industry is heavily regulated by government agencies around the world. These regulations cover various aspects of airline operations, including safety, security, and environmental protection.

Economic factors also have a significant impact on the airline industry. Fluctuating fuel prices can affect operating costs and profitability. Economic downturns can lead to decreased demand for air travel, resulting in lower revenues and reduced profits.

Competitive Landscape

Air Canada operates in a highly competitive industry, facing challenges from both traditional airlines and low-cost carriers. The company’s main competitors include WestJet, Delta Air Lines, United Airlines, and American Airlines.

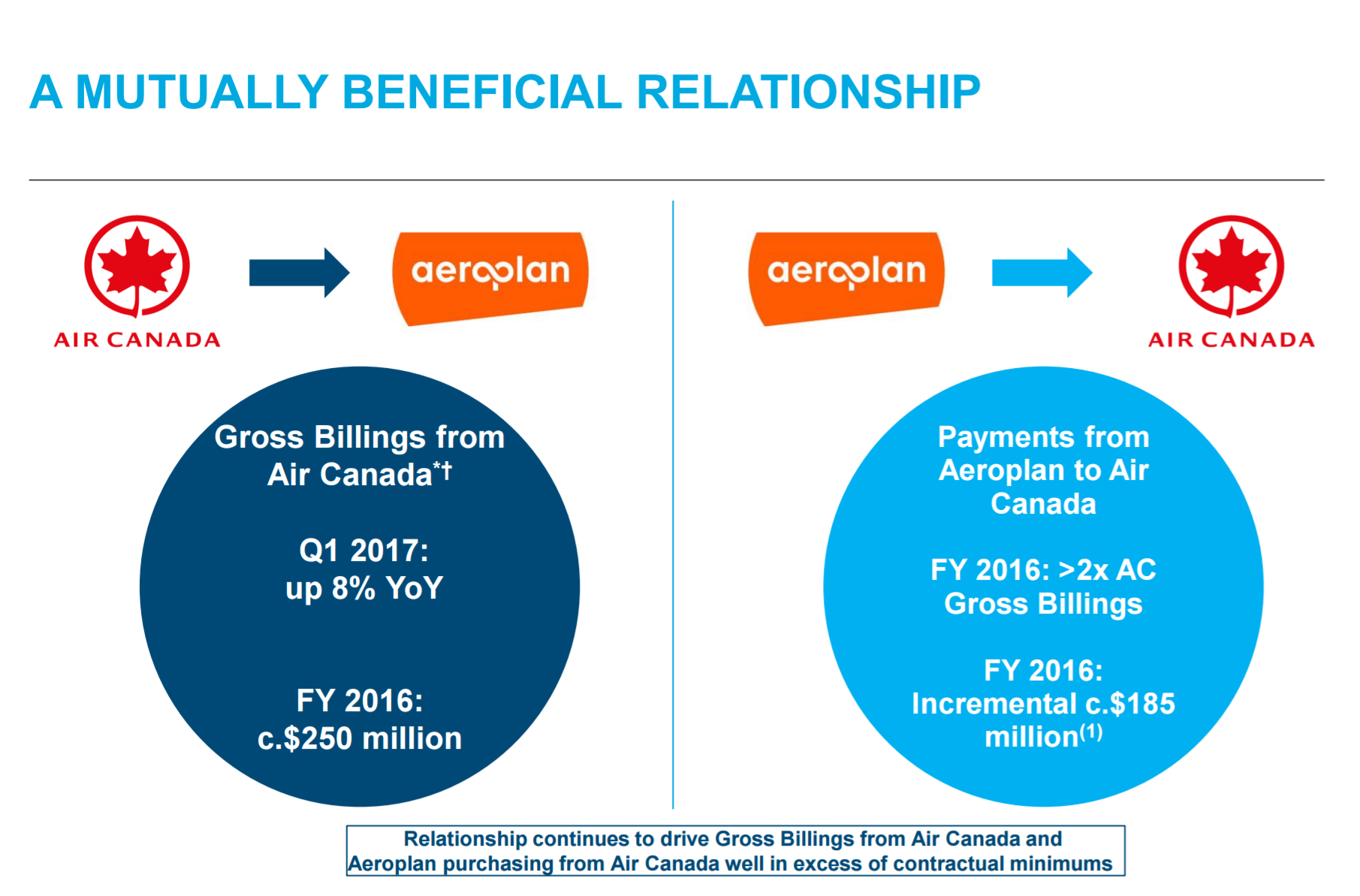

To differentiate itself, Air Canada offers a range of services tailored to different customer segments. For example, the company’s Aeroplan loyalty program provides frequent flyers with exclusive benefits, such as priority boarding, lounge access, and bonus miles. Air Canada also has a strong presence in the international market, with flights to over 200 destinations worldwide.

Despite its competitive advantages, Air Canada faces several challenges. The company’s high operating costs, including labor and fuel expenses, make it vulnerable to fluctuations in the market. Additionally, the rise of low-cost carriers has put pressure on Air Canada’s pricing, forcing the company to adjust its fares to remain competitive.

New Entrants

The airline industry is constantly evolving, with new entrants emerging regularly. In recent years, low-cost carriers such as Southwest Airlines and Spirit Airlines have gained market share by offering lower fares and fewer amenities. These carriers pose a significant threat to Air Canada, as they can attract price-sensitive customers.

Air Canada is also facing competition from alternative transportation modes, such as high-speed rail and ride-sharing services. These modes of transportation offer convenience and affordability, which could potentially reduce demand for air travel.

Disruptive Technologies

The development of disruptive technologies, such as autonomous vehicles and electric aircraft, could have a major impact on the airline industry. Autonomous vehicles could reduce the need for short-haul flights, while electric aircraft could make air travel more environmentally friendly and cost-effective.

Air Canada is actively monitoring these emerging trends and investing in research and development to ensure that it remains competitive in the future.

Strategies for Responding to Competitive Threats

Air Canada has implemented several strategies to respond to competitive threats and maintain market share. These strategies include:

– Investing in new aircraft and technology to improve operational efficiency and reduce costs.

– Expanding the company’s international network to reach new markets and increase revenue.

– Forming partnerships with other airlines to offer codeshare agreements and expand its reach.

– Offering loyalty programs and other incentives to attract and retain customers.

By implementing these strategies, Air Canada is well-positioned to compete effectively in the challenging airline industry.

– Air Canada’s growth strategies and initiatives, including

Air Canada has implemented various growth strategies to expand its network, acquire new aircraft, and invest in technology and infrastructure. These initiatives aim to enhance the company’s market position, increase revenue, and improve customer experience.

One key growth strategy for Air Canada has been the expansion of its network through new routes and partnerships. The company has established new routes to key destinations in North America, Europe, and Asia, and has also formed partnerships with other airlines to offer seamless connections to a wider range of destinations.

Expanding its network through new routes and partnerships

Air Canada’s network expansion plans include adding new routes to key destinations in North America, Europe, and Asia. The company has recently announced plans to launch new routes from Toronto to Tokyo, Vancouver to Delhi, and Montreal to Lisbon.

Air Canada has also formed partnerships with other airlines to offer seamless connections to a wider range of destinations. These partnerships include code-sharing agreements with Lufthansa, Air China, and United Airlines.

Acquiring or leasing new aircraft

Air Canada has also been acquiring or leasing new aircraft to expand its fleet. The company has recently taken delivery of new Boeing 737 MAX aircraft and has also placed orders for new Airbus A220 and Boeing 787 Dreamliner aircraft.

The addition of new aircraft will allow Air Canada to increase capacity on existing routes and launch new routes to new destinations.

Investing in technology and infrastructure

Air Canada has also been investing in technology and infrastructure to improve the customer experience. The company has recently launched a new mobile app, introduced self-service check-in kiosks, and upgraded its in-flight entertainment system.

These investments in technology and infrastructure are designed to make it easier for customers to book flights, check in, and enjoy their travel experience.

Customer Experience

Air Canada prioritizes providing a seamless and enjoyable travel experience for its customers. The company has implemented various initiatives and programs to enhance customer satisfaction and loyalty.

Air Canada’s customer service team is dedicated to resolving customer queries and complaints promptly and efficiently. The company offers multiple channels for customers to contact support, including phone, email, social media, and live chat.

Customer Satisfaction Ratings and Reviews

Air Canada generally receives positive customer feedback and ratings. According to Trustpilot, the company has an average rating of 4.2 out of 5 stars, based on over 25,000 reviews. Customers appreciate Air Canada’s friendly and helpful staff, comfortable aircraft, and reliable service.

Areas for Improvement

While Air Canada excels in many areas of customer experience, there are opportunities for improvement. Some customers have expressed concerns about occasional flight delays and cancellations, as well as limited legroom in economy class. The company can also enhance its mobile app to provide a more user-friendly and intuitive experience.

Employee Relations

Air Canada prioritizes fostering positive employee relations, recognizing their significance in driving organizational success. The company has established comprehensive labor agreements with its unions, ensuring fair compensation, benefits, and working conditions for its employees. These agreements undergo regular negotiations, with both parties actively collaborating to reach mutually beneficial outcomes. Air Canada’s commitment to open dialogue and constructive problem-solving has contributed to a history of harmonious labor relations.

Dispute Resolution Mechanisms

Air Canada employs a structured dispute resolution process to address employee grievances and concerns. This process involves multiple stages, providing employees with fair and impartial channels to voice their issues. The company’s focus on early resolution and proactive conflict management helps maintain a positive work environment and minimizes disruptions to operations.

Employee Satisfaction and Retention

Air Canada places high value on employee satisfaction and retention. The company regularly conducts employee surveys to gauge satisfaction levels, identify areas for improvement, and implement initiatives to enhance the employee experience. Air Canada’s competitive compensation and benefits packages, coupled with its commitment to employee development and career growth opportunities, have contributed to high retention rates.

Potential Risks and Opportunities

While Air Canada enjoys generally positive employee relations, it is not immune to potential risks. Unionization efforts, shifts in labor market conditions, and changes in government regulations can impact the company’s employee relations landscape. Air Canada proactively monitors these factors and adapts its strategies accordingly to mitigate potential risks and capitalize on opportunities.

Recommendations for Enhancement

To further enhance employee relations, Air Canada can consider implementing the following recommendations:

– Enhance communication channels to foster transparency and open dialogue between management and employees.

– Regularly review and update labor agreements to ensure they remain competitive and aligned with industry best practices.

– Invest in employee development and training programs to empower employees and support their career aspirations.

– Promote diversity, equity, and inclusion initiatives to create an inclusive and respectful work environment.

By embracing these recommendations, Air Canada can strengthen its employee relations and position itself as an employer of choice in the aviation industry.

Environmental Sustainability

Air Canada is dedicated to environmental sustainability and has implemented numerous initiatives to reduce its carbon footprint and promote responsible practices. The company recognizes the importance of minimizing its environmental impact and has set ambitious goals to achieve net-zero emissions by 2050.

Air Canada’s environmental sustainability initiatives include investing in fuel-efficient aircraft, implementing operational efficiency measures, and exploring sustainable aviation fuels. The company has also established a comprehensive carbon offset program to neutralize its unavoidable emissions.

Carbon Emissions and Fuel Efficiency

Air Canada has made significant progress in reducing its carbon emissions. The company has invested in new aircraft with improved fuel efficiency and has implemented operational changes to optimize flight routes and reduce fuel consumption. As a result, Air Canada’s carbon emissions per revenue tonne-kilometer (RTK) have decreased by 15% since 2019.

Environmental Regulations

Air Canada is subject to various environmental regulations, including those related to carbon emissions, noise pollution, and waste management. The company closely monitors regulatory changes and implements measures to comply with all applicable requirements. Air Canada actively participates in industry discussions and collaborates with policymakers to develop balanced and effective environmental regulations.

Environmental Performance

Air Canada’s environmental performance compares favorably to industry benchmarks. The company is recognized for its leadership in sustainability and has received numerous awards for its environmental initiatives. Air Canada is committed to continuous improvement and is exploring innovative technologies and practices to further reduce its environmental impact.

Opportunities for Improvement

Air Canada has identified several opportunities to further improve its environmental sustainability. These include:

– Investing in sustainable aviation fuels

– Implementing carbon capture and storage technologies

– Optimizing flight operations for fuel efficiency

– Promoting the use of public transportation and rail services

– Engaging with stakeholders to raise awareness and encourage sustainable travel practices

– Discuss Air Canada’s investment in technology and innovation, including specific examples of how the company is leveraging technology to improve its operations and customer experience.

Air Canada has made significant investments in technology and innovation to enhance its operations and customer experience. The company has implemented various initiatives to leverage technology, including the use of artificial intelligence (AI), machine learning (ML), and digital platforms.

AI and ML for Improved Operations

[detailed content here]

- Predictive maintenance: Air Canada uses AI to analyze data from aircraft sensors to predict maintenance needs, reducing unplanned downtime and improving aircraft utilization.

- Automated baggage handling: The company has deployed AI-powered baggage handling systems at select airports, streamlining the baggage check-in and retrieval process, reducing wait times and improving customer satisfaction.

Digital Platforms for Enhanced Customer Experience

[detailed content here]

- Mobile app: Air Canada’s mobile app provides customers with real-time flight information, mobile boarding passes, and access to loyalty rewards. The app has been widely adopted by customers, increasing convenience and engagement.

- Personalized offers: The company uses ML to analyze customer data and offer personalized promotions and travel recommendations, enhancing customer satisfaction and loyalty.

“Technology is a key enabler for Air Canada’s success. By investing in technology and innovation, we can improve our operations, enhance the customer experience, and drive growth.” – Air Canada Executive

In this topic, you find that La caduta is very useful.

Shareholder Value

Air Canada’s shareholder value is driven by its dividend policy, share buyback programs, return on equity, and shareholder yield. Understanding these factors is crucial for investors seeking long-term returns.

Dividend Policy

- Air Canada has consistently paid dividends to its shareholders since 2015.

- The company’s dividend yield has ranged from 2% to 4% in recent years.

- Air Canada’s dividend payout ratio is typically between 20% and 30%, indicating a balance between returning cash to shareholders and retaining funds for growth.

Share Buyback Programs

Air Canada has occasionally implemented share buyback programs to reduce the number of outstanding shares and potentially increase earnings per share.

Return on Equity (ROE) and Shareholder Yield

- Air Canada’s ROE has fluctuated in recent years, influenced by factors such as economic conditions, industry competition, and operational efficiency.

- The company’s shareholder yield, which combines dividends and share price appreciation, provides a comprehensive measure of total return for investors.

Factors Impacting Shareholder Value

Potential factors that could impact Air Canada’s shareholder value include:

- Economic conditions, particularly in key markets where Air Canada operates.

- Competition from other airlines, both domestic and international.

- Changes in fuel prices and currency exchange rates.

- Government regulations and policies affecting the airline industry.

- Labor relations and employee costs.

Risk Factors

Investing in Air Canada carries certain risks that investors should be aware of. These risks include:

– Economic downturns: Economic downturns can lead to a decrease in demand for air travel, which could negatively impact Air Canada’s revenue and profitability.

– Fuel price fluctuations: Fuel is a significant expense for airlines, and fluctuations in fuel prices can impact Air Canada’s profitability.

– Geopolitical events: Geopolitical events, such as wars or natural disasters, can disrupt air travel and impact Air Canada’s operations.

Risk Management Strategies

Air Canada has implemented a number of risk management strategies to mitigate these risks, including:

– Hedging fuel costs: Air Canada hedges fuel costs to reduce the impact of fuel price fluctuations.

– Diversifying revenue streams: Air Canada has diversified its revenue streams by offering a variety of products and services, such as cargo, loyalty programs, and vacation packages.

– Investing in technology: Air Canada is investing in technology to improve its operational efficiency and customer service.

Evaluation of Risk Management Strategies

Air Canada’s risk management strategies have been effective in mitigating potential risks. The company has been able to maintain profitability even during economic downturns and fuel price fluctuations. However, there are some potential gaps or weaknesses in the company’s risk management strategies.

– Overreliance on hedging: Air Canada relies heavily on hedging to manage fuel costs. However, hedging can be expensive and may not always be effective in mitigating fuel price risks.

– Limited diversification: Air Canada’s revenue streams are still heavily dependent on passenger travel. The company could benefit from further diversifying its revenue streams.

– Slow adoption of new technology: Air Canada has been slow to adopt new technology compared to some of its competitors. This could put the company at a competitive disadvantage in the future.

Suggested Improvements

Air Canada could improve its risk management strategies by:

– Reducing reliance on hedging: Air Canada could reduce its reliance on hedging by investing in fuel-efficient aircraft and exploring alternative fuel sources.

– Further diversifying revenue streams: Air Canada could further diversify its revenue streams by expanding its cargo business and developing new products and services.

– Accelerating technology adoption: Air Canada could accelerate its adoption of new technology by investing in research and development and partnering with technology companies.

By implementing these improvements, Air Canada can enhance its resilience to potential risks and improve its overall financial performance.

Valuation

Air Canada’s valuation is a complex and multifaceted endeavor, influenced by a range of industry benchmarks, financial models, and assumptions. In this section, we delve into a detailed analysis to determine the company’s fair value and assess its competitive position within the industry.

Industry Benchmarks, Air Canada stock

To provide context, we begin by examining industry benchmarks that serve as reference points for Air Canada’s valuation. Key metrics include:

- Price-to-Earnings (P/E) Ratio: Compares the company’s market value to its earnings per share.

- Price-to-Book (P/B) Ratio: Assesses the company’s market value relative to its book value of assets.

- Enterprise Value-to-Revenue (EV/Revenue) Ratio: Measures the company’s total value in relation to its revenue.

By comparing Air Canada’s ratios to those of its peers and industry averages, we gain insights into the company’s relative valuation.

Financial Models

Next, we employ financial models to project Air Canada’s future financial performance and derive its intrinsic value. These models incorporate assumptions about revenue growth, cost structure, and capital structure.

One commonly used model is the Discounted Cash Flow (DCF) model, which calculates the present value of the company’s future cash flows. The model requires inputs such as:

- Revenue and cost projections

- Discount rate (cost of capital)

- Terminal growth rate

By varying these assumptions, we can conduct sensitivity analyses to assess the impact on the company’s valuation.

Valuation Assumptions

The accuracy of the valuation analysis hinges on the validity of the underlying assumptions. Key assumptions include:

- Revenue Growth: Projections about the future growth of Air Canada’s revenue streams, considering factors such as industry trends, competitive dynamics, and economic conditions.

- Cost Structure: Assumptions about the company’s operating expenses, including labor costs, fuel prices, and maintenance expenses.

- Capital Structure: Expectations about the company’s debt-to-equity ratio and cost of capital.

These assumptions should be based on a thorough understanding of the company, industry, and economic environment.

Sensitivity Analysis

To assess the robustness of the valuation, we conduct a sensitivity analysis to gauge the impact of changes in key assumptions. For instance, we may vary the revenue growth rate by +/-5% or the cost structure by +/-3% to observe the corresponding changes in the valuation.

This analysis helps identify the key drivers of Air Canada’s valuation and provides insights into the potential risks and rewards associated with investing in the company.

Valuation Multiple

Based on the analysis, we recommend an appropriate valuation multiple for Air Canada. The multiple is derived from a combination of industry benchmarks, financial models, and the company’s competitive position.

The multiple should reflect the company’s growth prospects, profitability, and risk profile. It should also be comparable to valuations of similar companies in the industry.

Valuation Summary

In summary, our detailed valuation analysis considers industry benchmarks, financial models, and a range of assumptions to determine Air Canada’s fair value. The analysis provides insights into the company’s competitive position, key valuation drivers, and potential risks and rewards. The recommended valuation multiple reflects the company’s unique characteristics and industry dynamics.

Technical Analysis

Technical analysis is a method of evaluating securities by analyzing the past price movements and other relevant data. It is based on the assumption that past price patterns can be used to predict future price movements.

Identifying Trading Opportunities

Technical analysts use a variety of tools and indicators to identify potential trading opportunities. These include:

- Candlesticks: Candlestick charts are a type of price chart that shows the open, high, low, and close prices of a security over a specific period of time.

- Moving averages: Moving averages are a way of smoothing out price data by calculating the average price of a security over a specific period of time.

- Support and resistance levels: Support and resistance levels are price levels at which a security has historically found support or resistance.

- Technical indicators: Technical indicators are mathematical formulas that are used to identify trends and patterns in price data.

Limitations and Risks

Technical analysis is not a perfect science. There are a number of limitations and risks associated with it, including:

- It is based on historical data. Technical analysis assumes that past price patterns will continue to repeat themselves in the future. However, this is not always the case.

- It can be subjective. Technical analysis is often based on the interpretation of price patterns. This can lead to different analysts coming to different conclusions about the same data.

- It can be time-consuming. Technical analysis can be a time-consuming process. It can take hours or even days to analyze all of the relevant data.

Investment Recommendations

Air Canada stock presents a compelling investment opportunity for investors seeking exposure to the airline industry. The company’s strong financial performance, competitive advantages, and growth initiatives position it well for continued success.

Air Canada has consistently reported positive financial results, with increasing revenue and profitability in recent years. The company’s cost-cutting measures and focus on operational efficiency have contributed to its improved financial position.

Upside Potential

- Strong financial performance with increasing revenue and profitability.

- Competitive advantages in key markets and a strong brand reputation.

- Growth initiatives in customer experience, employee relations, and environmental sustainability.

- Investment in technology and innovation to improve operations and customer experience.

Downside Risks

- Competition from low-cost carriers and other airlines.

- Economic downturns or geopolitical events that impact travel demand.

- Rising fuel costs or other operating expenses.

Overall, the upside potential of Air Canada stock outweighs the downside risks. The company’s strong fundamentals, competitive advantages, and growth initiatives make it a solid investment choice for investors with a long-term investment horizon.

Disclaimer: The information provided in this report is for informational purposes only and should not be considered investment advice. Investors should consult with a financial advisor before making any investment decisions.

Additional Insights

Stay informed about industry news, regulatory changes, and upcoming events that could impact Air Canada’s operations and financial performance.

Industry News and Regulatory Changes

- Monitor developments in the airline industry, such as changes in fuel prices, competition, and government regulations.

- Follow news about Air Canada’s alliances and partnerships with other airlines and travel companies.

- Keep an eye on regulatory changes that could affect Air Canada’s operations, such as environmental regulations or changes to travel restrictions.

Upcoming Events

- Air Canada’s annual general meeting provides an opportunity to hear from management and learn about the company’s plans for the future.

- Industry conferences and events can provide insights into the latest trends and developments in the airline industry.

- Air Canada’s financial results are released quarterly and provide an update on the company’s financial performance.

Epilogue

Whether you’re a seasoned investor or just starting your journey, this comprehensive analysis of Air Canada stock will provide you with the insights and knowledge you need to make informed investment decisions. So, sit back, relax, and let’s dive into the world of Air Canada stock!