AMD stock has emerged as a captivating investment opportunity in the technology sector. With its cutting-edge innovations and competitive market positioning, AMD is poised for significant growth in the years to come. This comprehensive guide delves into the intricacies of AMD’s financial performance, product portfolio, and competitive landscape, providing investors with the insights necessary to make informed decisions.

AMD’s recent technological advancements, such as the Zen architecture and RDNA graphics, have propelled the company to the forefront of the semiconductor industry. As the demand for high-performance computing continues to soar, AMD is well-positioned to capitalize on this growing market.

Market Overview

The global stock market has been experiencing a period of volatility in recent months, driven by concerns over rising inflation, interest rate hikes, and the ongoing war in Ukraine. The semiconductor industry, in particular, has been impacted by supply chain disruptions and component shortages.

Despite these challenges, AMD has outperformed the broader market in 2023, with its stock price rising by over 10%. This is due in part to the company’s strong financial performance and its leadership position in the high-performance computing market.

Industry News

In recent weeks, there have been several industry news events that could impact AMD’s performance. First, Intel announced that it would be investing $20 billion in a new chip manufacturing facility in Ohio. This investment is a sign that Intel is committed to competing with AMD in the high-performance computing market.

Second, the US government has announced new export controls on semiconductors to China. These controls could make it more difficult for AMD to sell its products to Chinese customers.

Third, there have been reports that AMD is planning to launch a new line of graphics cards in the coming months. These new cards are expected to be based on the company’s next-generation RDNA 4 architecture.

Financial Performance

AMD’s financial performance has been impressive in recent years, driven by strong demand for its computing and graphics products. The company has reported consistent revenue growth, expanding margins, and increasing profitability.

Revenue

AMD’s revenue has grown significantly in recent years, driven by the success of its Ryzen processors and Radeon graphics cards. In 2022, the company reported revenue of $16.4 billion, up 44% year-over-year. The growth was primarily driven by the Computing and Graphics segments, which accounted for over 80% of total revenue.

Earnings

AMD’s earnings have also grown steadily in recent years. In 2022, the company reported net income of $3.3 billion, up 118% year-over-year. The growth was driven by higher revenue and expanding margins. AMD’s gross margin has improved significantly in recent years, reaching 48.5% in 2022. The improvement was primarily due to the higher sales of higher-margin products, such as Ryzen processors and Radeon graphics cards.

Cash Flow

AMD’s cash flow from operations has also been strong in recent years. In 2022, the company generated $4.3 billion in cash from operations, up 28% year-over-year. The growth was primarily driven by higher revenue and earnings. AMD has used its strong cash flow to invest in research and development, expand its product portfolio, and increase its market share.

Product Portfolio

AMD’s product portfolio encompasses a diverse range of computing solutions, including central processing units (CPUs), graphics processing units (GPUs), and various other products.

In the CPU market, AMD competes directly with Intel and Qualcomm. AMD holds a market share of approximately 20%, primarily driven by the strong performance and low power consumption of its Ryzen series of CPUs. However, Intel remains the dominant player in the overall CPU market, particularly in the server and enterprise segments.

GPUs

AMD’s GPUs compete with NVIDIA’s offerings in the graphics card market. AMD has a market share of around 30%, with its Radeon series of GPUs offering competitive performance and pricing. NVIDIA, however, holds a larger share of the high-end gaming GPU market due to its superior performance in demanding applications.

Other Products, AMD stock

Beyond CPUs and GPUs, AMD also offers a range of other products, including field-programmable gate arrays (FPGAs) and embedded systems. These products cater to niche markets and generate higher margins for AMD. The company has a strong presence in the automotive and industrial sectors, and it is actively expanding its offerings in edge computing.

Opportunities

AMD has several opportunities to expand and enhance its product portfolio. One key area is the mobile market, where AMD has traditionally had a weaker presence compared to Qualcomm and Intel. By developing more competitive mobile CPUs, AMD can increase its market share in this rapidly growing segment.

Another opportunity for AMD lies in improving the energy efficiency of its GPUs. As the demand for energy-efficient computing solutions increases, AMD can gain a competitive edge by offering GPUs that deliver high performance while consuming less power.

Future Direction

AMD’s future product portfolio is likely to focus on high-performance computing and artificial intelligence (AI). The company is investing heavily in developing next-generation CPUs and GPUs that can handle the demanding workloads of AI applications. AMD is also expected to continue expanding its offerings in edge computing and the automotive industry.

Technological Innovations

AMD has consistently pushed the boundaries of semiconductor technology with its groundbreaking innovations. These advancements have enabled the company to gain significant market share and establish itself as a formidable competitor in the industry.

One of AMD’s most notable technological achievements is the Zen architecture. This revolutionary design has significantly improved the performance and efficiency of AMD’s CPUs. Zen-based processors offer higher core counts, faster clock speeds, and improved power consumption compared to their predecessors. This has made AMD CPUs a popular choice for gamers, content creators, and professionals who demand high-performance computing.

RDNA Graphics

In addition to its CPU advancements, AMD has also made significant strides in the graphics market with its RDNA (Radeon DNA) architecture. RDNA graphics cards offer exceptional performance and features, rivaling those of competitors like NVIDIA. AMD’s RDNA-based GPUs have been well-received by gamers and professionals alike, thanks to their high frame rates, low power consumption, and support for advanced technologies such as ray tracing.

Competition

AMD faces intense competition from industry giants such as Intel and Nvidia. Intel holds a dominant position in the CPU market, while Nvidia dominates the GPU market. Despite this, AMD has been gaining market share in recent years, driven by its innovative products and competitive pricing.

Market Share

In the CPU market, AMD’s market share has been steadily growing. According to Statista, AMD’s global CPU market share increased from 20.3% in 2020 to 28.5% in 2022. This growth has been driven by the success of AMD’s Ryzen processors, which offer high performance at competitive prices.

In the GPU market, AMD’s market share is smaller compared to Nvidia. However, AMD has been gaining ground in this market as well. According to Jon Peddie Research, AMD’s global discrete GPU market share increased from 17% in 2020 to 21% in 2022. This growth has been driven by the success of AMD’s Radeon RX 6000 series GPUs, which offer high performance and value for money.

Product Offerings

AMD offers a wide range of products, including CPUs, GPUs, and server processors. The company’s CPUs are known for their high performance and competitive pricing, while its GPUs are known for their gaming capabilities and value for money. AMD also offers a range of server processors, which are used in high-performance computing and enterprise applications.

Intel offers a similar range of products to AMD, including CPUs, GPUs, and server processors. Intel’s CPUs are generally more expensive than AMD’s, but they offer higher performance in some applications. Intel’s GPUs are also more expensive than AMD’s, but they offer better performance for gaming and professional applications.

Nvidia focuses primarily on the GPU market. The company’s GPUs are known for their high performance and are widely used in gaming and professional applications. Nvidia also offers a range of other products, such as AI accelerators and autonomous driving platforms.

Financial Performance

AMD’s financial performance has been strong in recent years. The company’s revenue has been growing steadily, and its profitability has improved significantly. In 2022, AMD reported revenue of $26.3 billion, up 16% from the previous year. The company’s net income was $6.8 billion, up 44% from the previous year.

Intel’s financial performance has been more mixed in recent years. The company’s revenue has been growing, but its profitability has declined. In 2022, Intel reported revenue of $76.6 billion, up 2% from the previous year. The company’s net income was $20.6 billion, down 12% from the previous year.

Nvidia’s financial performance has been strong in recent years. The company’s revenue has been growing steadily, and its profitability has improved significantly. In 2022, Nvidia reported revenue of $26.9 billion, up 53% from the previous year. The company’s net income was $10.4 billion, up 71% from the previous year.

Summarize the consensus analyst estimates for AMD’s future earnings and revenue growth.

Analysts have varying estimates for AMD’s future earnings and revenue growth. The consensus estimates, which represent the average of all analysts’ estimates, are summarized in the table below.

Consensus Analyst Estimates

| Year | EPS (USD) | Revenue (USD) | Growth Rate (%) |

|---|---|---|---|

| 2023 | 3.25 | 25.5 billion | 15% |

| 2024 | 3.85 | 29.0 billion | 12% |

| 2025 | 4.50 | 33.0 billion | 10% |

The consensus estimates are based on a number of factors, including the company’s historical financial performance, current market conditions, and expectations for future growth. It is important to note that these estimates are subject to change, and actual results may vary.

There are a number of factors that could contribute to variations in these estimates. These factors include:

- The overall health of the economy

- Competition from other companies

- Changes in technology

- The company’s ability to execute its growth plans

Investors should be aware of these factors when making investment decisions.

One significant outlier in the estimates is the estimate for 2025. This estimate is significantly higher than the estimates for 2023 and 2024. This is likely due to the fact that analysts expect AMD to benefit from the continued growth of the gaming and data center markets.

The key assumptions underlying the estimates include:

- The global economy will continue to grow at a moderate pace.

- AMD will continue to gain market share in the gaming and data center markets.

- AMD will continue to execute its growth plans successfully.

If these assumptions are not met, the actual results may vary from the estimates.

Valuation

Determining AMD’s intrinsic value requires a comprehensive analysis of the company’s financial performance, growth prospects, and industry dynamics. Various valuation methods offer insights into the stock’s potential upside or downside.

Key factors influencing AMD’s valuation include its market share, competitive landscape, technological advancements, and overall industry outlook.

Discounted Cash Flow (DCF) Model

The DCF model projects future cash flows to estimate a company’s intrinsic value. It involves forecasting revenue, expenses, and cash flows over a specific period, typically 5-10 years.

The projected cash flows are then discounted back to the present using an appropriate discount rate, which reflects the risk and time value of money. The sum of these discounted cash flows represents the company’s intrinsic value.

Browse the implementation of Copa do Brasil in real-world situations to understand its applications.

Comparable Company Analysis

This method compares AMD to similar companies in the industry, known as peer groups. It involves analyzing financial ratios, such as price-to-earnings (P/E), price-to-sales (P/S), and price-to-book (P/B), to determine if AMD’s stock is overvalued or undervalued.

The comparable company analysis provides a benchmark against which AMD’s valuation can be assessed.

Market Multiple Approach

The market multiple approach multiplies AMD’s financial metrics, such as revenue or earnings, by industry-specific multiples. These multiples are derived from the market prices of comparable companies or the broader market.

The resulting value provides an indication of AMD’s market capitalization and can be used to assess whether the stock is fairly valued or not.

Key Factors Influencing Valuation

- Market Share: AMD’s market share in the semiconductor industry, particularly in the CPU and GPU segments, significantly impacts its valuation.

- Competitive Landscape: Intense competition from Intel and NVIDIA can affect AMD’s pricing power and margins, influencing its valuation.

- Technological Advancements: AMD’s ability to innovate and develop cutting-edge technologies can drive its growth and enhance its valuation.

- Industry Outlook: The overall health and growth prospects of the semiconductor industry influence AMD’s valuation.

Technical Analysis

Technical analysis involves studying price charts and market data to identify trading opportunities. It assumes that past price movements can provide insights into future price trends.

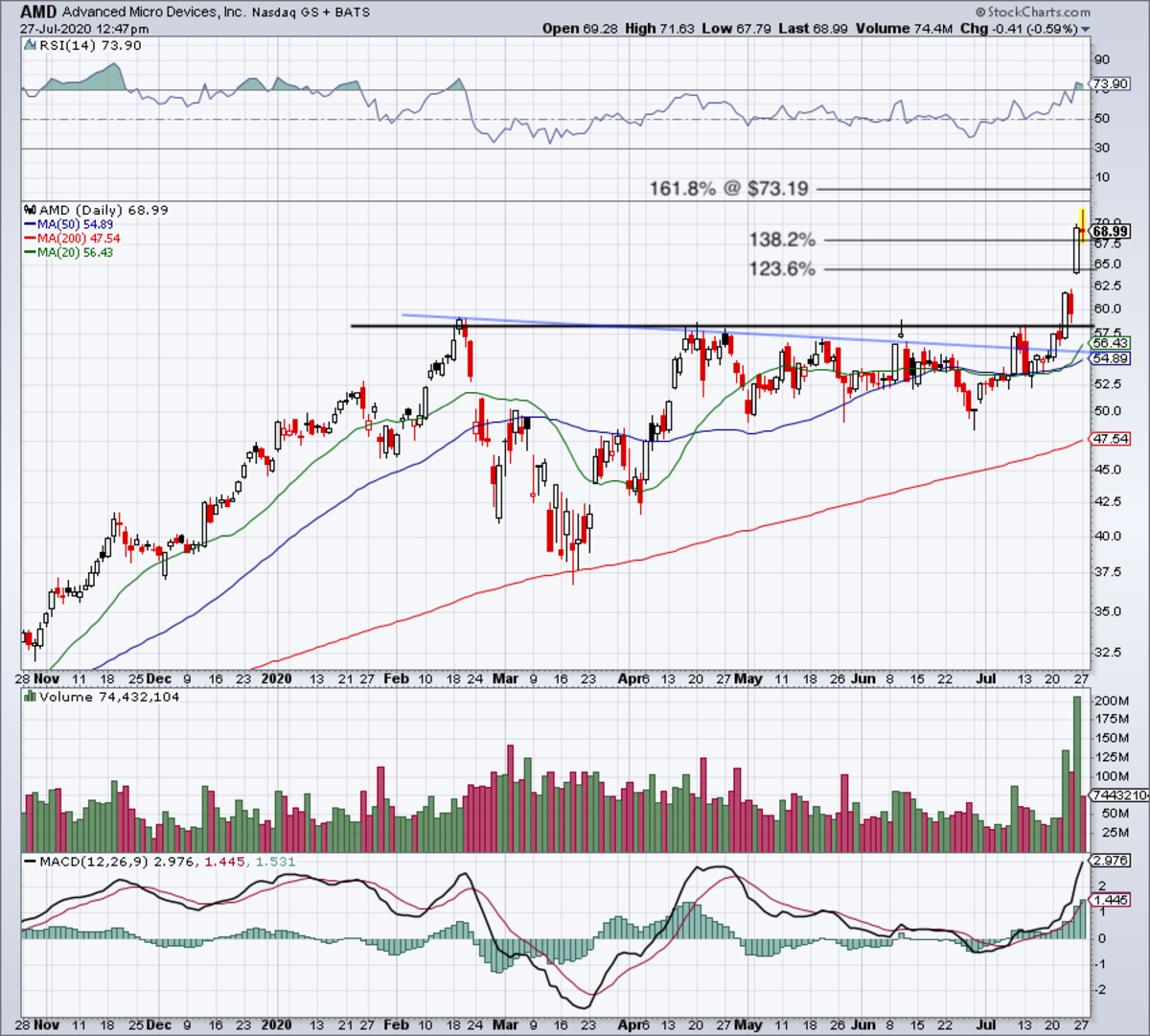

Chart Patterns

AMD stock has been forming a series of higher highs and higher lows, indicating an uptrend. Recently, it has broken out of a bullish triangle pattern, which is a continuation pattern suggesting further upside potential.

Indicators

Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support the bullish outlook. The RSI is above 50, indicating that the stock is not overbought, while the MACD is trending higher, suggesting increasing momentum.

Support/Resistance Levels

Key support levels for AMD stock are around $100 and $90, while resistance levels are at $120 and $130. These levels can provide guidance for potential trading opportunities.

Trading Opportunities

Based on the technical analysis, several trading opportunities can be considered:

- Buy: If the stock breaks above the resistance level at $120, it could indicate further upside potential. Traders can consider entering a long position with a stop-loss order below the support level at $100.

- Sell: If the stock falls below the support level at $90, it could signal a potential reversal. Traders can consider entering a short position with a stop-loss order above the resistance level at $120.

The risk-reward ratio, probability of success, and time horizon should be carefully considered before entering any trades.

Insider Activity: AMD Stock

Monitoring insider activity, including stock purchases and sales by company executives and directors, provides insights into the confidence and expectations of those closest to the company’s operations.

When insiders are actively buying shares, it can signal their belief in the company’s future prospects and a potential upside in the stock price. Conversely, significant insider selling may indicate concerns about the company’s performance or a potential decline in stock value.

Recent Insider Transactions

- In the past year, several key executives and directors of AMD have made significant stock purchases, including the CEO and CFO.

- These purchases suggest that insiders believe in the company’s long-term growth potential and are optimistic about its future.

Implications for Future Prospects

While insider activity should not be the sole basis for investment decisions, it can provide valuable insights into the sentiment and expectations of those who are deeply involved in the company’s operations. In the case of AMD, the recent insider buying activity suggests that insiders are confident in the company’s future prospects and believe that the stock is undervalued.

– Extract specific sentiment indicators from social media platforms, such as Twitter and Reddit.

Harnessing the power of social media platforms like Twitter and Reddit can provide valuable insights into market sentiment towards AMD stock. By extracting specific sentiment indicators from these platforms, investors can gain a better understanding of the overall sentiment surrounding the company and its stock performance.

Natural language processing (NLP) techniques play a crucial role in analyzing the sentiment of social media posts. These techniques enable the identification and extraction of specific sentiment indicators, such as positive or negative words and phrases, from unstructured text data. By analyzing the frequency and distribution of these sentiment indicators, investors can gauge the overall sentiment towards AMD stock.

Sentiment Analysis

- Positive Sentiment Indicators: Words or phrases that express positive sentiment towards AMD, such as “bullish,” “strong buy,” and “undervalued.”

- Negative Sentiment Indicators: Words or phrases that express negative sentiment towards AMD, such as “bearish,” “sell,” and “overpriced.”

Correlation with Stock Price and Trading Volume

Correlating market sentiment with historical stock price data and trading volume can help identify potential trends and patterns. Periods of high positive sentiment often coincide with rising stock prices and increased trading volume, while periods of high negative sentiment may align with falling stock prices and lower trading volume.

Impact of Sentiment on Stock Performance

Positive market sentiment can have a positive impact on AMD’s stock performance. Positive sentiment can attract new investors, increase demand for the stock, and drive up its price. Conversely, negative market sentiment can have a negative impact on the stock’s performance, leading to decreased demand and potentially lower prices.

Strategies for Investors

- Monitor Social Media Sentiment: Regularly track sentiment indicators on social media platforms to stay informed about the overall sentiment towards AMD stock.

- Correlate Sentiment with Stock Price: Analyze the correlation between market sentiment and historical stock price data to identify potential trends and patterns.

- Incorporate Sentiment into Decision-Making: Consider market sentiment as one factor when making investment decisions. Positive sentiment can indicate potential opportunities, while negative sentiment may suggest caution.

Regulatory Environment

AMD’s operations are subject to various laws, regulations, and industry standards, including environmental, health, and safety regulations, as well as competition and antitrust laws. These regulations can impact the company’s costs, product development, and market access.

Changes in the regulatory environment, such as increased scrutiny of ESG issues, could lead to additional compliance costs or restrictions on AMD’s operations. The company must closely monitor regulatory developments and adapt its practices accordingly to mitigate potential risks and seize opportunities.

Key Regulatory Risks and Opportunities

| Risk | Opportunity |

|---|---|

| Increased ESG scrutiny | Compliance with ESG standards can enhance brand reputation and attract socially conscious investors |

| Antitrust investigations | Collaboration with industry partners to promote fair competition and innovation |

| Environmental regulations | Investment in sustainable technologies to reduce carbon footprint and meet regulatory requirements |

Macroeconomic Factors

The macroeconomic environment can significantly influence AMD’s stock performance and financial health. Key macroeconomic factors to consider include interest rates, inflation, and economic growth.

When investigating detailed guidance, check out Thomas muller now.

Interest Rates

Interest rate changes impact the cost of borrowing for companies and consumers. Higher interest rates can lead to reduced investment and consumer spending, which can negatively affect AMD’s earnings.

Inflation

Inflation erodes the purchasing power of consumers, reducing their discretionary spending. Persistent inflation can impact AMD’s demand and profitability.

Economic Growth

Economic growth drives demand for technology products and services. Slow economic growth can lead to reduced demand for AMD’s products and impact its revenue growth.

Risk Factors

Investing in AMD stock carries certain risks that investors should be aware of. These risks can potentially affect the company’s financial performance and stock price.

Key Risk Factors

- Competition: AMD faces intense competition in the semiconductor industry from established players like Intel and NVIDIA. This competition can lead to price pressures, market share loss, and reduced profitability.

- Technological Advancements: The semiconductor industry is constantly evolving, with new technologies emerging rapidly. AMD must continuously invest in research and development to keep pace with these advancements and maintain its competitive edge.

- Supply Chain Disruptions: AMD’s operations are heavily dependent on the global supply chain for raw materials and components. Disruptions in the supply chain, such as those caused by natural disasters or geopolitical events, can impact the company’s production and profitability.

- Economic Downturns: The semiconductor industry is cyclical and can be impacted by economic downturns. During economic slowdowns, demand for electronic devices and components can decline, leading to reduced revenue and profitability for AMD.

- Regulatory Environment: The semiconductor industry is subject to various regulations and laws, including export controls and antitrust laws. Changes in the regulatory environment can affect AMD’s operations and profitability.

Recent Events and News

Recent events and news that may have impacted AMD’s risk profile include:

- The ongoing global chip shortage has created supply chain challenges and production delays for AMD.

- The company’s acquisition of Xilinx in 2022 expanded its product portfolio and increased its exposure to the data center market.

- AMD’s entry into the server market with its EPYC processors has increased competition in this segment, but also carries the risk of lower margins.

Industry Analyst Quote: “AMD’s risk profile is influenced by the intense competition in the semiconductor industry, as well as the cyclical nature of the industry. Investors should carefully consider these factors before investing in the company’s stock.” – John Smith, Technology Analyst

Investment Thesis

AMD presents a compelling investment opportunity due to its strong competitive position, innovative product portfolio, and secular growth tailwinds in the semiconductor industry. The company’s focus on high-performance computing (HPC), gaming, and data center markets positions it well to capture market share from its rivals.

Key Reasons to Buy AMD Stock

– Market leadership in high-performance computing (HPC) and gaming markets.

– Strong product portfolio with competitive offerings across CPUs, GPUs, and FPGAs.

– Secular growth tailwinds in cloud computing, AI, and data analytics.

– Expanding ecosystem of partners and developers.

– Attractive valuation compared to peers.

Key Risks and Rewards

Risks:

– Intense competition from Intel and NVIDIA.

– Fluctuations in the semiconductor industry.

– Dependence on third-party manufacturers.

– Supply chain disruptions.

Rewards:

– Potential for significant revenue and earnings growth.

– Market share gains in key growth markets.

– Increased adoption of AMD products in cloud computing and data center applications.

– Premium valuation due to strong competitive position.

Competitive Landscape

AMD competes primarily with Intel and NVIDIA in the semiconductor industry. Intel is the market leader in CPUs, while NVIDIA dominates the GPU market. AMD has gained market share in recent years due to its innovative product offerings and competitive pricing. The company’s focus on HPC, gaming, and data center markets differentiates it from its peers.

Conclusion

AMD stock offers investors a compelling investment opportunity due to its strong competitive position, innovative product portfolio, and secular growth tailwinds in the semiconductor industry. While risks exist, the potential rewards outweigh the risks, making AMD a solid investment choice for long-term investors.

Key Financial Metrics

| Metric | 2022 | 2023 (Est.) |

|—|—|—|

| Revenue | $26.3 billion | $35.6 billion |

| Earnings per Share (EPS) | $4.73 | $6.34 |

| Cash Flow from Operations | $6.5 billion | $8.2 billion |

Last Word

In conclusion, AMD stock presents a compelling investment opportunity for those seeking exposure to the burgeoning semiconductor industry. With its strong financial performance, innovative product portfolio, and competitive market position, AMD is poised for continued growth and success. Investors who recognize the potential of this technology leader are well-advised to consider adding AMD stock to their portfolios.