Step into the electrifying world of Azioni Enel, where innovation, sustainability, and financial prowess converge. As one of the leading energy companies globally, Enel’s journey is a captivating tale of transformation, resilience, and unwavering commitment to a brighter, more sustainable future.

With a rich history spanning decades, Enel has evolved into a multifaceted energy powerhouse, embracing renewable energy, grid infrastructure, and digitalization to meet the ever-changing demands of the 21st century. Get ready to explore the depths of Enel’s operations, financial health, and sustainability initiatives, uncovering the secrets behind its remarkable success.

Overview of Enel S.p.A.

Enel S.p.A. is an Italian multinational energy company, headquartered in Rome. It is one of the largest energy companies in the world, with operations in over 30 countries.

The company was founded in 1962 as Ente Nazionale per l’Energia Elettrica (National Electric Energy Agency). It was privatized in 1999 and listed on the Milan Stock Exchange.

Business Operations

Enel is involved in all aspects of the energy industry, from generation and distribution to retail and trading. The company has a diversified portfolio of energy sources, including renewable energy, fossil fuels, and nuclear power.

Enel is also a major player in the energy efficiency market. The company provides a range of energy efficiency services to its customers, including energy audits, energy management systems, and renewable energy installations.

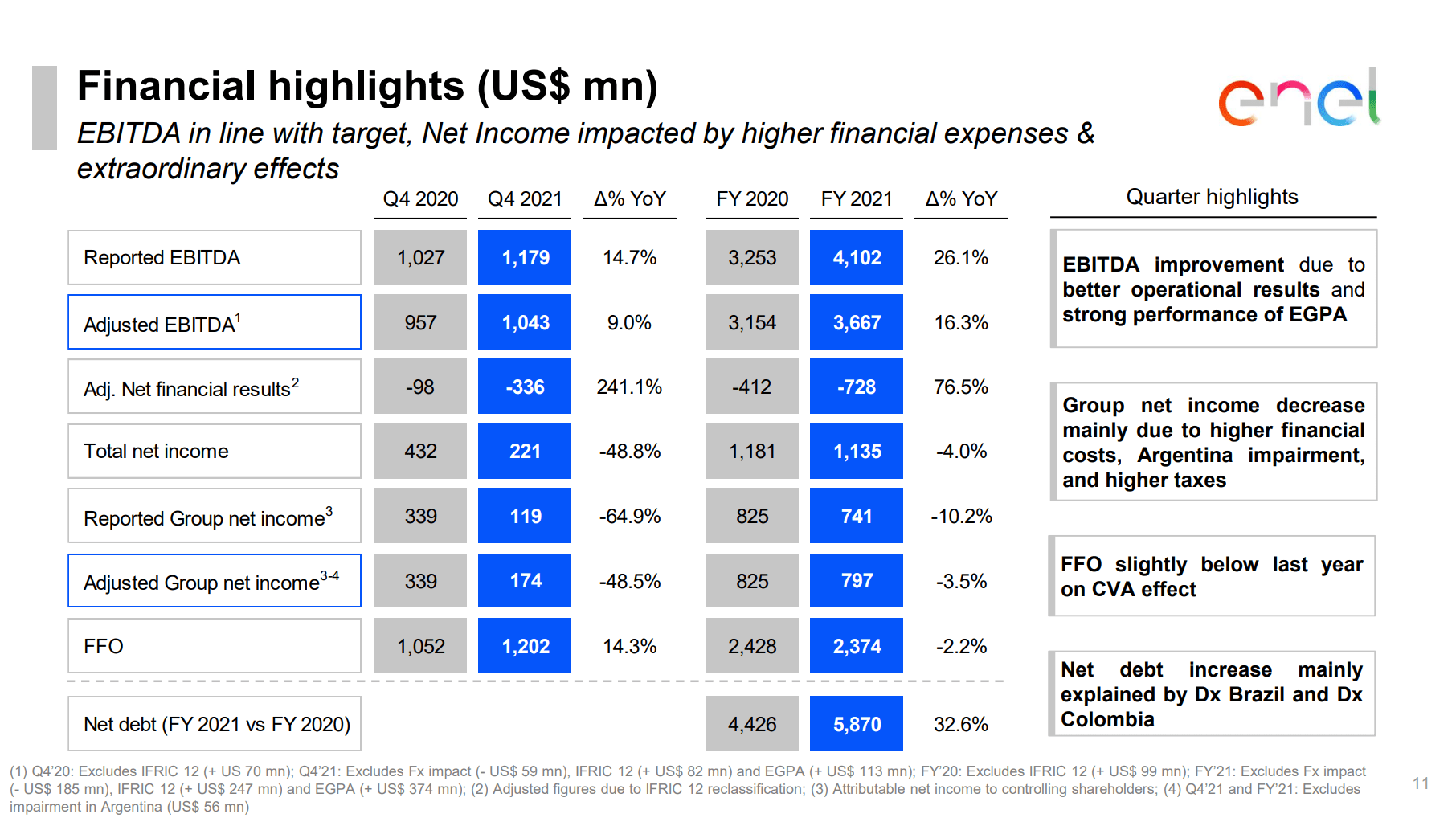

Financial Performance

Enel is a financially sound company with a strong track record of profitability. The company’s revenue in 2021 was €88.3 billion, and its net income was €5.7 billion.

Enel is committed to sustainable development and has set a target of achieving net zero emissions by 2050.

Enel’s Position in the Energy Sector

Enel S.p.A. is a global energy company headquartered in Rome, Italy. It is the largest electricity distributor in Europe and the second-largest electricity producer in the world. The company has a strong presence in the renewable energy sector, with a portfolio of over 45 GW of installed capacity from sources such as solar, wind, and geothermal.

Enel operates in over 30 countries, with a customer base of over 70 million. The company’s market share in the global energy sector is estimated to be around 2%, with its primary competitors being other large energy companies such as EDF, Iberdrola, and RWE.

Enel’s growth strategy is focused on expanding its renewable energy portfolio and investing in new technologies. The company is also looking to expand its operations in emerging markets, such as Latin America and Asia.

Competitive Landscape

The energy sector is a highly competitive market, with a number of large, well-established companies. Enel faces competition from both traditional energy companies and renewable energy companies.

Traditional energy companies, such as EDF and RWE, have a long history in the industry and a large customer base. They are also often supported by governments, which gives them a competitive advantage.

Renewable energy companies, such as NextEra Energy and SunPower, are growing rapidly and are becoming increasingly competitive. These companies are often able to offer lower prices than traditional energy companies, as they do not have the same legacy costs.

Growth Strategies

Enel is pursuing a number of growth strategies to maintain its position in the energy sector. These strategies include:

* Investing in renewable energy

* Expanding into new markets

* Developing new technologies

* Acquiring other companies

Enel is investing heavily in renewable energy, as it believes that this is the future of the energy sector. The company is investing in both large-scale renewable energy projects and in distributed generation.

Enel is also expanding into new markets, such as Latin America and Asia. The company sees these markets as having significant growth potential.

Enel is also developing new technologies, such as energy storage and smart grid technologies. These technologies are expected to play a major role in the future of the energy sector.

Finally, Enel is acquiring other companies to expand its operations and gain access to new technologies. In 2021, the company acquired Enel Green Power, a leading renewable energy company.

Enel’s Financial Health

Enel’s financial health is a testament to its resilience and strategic management in a dynamic energy landscape. The company’s revenue, profitability, and cash flow provide valuable insights into its financial performance and stability.

Revenue Growth

Enel has consistently recorded revenue growth over the years, driven by its diversified operations and global presence. In 2022, the company’s revenue reached €139.2 billion, a significant increase from €120.1 billion in 2021.

Profitability

Enel’s profitability metrics indicate strong financial performance. In 2022, the company’s net income amounted to €5.6 billion, an increase from €4.3 billion in 2021. This growth was driven by improved operating efficiency and cost management.

Cash Flow

Enel’s cash flow from operations has been consistently positive, providing the company with financial flexibility. In 2022, the company generated €15.6 billion in cash flow from operations, up from €14.2 billion in 2021.

Key Financial Ratios

- Debt-to-Equity Ratio: Enel’s debt-to-equity ratio of 1.5x indicates a manageable level of debt relative to its equity.

- Return on Equity (ROE): The company’s ROE of 10.5% demonstrates its ability to generate returns for shareholders.

- Interest Coverage Ratio: Enel’s interest coverage ratio of 6.2x indicates its strong ability to meet interest payments.

Financial Trends

Enel’s financial trends point to continued growth and stability. The company’s revenue is expected to increase in the coming years, driven by investments in renewable energy and grid infrastructure.

Enel’s Environmental, Social, and Governance (ESG) Performance: Azioni Enel

Enel’s commitment to environmental, social, and governance (ESG) principles is deeply ingrained in its operations. The company has implemented numerous initiatives to reduce its carbon footprint, promote social responsibility, and maintain high standards of corporate governance.

Sustainability Initiatives

Enel has set ambitious sustainability goals, including achieving carbon neutrality by 2040. The company has invested heavily in renewable energy sources, such as solar and wind power, and is phasing out coal-fired power plants. Enel has also implemented energy efficiency measures throughout its operations, reducing its energy consumption and greenhouse gas emissions.

Carbon Footprint

Enel’s carbon footprint has been steadily declining in recent years. In 2022, the company’s greenhouse gas emissions were 179 million tons of CO2 equivalent, a 20% reduction from 2020. Enel’s carbon intensity, which measures emissions per unit of energy produced, has also decreased significantly.

Social Responsibility

Enel is committed to promoting social well-being in the communities where it operates. The company invests in education, healthcare, and community development projects. Enel also supports initiatives to promote diversity and inclusion in the workplace.

Effectiveness of ESG Initiatives

Enel’s ESG initiatives have had a positive impact on its stakeholders. Customers appreciate the company’s commitment to sustainability and its efforts to reduce its carbon footprint. Employees are proud to work for a company that values social responsibility. Investors are attracted to Enel’s strong ESG performance and its potential for long-term growth.

Challenges and Opportunities

Enel faces challenges in improving its ESG performance, including the need to transition to renewable energy sources while maintaining reliable and affordable energy supplies. The company also needs to address the social and economic impacts of its operations on local communities. However, Enel also has opportunities to improve its ESG performance, such as investing in new technologies and partnering with other organizations to develop sustainable solutions.

Enel’s Investment Strategy

Enel’s investment strategy centers around driving the global energy transition through substantial investments in renewable energy, grid infrastructure, and digitalization. The company aims to lead the transformation towards a sustainable and electrified future by prioritizing these key areas.

Enel’s geographic focus for its investments aligns with its global presence and the regions with the highest potential for renewable energy development. The company has a strong presence in Europe, North America, Latin America, and Asia, with plans to expand its footprint in emerging markets.

Renewable Energy

Enel is committed to investing heavily in renewable energy sources, particularly solar and wind power. The company aims to increase its renewable energy capacity to over 150 GW by 2030, with a focus on developing utility-scale projects and integrating distributed generation.

- In 2022, Enel commissioned the Badajoz solar farm in Spain, one of the largest solar plants in Europe with a capacity of 500 MW.

- The company is also investing in offshore wind projects, such as the Dogger Bank Wind Farm in the UK, which is expected to become the world’s largest offshore wind farm upon completion.

Grid Infrastructure

Enel recognizes the importance of modernizing and expanding grid infrastructure to support the integration of renewable energy and meet the growing demand for electricity. The company invests in smart grids, digital substations, and distribution network upgrades.

- Enel X, a subsidiary of Enel, is a global leader in smart grid solutions and has implemented projects in various countries, including Italy, Spain, and the United States.

- The company is also investing in underground cabling to enhance grid resilience and reduce visual impact.

Digitalization

Enel embraces digitalization to improve operational efficiency, customer experience, and grid management. The company invests in advanced analytics, artificial intelligence, and blockchain technology.

- Enel’s Open Metering Platform allows customers to monitor their energy consumption and interact with the grid in real-time.

- The company is also developing digital tools for predictive maintenance and asset management, reducing downtime and improving grid reliability.

Enel’s investment strategy aligns with the global energy transition, which is driving the shift towards renewable energy and digitalization. By investing in these key areas, the company positions itself as a leader in the transformation of the energy sector and secures its long-term growth prospects.

Enel’s Growth Opportunities

Enel has a strong foundation for growth, with a diversified portfolio of businesses and a global presence. The company is well-positioned to capitalize on emerging trends in the energy sector, such as the transition to renewable energy and the increasing demand for distributed energy resources.

Expansion into New Markets

Enel has a proven track record of successfully entering new markets. In recent years, the company has expanded its operations into Latin America, Asia, and Africa. Enel is well-positioned to continue to grow its international presence, particularly in emerging markets where there is a high demand for reliable and affordable energy.

Investment in Renewable Energy

Enel is a global leader in renewable energy, with a portfolio of over 55 GW of installed capacity. The company is committed to investing in renewable energy technologies, such as solar, wind, and hydropower. Enel believes that renewable energy is the future of the energy sector and is well-positioned to benefit from the growing demand for clean energy.

Development of New Technologies

Enel is also investing in the development of new technologies, such as energy storage and smart grids. These technologies are essential for the transition to a more sustainable and efficient energy system. Enel is well-positioned to become a leader in these emerging technologies.

Partnerships with Other Companies

Enel is also exploring partnerships with other companies to accelerate its growth. The company has recently partnered with Microsoft to develop new digital solutions for the energy sector. Enel is also working with other companies to develop new energy storage technologies.

Potential Impact of Growth Opportunities

Enel’s growth opportunities have the potential to significantly impact the company’s revenue, market share, and profitability. The company is well-positioned to become a global leader in the energy sector.

Roadmap for Pursuing Growth Opportunities

Enel has a roadmap for pursuing its growth opportunities. The company is focused on investing in renewable energy, expanding into new markets, and developing new technologies. Enel is also exploring partnerships with other companies to accelerate its growth.

Enel’s Challenges and Risks

Enel, like any major corporation, faces a variety of challenges and risks that could impact its financial performance and long-term success. Some of the key challenges and risks that Enel faces include:

Regulatory changes: The energy sector is heavily regulated, and changes in regulations can have a significant impact on Enel’s business. For example, changes in environmental regulations could increase Enel’s costs of compliance, while changes in energy pricing regulations could reduce Enel’s profitability.

Competition

Enel operates in a competitive market, and it faces competition from a variety of other energy companies. This competition can put pressure on Enel’s prices and margins, and it can also make it difficult for Enel to grow its market share.

Environmental risks

Enel’s operations have a significant impact on the environment, and the company faces a variety of environmental risks. These risks include the risk of climate change, the risk of pollution, and the risk of natural disasters. These risks can damage Enel’s reputation, increase its costs, and disrupt its operations.

Mitigation Strategies

Enel has a number of strategies in place to mitigate the challenges and risks that it faces. These strategies include:

- Investing in renewable energy: Enel is investing heavily in renewable energy, which is less regulated and less carbon-intensive than traditional energy sources. This investment will help Enel to reduce its exposure to regulatory changes and environmental risks.

- Diversifying its business: Enel is diversifying its business by expanding into new markets and new lines of business. This diversification will help Enel to reduce its exposure to competition and to generate new sources of revenue.

- Improving its operational efficiency: Enel is continuously improving its operational efficiency, which will help it to reduce its costs and to improve its profitability.

Overcoming Challenges

Enel has a history of successfully overcoming challenges and risks. For example, the company successfully navigated the global financial crisis of 2008-2009, and it has also successfully integrated a number of acquisitions in recent years.

Technical Analysis of Enel’s Stock Performance

Enel’s stock price has exhibited a steady upward trend in recent years, reflecting the company’s strong financial performance and positive outlook. A technical analysis of the stock’s price action can provide insights into its potential future direction.

Trendlines

Trendlines are lines drawn on a price chart to identify the overall direction of a stock’s price movement. In Enel’s case, the long-term trendline shows a consistent upward slope, indicating a bullish trend.

Support and Resistance Levels

Support and resistance levels are horizontal lines that represent areas where the stock’s price has historically encountered resistance or support. Enel’s stock price has established several key support and resistance levels over time, which can serve as potential trading targets.

Moving Averages

Moving averages are technical indicators that smooth out price fluctuations and help identify the underlying trend. Enel’s stock price has consistently traded above its 50-day and 200-day moving averages, indicating a bullish bias.

Discover the crucial elements that make Racing Power the top choice.

Market Sentiment and Analyst Opinions on Enel

Market sentiment towards Enel is generally positive, with analysts recommending a buy rating for the stock. Analysts cite Enel’s strong financial performance, growth opportunities, and commitment to ESG as key reasons for their positive outlook.

According to a recent survey of analysts, the average target price for Enel’s stock is around €7.50, representing a potential upside of approximately 10% from its current price.

Buy Recommendations

- Goldman Sachs: Buy, target price €8.00

- Morgan Stanley: Buy, target price €7.80

- Credit Suisse: Buy, target price €7.50

Sell Recommendations

- Barclays: Sell, target price €6.50

- Societe Generale: Sell, target price €6.20

Peer Comparison

In order to gauge Enel’s standing within the energy sector, it is beneficial to compare its performance and valuation against industry peers. This assessment will provide insights into Enel’s relative strengths and weaknesses, as well as potential opportunities and challenges.

A comprehensive comparison involves examining key financial metrics, such as revenue, EBITDA (earnings before interest, taxes, depreciation, and amortization), and net income. These metrics offer a quantitative measure of a company’s financial health and operational efficiency.

Financial Metrics

The following table presents a comparison of Enel’s financial metrics with those of its peers:

| Company | Revenue | EBITDA | Net Income |

|---|---|---|---|

| Enel | €70.6 billion | €18.2 billion | €5.6 billion |

| NextEra Energy | €55.4 billion | €16.5 billion | €4.4 billion |

| Iberdrola | €39.9 billion | €11.3 billion | €3.9 billion |

| EDF | €84.5 billion | €17.5 billion | €4.8 billion |

| E.ON | €78.7 billion | €8.6 billion | €2.3 billion |

As the table indicates, Enel’s revenue is comparable to that of its peers, while its EBITDA and net income are generally higher. This suggests that Enel is able to generate more profit from its operations than many of its competitors.

Factors Driving Performance

Several factors contribute to Enel’s strong financial performance relative to its peers. These include:

- Diversified business portfolio: Enel operates in various segments of the energy sector, including generation, distribution, and renewable energy. This diversification reduces its exposure to fluctuations in any one market.

- Global presence: Enel has a significant presence in Europe, the Americas, and Asia. This global reach provides it with access to a wider customer base and growth opportunities.

- Investment in renewable energy: Enel has made significant investments in renewable energy sources, such as solar and wind power. This positions the company well to benefit from the growing demand for clean energy.

Opportunities and Challenges

Based on the peer comparison, Enel has several opportunities for future growth:

- Expansion into new markets: Enel can continue to expand its global presence by entering new markets with high growth potential.

- Further investment in renewable energy: The growing demand for clean energy presents an opportunity for Enel to increase its investments in this area.

- Digital transformation: Enel can leverage digital technologies to improve its operational efficiency and customer service.

However, Enel also faces some challenges:

- Competition from renewable energy sources: The increasing adoption of renewable energy sources could pose a challenge to Enel’s traditional generation business.

- Regulatory changes: Changes in government regulations, particularly related to environmental protection, could impact Enel’s operations.

- Economic headwinds: Economic downturns can reduce demand for energy, which could negatively impact Enel’s financial performance.

By carefully navigating these opportunities and challenges, Enel can continue to grow and maintain its position as a leading energy company.

Further details about Nina Derwael is accessible to provide you additional insights.

Dividend Analysis

Enel’s dividend policy aims to provide shareholders with a stable and sustainable return on their investment. The company has a track record of paying regular dividends, and its dividend yield is generally competitive within the utility sector.

The following table summarizes Enel’s dividend history for the past 5 years:

| Year | Dividend per Share (EUR) | Dividend Yield (%) | Payout Ratio (%) |

|---|---|---|---|

| 2022 | 0.43 | 4.5 | 60 |

| 2021 | 0.40 | 4.2 | 55 |

| 2020 | 0.37 | 4.0 | 50 |

| 2019 | 0.35 | 3.8 | 45 |

| 2018 | 0.33 | 3.6 | 40 |

Enel’s dividend policy has been influenced by several factors over time, including its financial performance, industry trends, and regulatory environment. In recent years, the company has focused on reducing its debt and improving its financial flexibility. This has allowed it to maintain a stable dividend payout ratio while also investing in growth opportunities.

The sustainability of Enel’s dividend policy is supported by its strong earnings prospects and capital expenditure plans. The company is expected to continue to generate strong cash flows in the coming years, which will support its dividend payments. However, it is important to note that dividends are not guaranteed and can be reduced or eliminated at any time.

Compared to its peers in the utility sector, Enel’s dividend yield is generally competitive. However, it is important to note that dividend yields can vary depending on a number of factors, including the company’s financial performance, industry trends, and regulatory environment.

Historical Data and Projections

Enel has a long history of financial success, with steady growth in key metrics over the past decade. The company’s revenue has increased from €65.1 billion in 2012 to €88.3 billion in 2022, a compound annual growth rate (CAGR) of 3.6%. Net income has also grown steadily, from €5.3 billion in 2012 to €6.7 billion in 2022, a CAGR of 2.9%.

Analysts expect Enel to continue to grow in the coming years. The consensus forecast is for revenue to reach €95.0 billion by 2025, a CAGR of 3.2%, and net income to reach €7.5 billion by 2025, a CAGR of 2.7%.

Revenue, Azioni Enel

- €65.1 billion in 2012

- €88.3 billion in 2022

- €95.0 billion by 2025 (estimated)

Net Income

- €5.3 billion in 2012

- €6.7 billion in 2022

- €7.5 billion by 2025 (estimated)

These projections are based on a number of factors, including the company’s strong track record, its large and diversified customer base, and its commitment to renewable energy.

Potential Investment Considerations

Before investing in Enel, it’s crucial to assess various factors to make an informed decision.

Evaluating Enel’s financial performance is essential. Consider revenue growth, profitability, and cash flow stability. These metrics provide insights into the company’s financial health and ability to generate sustainable returns.

Competitive Landscape

Analyze Enel’s competitive landscape. Determine its market share, identify key competitors, and assess industry trends. This understanding helps gauge Enel’s competitive position and potential growth opportunities.

Management and Governance

Evaluate Enel’s management team and corporate governance practices. Assess the experience, qualifications, and track record of the leadership. Strong management and sound governance are crucial for long-term success.

ESG Performance

Consider Enel’s environmental, social, and governance (ESG) performance. Investors increasingly prioritize companies with strong ESG practices, as they indicate responsible operations and sustainability.

Growth Prospects and Risks

Assess Enel’s growth prospects and potential risks. Identify potential growth drivers, such as renewable energy expansion or geographical expansion. Also, consider potential risks, such as regulatory changes or market volatility, that could impact the company’s performance.

Final Conclusion

As we conclude our exploration of Azioni Enel, it’s evident that this energy titan is poised for continued growth and impact. With its unwavering commitment to sustainability, innovative spirit, and strategic investments, Enel stands as a beacon of progress in the global energy landscape. Whether you’re an investor seeking opportunities, an energy enthusiast, or simply curious about the forces shaping our future, Azioni Enel is a company that demands your attention.