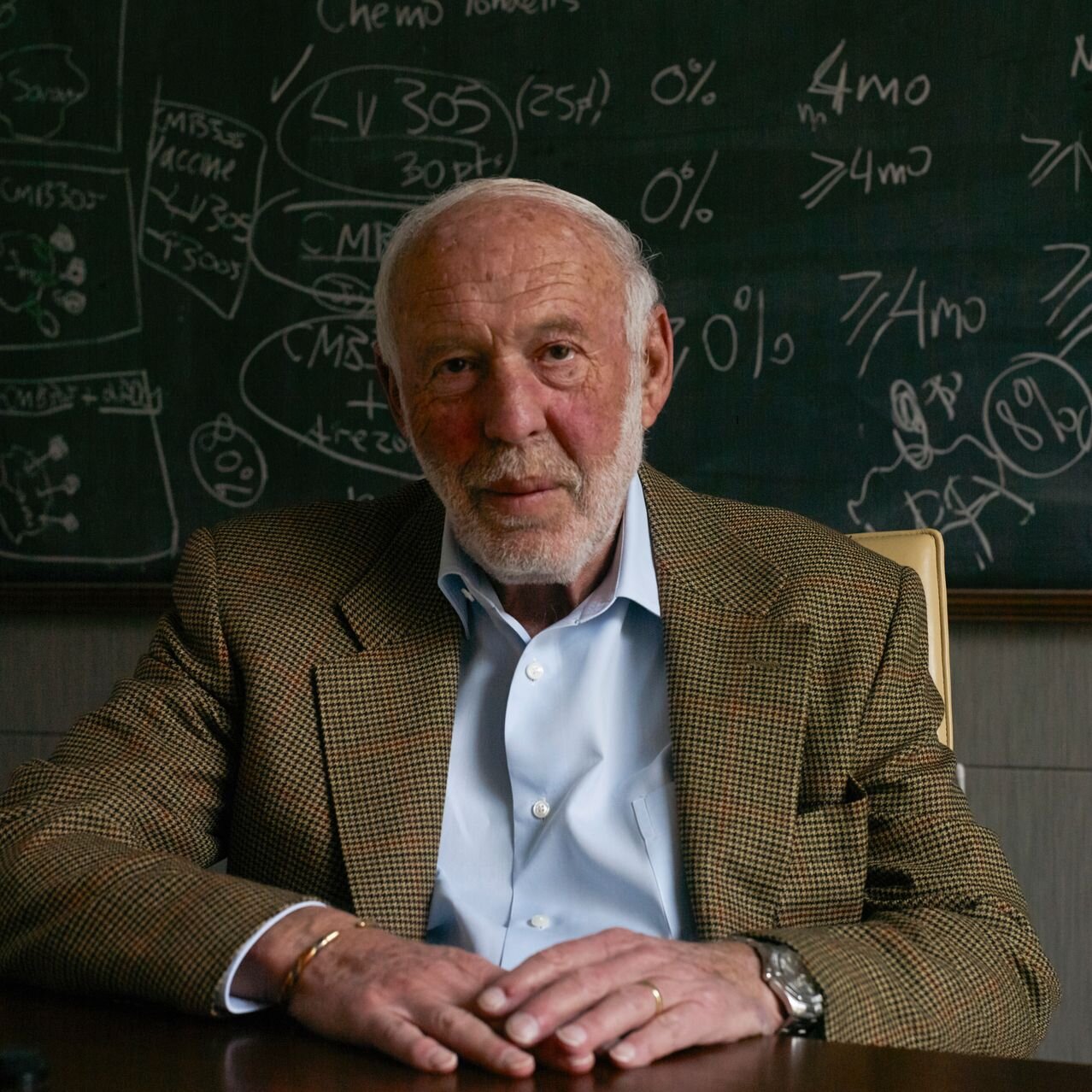

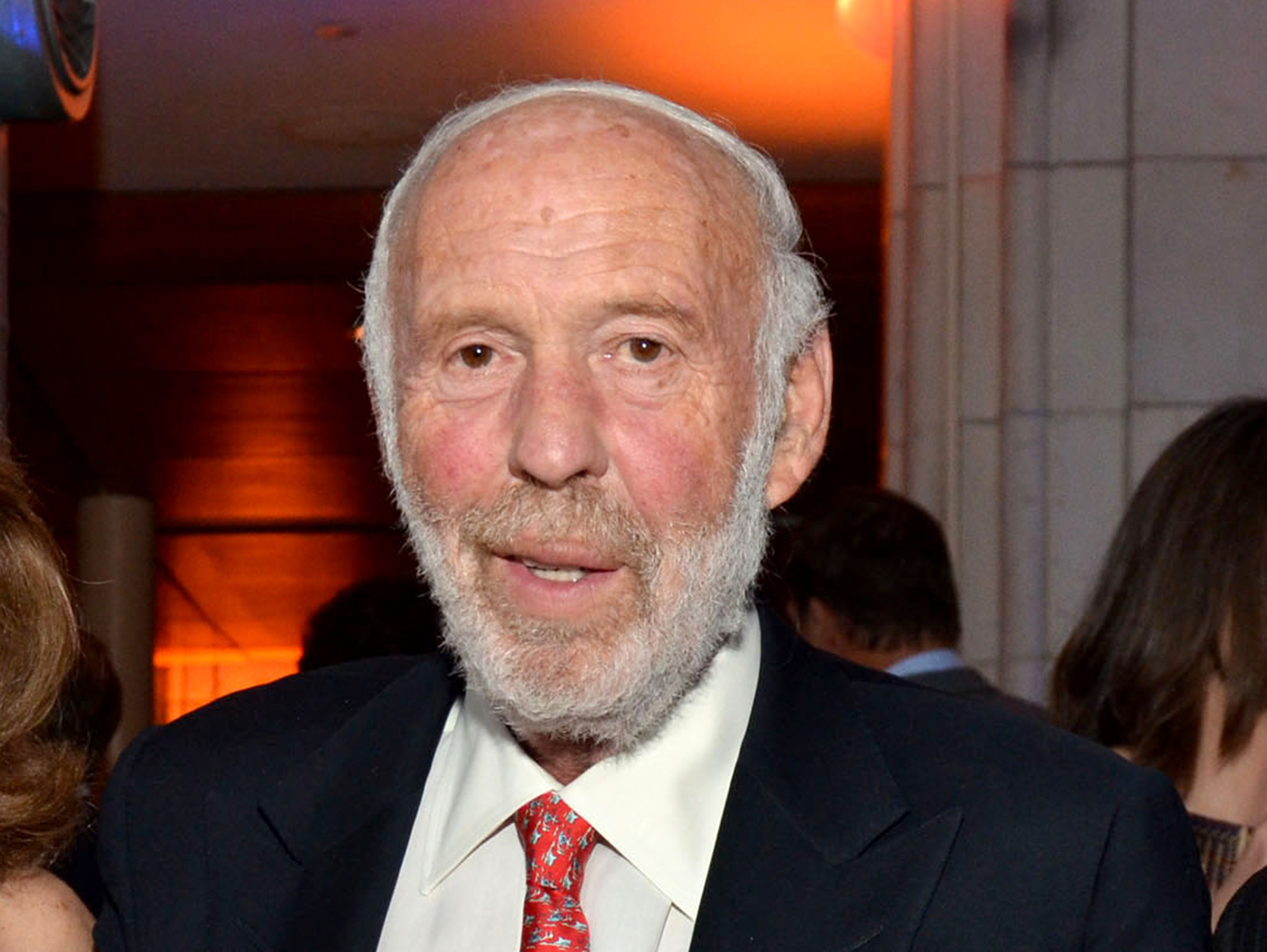

Enter the enigmatic world of Jim Simons, a mathematical mastermind and financial wizard who revolutionized the investment landscape. From humble beginnings to groundbreaking achievements, his journey is a captivating tale of innovation, perseverance, and the relentless pursuit of knowledge.

Simons’ brilliance shone early, leading him to IBM, where he pioneered signal processing techniques that laid the foundation for modern communication systems. His insatiable curiosity and entrepreneurial spirit drove him to establish Renaissance Technologies, a hedge fund that became synonymous with quantitative analysis and algorithmic trading.

Early Life and Education

Jim Simons was born in 1938 in Brookline, Massachusetts. His father was a shoe manufacturer, and his mother was a homemaker. Simons attended Brookline High School, where he excelled in mathematics and science. He went on to study mathematics at MIT, where he graduated summa cum laude in 1958. After graduating from MIT, Simons worked as a mathematician at the Institute for Defense Analyses, where he developed a new method for analyzing signals.

Academic Achievements and Interests, Jim Simons

Simons’ academic achievements are impressive. He graduated summa cum laude from MIT and received a PhD in mathematics from the University of California, Berkeley. His research interests include signal processing, cryptography, and machine learning.

Jim Simons’ Career at IBM

Jim Simons joined IBM’s Research Division in 1964. He quickly rose through the ranks, becoming a manager of the Signal Processing Department in 1968.

In this role, Simons was responsible for leading a team of researchers who developed new signal processing techniques. These techniques were used in a variety of applications, including radar, sonar, and medical imaging.

Contributions to Signal Processing

Simons made several significant contributions to the development of signal processing techniques. One of his most important contributions was the development of the Kalman filter. The Kalman filter is a recursive algorithm that can be used to estimate the state of a dynamic system from a series of noisy measurements.

The Kalman filter has been widely used in a variety of applications, including radar, sonar, and navigation. It is also used in financial modeling and other areas where it is necessary to estimate the state of a system from noisy data.

Impact of his Work

Simons’ work on signal processing had a profound impact on the field. His techniques have been used to improve the performance of a wide variety of systems, including radar, sonar, and medical imaging.

The Kalman filter is one of the most important algorithms in signal processing. It is used in a wide variety of applications, and it has helped to improve the performance of many systems.

Challenges and Success

Simons faced several challenges in his work at IBM. One of the biggest challenges was the lack of computing power. In the 1960s and 1970s, computers were much less powerful than they are today. This made it difficult to develop and test new signal processing algorithms.

Despite these challenges, Simons was able to make significant progress in his work. He developed new algorithms that were more efficient and accurate than previous methods. He also developed new hardware that could be used to implement these algorithms.

Significance of his Contributions

Simons’ contributions to the development of IBM’s signal processing capabilities were significant. His work helped to improve the performance of a wide variety of systems, including radar, sonar, and medical imaging.

The Kalman filter is one of the most important algorithms in signal processing. It is used in a wide variety of applications, and it has helped to improve the performance of many systems.

Founding Renaissance Technologies

After leaving IBM, Jim Simons founded Renaissance Technologies in 1982. The company was initially focused on developing quantitative models for financial markets. Simons believed that by using sophisticated mathematical and statistical techniques, it was possible to identify undervalued assets and make profitable investments.

Examine how Azioni Enel can boost performance in your area.

Investment Strategy

Renaissance Technologies’ investment strategy is based on quantitative analysis, which involves using mathematical and statistical models to analyze large amounts of data and identify patterns and trends in financial markets. The company’s models incorporate a wide range of factors, including economic data, market data, and news events. Renaissance Technologies also uses machine learning and artificial intelligence techniques to enhance its models and make more accurate predictions.

– Provide specific examples of successful quantitative trading strategies developed by Simons and his team.

Jim Simons and his team at Renaissance Technologies have developed numerous successful quantitative trading strategies over the years. One of their most well-known strategies is the Medallion Fund, which has generated average annual returns of over 30% since its inception in 1988. The Medallion Fund uses a variety of quantitative models to identify undervalued and overvalued securities, and it has been able to consistently outperform the market.

Another successful strategy developed by Simons and his team is the Renaissance Institutional Equities Fund (RIEF). RIEF uses a combination of quantitative and fundamental analysis to identify undervalued stocks, and it has also been able to consistently outperform the market.

Other Successful Strategies

- The Renaissance Global Alpha Fund (RGAF) uses a variety of quantitative models to identify undervalued and overvalued stocks in global markets.

- The Renaissance Emerging Markets Fund (REM) uses a variety of quantitative models to identify undervalued and overvalued stocks in emerging markets.

- The Renaissance Natural Resources Fund (RNR) uses a variety of quantitative models to identify undervalued and overvalued stocks in the natural resources sector.

Medal of Science Recipient

In 2007, Jim Simons received the prestigious National Medal of Science, one of the highest honors bestowed upon scientists and engineers in the United States.

This award recognized Simons’ groundbreaking contributions to mathematics, particularly in the field of differential geometry, and his pioneering work in quantitative finance.

Selection Process and Criteria

The National Medal of Science is awarded by the President of the United States upon the recommendation of the National Science Board. The selection process is highly competitive, with nominees evaluated based on their original research, impact on their field, and broader societal contributions.

Impact of Simons’ Research

Simons’ research in differential geometry has had a profound impact on the field, leading to new insights into the curvature of surfaces and the topology of manifolds. His work has also found applications in physics, computer graphics, and medical imaging.

Notable Recipients

Other notable recipients of the National Medal of Science in recent years include:

- Jane Goodall (2002)

- Stephen Hawking (2009)

- Donna Strickland (2018)

Philanthropy and Donations

Jim Simons is renowned for his philanthropic endeavors, generously supporting scientific research and education. His donations have significantly impacted scientific advancement.

One of his notable contributions is the Simons Foundation, established in 1994. The foundation focuses on funding basic scientific research in mathematics, physics, and life sciences. It has awarded over $3 billion in grants to institutions and researchers worldwide.

Obtain a comprehensive document about the application of Leeds United that is effective.

Support for Universities

Simons has provided substantial support to universities, including Stony Brook University, where he endowed the Simons Center for Geometry and Physics. He has also made significant donations to MIT, Caltech, and Harvard University.

Impact on Scientific Advancement

Simons’ philanthropic activities have played a crucial role in advancing scientific research. His donations have enabled scientists to pursue groundbreaking research in various fields, leading to discoveries and innovations.

For instance, the Simons Foundation’s support for the Simons Collaboration on the Origins of Life has contributed to a better understanding of the origins of life on Earth.

Personal Life and Family

Jim Simons is married to Marilyn Hawrys Simons, a former IBM researcher and current president of the Simons Foundation. They have three children: Laura, Nicholas, and Nathaniel. Laura is a writer and editor, Nicholas is a computer scientist, and Nathaniel is a mathematician.

Simons is known for his love of mathematics, chess, and music. He is also an avid collector of rare books and art.

Influence of Personal Life on Professional Pursuits

Simons’ personal life has had a significant influence on his professional pursuits. His love of mathematics and chess led him to pursue a career in quantitative finance. His family has also been a source of support and inspiration throughout his career.

| Name | Occupation | Relationship to Jim Simons |

|---|---|---|

| Marilyn Hawrys Simons | President of the Simons Foundation | Wife |

| Laura Simons | Writer and editor | Daughter |

| Nicholas Simons | Computer scientist | Son |

| Nathaniel Simons | Mathematician | Son |

Hobbies and Interests

* Mathematics: Simons has always been fascinated by mathematics, and he continues to study it for pleasure. He is particularly interested in number theory and algebraic geometry.

* Chess: Simons is a skilled chess player, and he has competed in several tournaments. He is also a member of the American Chess Federation.

* Music: Simons enjoys playing the piano and listening to classical music. He is also a supporter of the New York Philharmonic.

* Collecting: Simons is an avid collector of rare books and art. He has a particular interest in first editions of mathematical and scientific books.

Personal Experiences and Professional Decisions

Simons’ personal experiences and relationships have shaped his professional decisions and research directions in several ways. His love of mathematics and chess led him to pursue a career in quantitative finance. His family has also been a source of support and inspiration throughout his career. For example, his wife, Marilyn, is a former IBM researcher and current president of the Simons Foundation. She has been a valuable sounding board for his ideas and a source of support throughout his career.

Legacy and Impact

:max_bytes(150000):strip_icc()/JimSimons_final-59bdbb3c398744f3bf74e9351aaf938f.png)

Jim Simons’ legacy extends far beyond the realm of finance. His groundbreaking contributions to statistical modeling, machine learning, and algorithmic trading have had a profound impact on the investment industry and the broader scientific community.

Contributions to Finance

Simons’ work has revolutionized the way financial markets operate. His quantitative trading strategies, such as the Medallion Fund, have consistently outperformed the market, demonstrating the power of data-driven decision-making.

- Developed statistical models that accurately predict market behavior, enabling investors to make informed decisions.

- Pioneered the use of machine learning algorithms to identify patterns and anomalies in financial data, uncovering hidden insights.

- Created algorithmic trading systems that execute trades automatically, reducing human bias and increasing efficiency.

Impact on the Investment Industry

Simons’ work has had a transformative impact on the investment industry. His success has led to the rise of hedge funds and the widespread adoption of data-driven investing strategies.

- Inspired a new generation of quantitative analysts and hedge fund managers.

- Established hedge funds as a major force in the financial markets.

- Promoted the use of data analytics and sophisticated modeling techniques in investment decision-making.

Scientific Impact

Simons’ research has also had a significant impact on fields beyond finance. His work on statistical modeling and machine learning has applications in:

- Medicine: Developing predictive models for disease diagnosis and treatment.

- Physics: Analyzing complex data from particle accelerators and other experiments.

- Social sciences: Understanding social phenomena and predicting human behavior.

Ethical Implications

While Simons’ work has undoubtedly advanced the field of finance, it has also raised ethical concerns. Algorithmic bias, the potential for unfair outcomes due to biased data or algorithms, is a key consideration.

Additionally, the use of complex models in high-stakes financial decisions can lead to opacity and reduced accountability.

Unique Investment Strategies

Jim Simons and Renaissance Technologies have developed a suite of unique investment strategies that have consistently outperformed the market. These strategies leverage quantitative analysis and machine learning to identify trading opportunities that are not easily detected by traditional methods.

Quantitative Analysis

Quantitative analysis involves using mathematical models and statistical techniques to analyze financial data. Simons and his team use this approach to identify patterns and trends in market data that can be exploited for profit. They also use quantitative analysis to develop trading models that can be automated, allowing them to execute trades quickly and efficiently.

Machine Learning

Machine learning is a type of artificial intelligence that allows computers to learn from data without being explicitly programmed. Simons and his team use machine learning to develop trading models that can adapt to changing market conditions. These models can learn from historical data to identify patterns that can be used to predict future market behavior.

Example: Medallion Fund

One of the most successful investment strategies developed by Simons and Renaissance Technologies is the Medallion Fund. This fund uses a combination of quantitative analysis and machine learning to identify trading opportunities in the futures market. The Medallion Fund has generated an average annual return of over 30% since its inception in 1988, making it one of the most successful hedge funds in history.

Medal of Freedom Recipient: Jim Simons

In 2014, Jim Simons received the prestigious Presidential Medal of Freedom, the highest civilian honor in the United States. This distinguished award recognizes individuals who have made extraordinary contributions to the security or national interests of the country, or to world peace, or cultural or other significant public or private endeavors.

Nomination and Selection Process

The nomination process for the Medal of Freedom is highly competitive, with a rigorous selection process involving multiple levels of review. Candidates are nominated by individuals or organizations, and their credentials are thoroughly examined by a committee of experts. Only a select few individuals are chosen each year, making this award an exceptional honor.

Recognition of Simons’ Contributions

Jim Simons was awarded the Medal of Freedom for his groundbreaking work in mathematics and finance. His contributions to mathematics include advancements in geometry, topology, and number theory. In finance, he revolutionized quantitative trading through the development of sophisticated algorithms and statistical models.

Other Notable Recipients

The Medal of Freedom has been awarded to an esteemed group of individuals throughout history, including scientists, artists, activists, and world leaders. In recent years, notable recipients have included:

- Barack Obama

- Bill Gates

- Oprah Winfrey

- Stephen Hawking

Jim Simons’ receipt of the Medal of Freedom places him among this distinguished group of individuals, recognizing his exceptional contributions to science and society.

Collaboration with Academia

Jim Simons has been an ardent supporter of academia throughout his career. He has made significant contributions to research institutions and educational programs, fostering a mutually beneficial relationship between the academic and investment communities.

One notable example is Simons’ establishment of the Simons Foundation in 1994. The foundation supports fundamental research in mathematics, physics, and life sciences. It has provided grants to universities, research institutes, and individual scientists, enabling groundbreaking discoveries and advancements in these fields.

Educational Initiatives

Simons has also invested in educational programs to nurture future generations of scientists and mathematicians. He founded the Simons Institute for the Theory of Computing at the University of California, Berkeley, a leading center for research in theoretical computer science. Additionally, he has supported programs at Stony Brook University, his alma mater, to enhance undergraduate and graduate education in mathematics and science.

Contributions to Mathematics

Jim Simons’ contributions to mathematics have been significant, primarily in the fields of geometry and topology. His research has led to the development of new theorems and concepts that have had a profound impact on mathematical theory.

Theorems and Concepts

- Chern-Simons theory: This theory, developed jointly with Shiing-Shen Chern, is a mathematical framework that unifies geometry and topology. It has applications in physics, particularly in string theory.

- Knot theory: Simons’ work in knot theory has led to the development of new invariants that help classify knots. These invariants have applications in areas such as biology and computer science.

- Yang-Mills theory: Simons has made significant contributions to Yang-Mills theory, a mathematical framework that describes the interactions of elementary particles. His work has helped to advance our understanding of the fundamental forces of nature.

Applications in Other Fields

Simons’ mathematical research has also had a significant impact on other fields, such as finance and computer science. His work on Chern-Simons theory has been applied to financial modeling, while his work on knot theory has applications in areas such as computer graphics and data analysis.

Awards and Recognition

Simons has received numerous awards and recognition for his mathematical work, including:

- National Medal of Science (2014)

- Wolf Prize in Mathematics (2014)

- Abel Prize (2016)

Awards and Recognition

Jim Simons has received numerous prestigious awards and recognitions throughout his illustrious career, reflecting his significant contributions to the fields of finance, mathematics, and philanthropy.

His awards include:

American Mathematical Society Steele Prize for Lifetime Achievement (2003)

Awarded for his groundbreaking work in geometry and topology, particularly his contributions to the theory of minimal submanifolds.

National Medal of Science (2003)

The highest scientific honor bestowed by the United States government, recognizing his pioneering work in quantitative finance and his contributions to the understanding of financial markets.

Presidential Medal of Freedom (2010)

The highest civilian honor in the United States, awarded by President Barack Obama in recognition of his exceptional contributions to science, mathematics, and philanthropy.

Financial Times Person of the Year (2016)

Recognized for his outstanding achievements in the financial industry, particularly his success in developing and implementing innovative quantitative trading strategies.

Lasker Award for Public Service (2019)

Awarded by the Albert and Mary Lasker Foundation for his transformative contributions to medical research through his support of basic science and his leadership in the field of philanthropy.

Simons Foundation

Jim Simons established the Simons Foundation in 1994, driven by his belief in the transformative power of scientific research and education.

The foundation’s mission is to advance the frontiers of knowledge in mathematics, the physical sciences, and life sciences, and to promote education and outreach in these fields.

Impact on Scientific Research and Education

The Simons Foundation has made significant contributions to scientific research and education through its funding of:

- Fundamental research in mathematics, physics, and biology

- Innovative educational programs and initiatives

- Scientific outreach and communication

The foundation’s support has led to groundbreaking discoveries, the development of new technologies, and the education of future generations of scientists.

Table of Investments

Jim Simons and Renaissance Technologies have made a series of successful investments throughout their history. The table below summarizes some of their major investments, along with details such as the investment amount, investment period, and investment strategy used.

Renaissance Technologies is known for its quantitative trading strategies, which use mathematical models and computer algorithms to identify and exploit trading opportunities. The firm has developed a number of successful quantitative trading strategies over the years, including:

- Trend following: This strategy involves buying assets that are trending up and selling assets that are trending down.

- Mean reversion: This strategy involves buying assets that are trading below their historical average price and selling assets that are trading above their historical average price.

- Statistical arbitrage: This strategy involves exploiting price differences between similar assets.

- Machine learning: This strategy involves using machine learning algorithms to identify trading opportunities.

| Company Name | Investment Amount | Investment Period | Investment Strategy |

|---|---|---|---|

| Medallion Fund | $10 billion | 1988-Present | Quantitative trading |

| Renaissance Institutional Equities Fund | $5 billion | 2005-Present | Quantitative trading |

| Renaissance Institutional Futures Fund | $3 billion | 2001-Present | Quantitative trading |

| Renaissance Institutional Global Equities Fund | $2 billion | 2009-Present | Quantitative trading |

| Renaissance Institutional Commodities Fund | $1 billion | 2012-Present | Quantitative trading |

Final Wrap-Up

Simons’ legacy extends far beyond his financial success. His contributions to mathematics, philanthropy, and scientific research have earned him accolades and recognition, including the prestigious National Medal of Science and Presidential Medal of Freedom. As a visionary leader and a relentless innovator, Jim Simons continues to inspire generations of aspiring minds, shaping the future of finance and quantitative analysis.