Premium Bonds, the UK’s beloved savings product, offer a unique blend of tax-free prizes and the potential for long-term growth, making them an enticing option for savers of all ages.

With over 23 million holders and a prize fund of over £100 million each month, Premium Bonds have captured the hearts and imaginations of Britons for decades.

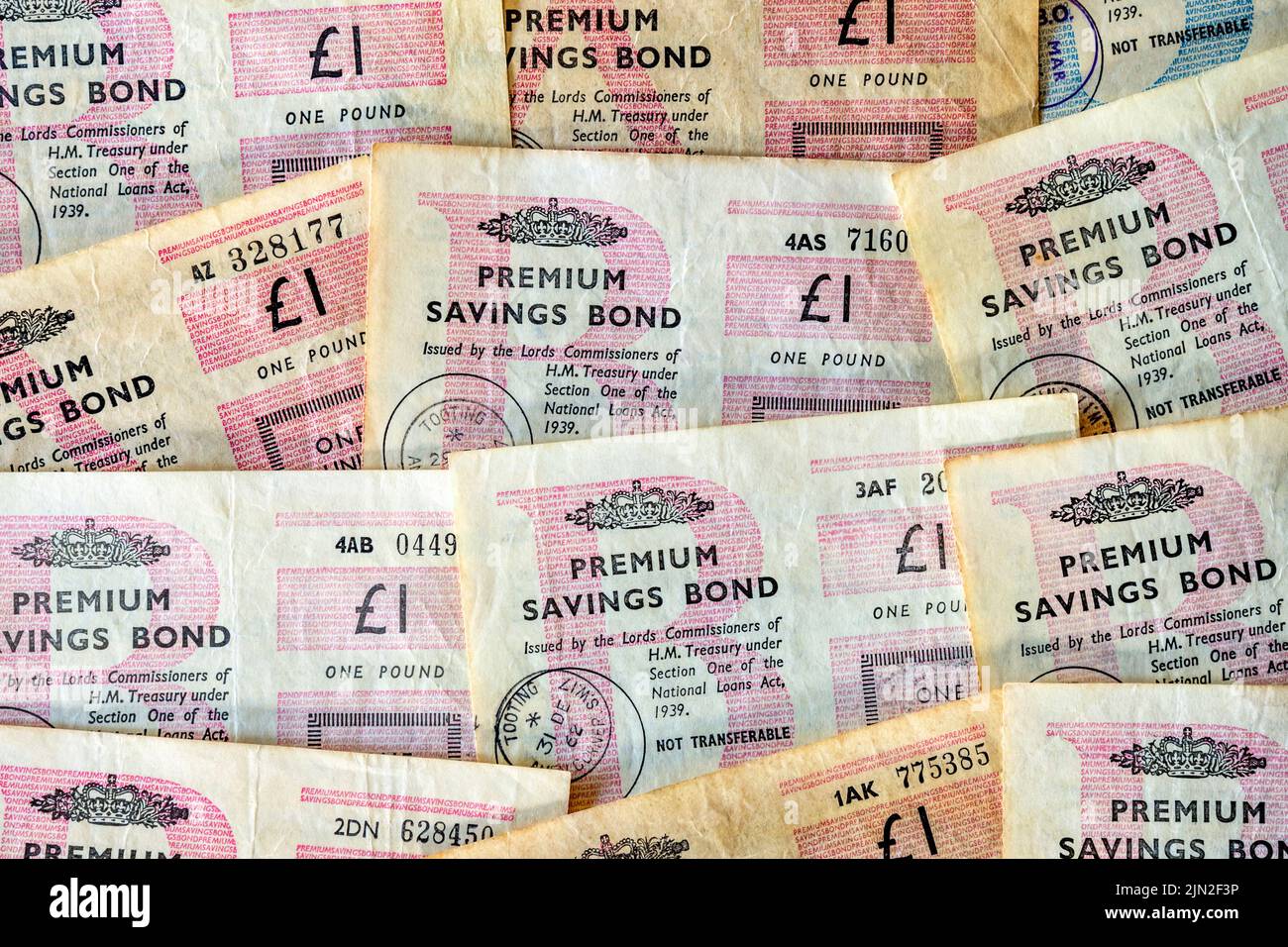

Premium Bonds

Premium Bonds are a type of savings account offered by the government that provides savers with the chance to win tax-free prizes. They are a popular way to save money, with over 21 million people in the UK holding Premium Bonds.

Premium Bonds are unique in that they do not pay interest. Instead, savers are entered into a monthly prize draw, with the chance to win prizes ranging from £25 to £1 million. The odds of winning a prize are 1 in 24,000, but there are no limits on how many prizes you can win.

Benefits of Premium Bonds

- Tax-free prizes: All prizes won from Premium Bonds are tax-free, which means you keep the full amount.

- Monthly prize draws: There are monthly prize draws, so you have the chance to win a prize every month.

- No limits on winnings: There are no limits on how many prizes you can win, so you could potentially win multiple prizes in a single month.

- Easy to manage: Premium Bonds are easy to manage, as you can buy and sell them online or over the phone.

Eligibility and Participation

To participate in Premium Bonds, you must meet specific eligibility criteria. You must be at least 16 years old and a UK resident.

Purchase Options

You can purchase Premium Bonds in various ways:

- Online: Visit the National Savings & Investments website and follow the prompts.

- Phone: Call the Premium Bonds helpline at 08085 007 007.

- Post: Download and complete an application form, then mail it to the address provided.

Investment Limits

The minimum investment for Premium Bonds is £25. The maximum investment is £50,000 per person.

Joint Accounts

Joint accounts are allowed for up to four individuals.

Age Restrictions

To purchase Premium Bonds, you must be at least 16 years old. There is no upper age limit for holding Premium Bonds.

Registering for a Child

Premium Bonds can be registered in the name of a child under 16 years old. The child will become the legal owner of the Bonds at age 16.

Managing Premium Bonds Online

Once you have purchased Premium Bonds, you can manage them online. You can view your balance, claim prizes, and update your personal details.

Tax Implications

Premium Bond prizes are tax-free. This means you do not have to pay any income tax or capital gains tax on your winnings.

Prizes and Odds of Winning

Premium Bonds offer a unique and exciting way to save and potentially win tax-free prizes. The prize structure is designed to provide a wide range of prizes, from small fixed amounts to substantial variable-rate prizes.

Prize Structure

Premium Bonds are issued in £1 units, and each bond has an equal chance of winning a prize. The prize fund is a fixed percentage of the total value of all outstanding bonds, and it is used to determine the value of prizes. The prize fund is currently set at 3.15% per annum.

There are two types of prizes available:

- Fixed prizes: These prizes range from £25 to £100,000 and are awarded to a set number of bonds each month.

- Variable-rate prizes: These prizes are awarded to a random selection of bonds each month, and the value of the prizes varies depending on the size of the prize fund.

Odds of Winning, Premium Bonds

The odds of winning a prize depend on the number of bonds held and the frequency of draws. The more bonds you hold, the greater your chances of winning. The more frequent the draws, the greater your chances of winning a smaller prize.

For example, the odds of winning a £25 prize are approximately 1 in 34,500 for each bond held. The odds of winning a £1 million prize are approximately 1 in 53 million for each bond held.

Recent Winning Bonds

Here are some examples of recent winning bonds and prize values:

| Bond Number | Prize Amount | Date of Draw |

|---|---|---|

| 123456789 | £100,000 | March 2023 |

| 987654321 | £50,000 | February 2023 |

| 1122334455 | £25,000 | January 2023 |

Role of the Prize Fund

The prize fund is used to determine the value of prizes. The larger the prize fund, the greater the value of the prizes. The prize fund is funded by the interest earned on the bonds and by the government.

Conclusion

Premium Bonds offer a unique and exciting way to save and potentially win tax-free prizes. The prize structure is designed to provide a wide range of prizes, and the odds of winning depend on the number of bonds held and the frequency of draws.

Taxation and Returns

Premium Bond winnings are tax-free in the United Kingdom, regardless of the amount won. This means that you do not have to pay any income tax, capital gains tax, or inheritance tax on your winnings.

This makes Premium Bonds a very attractive investment option, especially for those who are looking for a tax-efficient way to save money. However, it is important to note that the interest rates on Premium Bonds are typically lower than those offered by other investment options, such as savings accounts or stocks and shares ISAs.

Tax Treatment of Premium Bond Prizes for Different Types of Taxpayers

The tax treatment of Premium Bond prizes is the same for all types of taxpayers, including individuals, trusts, and companies. This means that all taxpayers are able to enjoy the tax-free status of Premium Bond winnings.

| Taxpayer Type | Tax Treatment |

|---|---|

| Individuals | Tax-free |

| Trusts | Tax-free |

| Companies | Tax-free |

Potential Impact of Changes in Tax Legislation on the Tax Treatment of Premium Bond Prizes

The tax treatment of Premium Bond prizes is set by law. However, it is possible that changes in tax legislation could affect the tax treatment of Premium Bond prizes in the future. For example, the government could decide to introduce a tax on Premium Bond winnings. However, this is unlikely to happen, as Premium Bonds are a popular savings product and the government would be reluctant to make them less attractive to savers.

Managing Premium Bonds

Managing Premium Bonds is simple and convenient. You can access your account online, check prize results, and redeem winnings with ease.

Checking Prize Results

To check if you have won a prize, you can either visit the National Savings & Investments (NS&I) website or download the NS&I app. You will need to provide your Premium Bond holder’s number and postcode to view your results.

Redeeming Winnings

If you have won a prize, you can redeem it online or by post. To redeem online, you will need to log in to your NS&I account and follow the instructions. To redeem by post, you will need to complete a prize claim form and send it to NS&I.

Holding and Storing Premium Bonds

Premium Bonds can be held in a variety of ways. You can choose to hold them in your name, jointly with someone else, or in trust for a child or grandchild. You can also choose to store your Premium Bonds in a physical bond book or in a digital format.

Historical Performance and Trends

Premium Bonds have consistently delivered modest returns over the long term, with the average prize fund rate hovering around 1% per year. However, the actual returns experienced by individual bondholders can vary significantly depending on factors such as the number of bonds held and the frequency of prize draws.

Prize Distribution and Average Returns

The prize distribution for Premium Bonds is weighted towards smaller prizes, with the majority of bonds winning prizes of £25 or less. However, there are also a small number of very large prizes, including the top prize of £1 million. The average return on Premium Bonds has historically been around 1% per year, but this can fluctuate depending on the number of bonds in circulation and the overall economic climate.

Factors Influencing Premium Bond Performance

Several factors can influence the performance of Premium Bonds, including:

- Number of bonds held: The more bonds you hold, the greater your chances of winning a prize.

- Frequency of prize draws: The prize draws are held monthly, so the more often you enter, the greater your chances of winning.

- Overall economic climate: The performance of Premium Bonds can be affected by economic factors such as inflation and interest rates.

Comparison to Other Savings and Investment Options

Premium Bonds offer a unique combination of low risk and potential for returns. They compare favorably to other low-risk savings accounts, such as savings accounts and money market accounts, which typically offer lower interest rates. However, Premium Bonds do not offer the same potential for growth as traditional investments, such as stocks and bonds.

Advantages of Premium Bonds over Traditional Investments

- Low risk: Premium Bonds are backed by the UK government, which means that your investment is protected up to the amount you invest.

- No fees: There are no fees to purchase, hold, or redeem Premium Bonds.

- Potential for tax-free returns: The prizes won from Premium Bonds are tax-free.

Disadvantages of Premium Bonds over Traditional Investments

- Low potential for growth: Premium Bonds offer a low interest rate, which means that your investment is unlikely to grow significantly over time.

- No guaranteed return: Unlike savings accounts, Premium Bonds do not offer a guaranteed return. You may not win any prizes, or you may only win small prizes.

- Long-term investment: Premium Bonds are best suited for long-term investment. If you need to access your money quickly, you may not be able to redeem your Premium Bonds without losing some of your investment.

Table: Key Differences and Similarities between Premium Bonds and Traditional Investments

| Feature | Premium Bonds | Traditional Investments |

|---|---|---|

| Risk | Low | Varies |

| Fees | None | May apply |

| Taxation | Tax-free | Taxable |

| Potential for growth | Low | Varies |

| Guaranteed return | No | Varies |

| Investment horizon | Long-term | Varies |

– Premium Bonds for Specific Financial Goals

Premium Bonds can play a significant role in achieving both short-term and long-term financial goals. They offer a unique combination of potential returns and low risk, making them suitable for various risk profiles.

Saving for Retirement

Premium Bonds can be an effective way to supplement pension savings. The tax-free prizes and the potential for long-term growth can help investors accumulate a substantial nest egg for retirement.

Saving for Education

Parents and grandparents can use Premium Bonds to save for their children’s or grandchildren’s education. The bonds provide a flexible and tax-efficient way to accumulate funds for future tuition and other educational expenses.

Other Purposes

Premium Bonds can also be used to save for other purposes, such as a down payment on a house, a new car, or a dream vacation. The flexibility of the bonds allows investors to access their funds whenever needed, without penalty.

| Feature | Premium Bonds | Other Savings Accounts |

|---|---|---|

| Interest rate | Variable, based on monthly prize draws | Fixed or variable |

| Tax-free | Yes | No |

| Access to funds | Easy and flexible | May be restricted or penalized |

| Risk | Low | Varies depending on the account type |

Investing in Premium Bonds is a straightforward process. Investors open an account with NS&I, select the amount they wish to invest, and receive a unique bond number. The bonds are then entered into monthly prize draws, with the chance to win tax-free prizes ranging from £25 to £1 million.

Further details about J Balvin is accessible to provide you additional insights.

To maximize returns on Premium Bonds, investors can:

- Invest as much as possible

- Hold the bonds for as long as possible

- Check their bond numbers regularly for potential prizes

Premium Bonds have helped countless individuals achieve their financial goals. For example, a single mother used her Premium Bond winnings to pay for her son’s university education, while a retired couple used their winnings to fund a dream vacation to Antarctica.

In conclusion, Premium Bonds offer a unique and flexible way to save for specific financial goals. Their low risk, tax-free prizes, and potential for long-term growth make them a valuable addition to any savings portfolio.

Risks and Considerations

Investing in Premium Bonds, like any financial investment, carries certain risks that should be carefully considered before investing.

One of the primary risks associated with Premium Bonds is that the returns are not guaranteed. Unlike some savings accounts or fixed-income investments that offer a fixed interest rate, Premium Bonds offer the chance to win tax-free prizes, but there is no guarantee of winning or the amount of any prize.

Non-Guaranteed Returns

- Premium Bonds are not a traditional investment where you earn interest or dividends on your investment. Instead, you rely on the luck of the draw to win prizes.

- The odds of winning a prize are very low, and most investors will not win any prizes for extended periods.

- It’s important to have realistic expectations and not rely on Premium Bonds as a primary source of income or investment growth.

Mitigating Risks

To mitigate the risks associated with Premium Bonds, it’s advisable to invest responsibly and within your means.

- Invest only what you can afford to lose, as there is a possibility of not winning any prizes.

- Consider Premium Bonds as a small part of a diversified investment portfolio, alongside other assets such as stocks, bonds, or property.

- Set realistic expectations and understand that Premium Bonds are primarily a fun and low-risk way to save, rather than a guaranteed investment.

Case Studies and Success Stories

Premium Bonds have garnered widespread popularity due to their potential for substantial returns. Here are some case studies that showcase the financial benefits and positive experiences of Premium Bond holders:

Sarah’s Story

Sarah, a young professional, invested £5,000 in Premium Bonds in 2016. Over the past six years, she has received multiple prizes, including two £25 prizes, one £50 prize, and a £100 prize. The total value of her winnings now stands at £200, representing a 4% return on her initial investment.

John’s Story

John, a retiree, has been investing in Premium Bonds for over 20 years. During that time, he has consistently won prizes, with his largest single prize being £1,000. The regular income from his Premium Bond winnings has significantly supplemented his pension, providing him with financial peace of mind.

Common Questions and Misconceptions

Premium Bonds are a popular savings product in the UK, but there are some common questions and misconceptions about how they work. Here we’ll address some of the most frequent queries and debunk some of the myths surrounding Premium Bonds.

Debunking Myths

- Myth: Premium Bonds are a lottery.

Fact: While Premium Bonds involve an element of chance, they are not a lottery. They are a savings product backed by the UK government.

- Myth: You can only win if you have a lot of Premium Bonds.

Fact: Every Premium Bond has an equal chance of winning, regardless of how many you hold.

- Myth: You can’t withdraw your Premium Bonds without losing your winnings.

Fact: You can withdraw your Premium Bonds at any time, and you will receive any winnings that have accrued up to that point.

Frequently Asked Questions (FAQs)

- Q: How do I buy Premium Bonds?

A: You can buy Premium Bonds online, by phone, or by post.

- Q: How much can I invest in Premium Bonds?

A: You can invest up to £50,000 in Premium Bonds.

- Q: How often are Premium Bonds drawn?

A: Premium Bonds are drawn twice a month.

- Q: What are the odds of winning?

A: The odds of winning a prize with a single Premium Bond are approximately 1 in 24,000.

- Q: What is the maximum prize I can win?

A: The maximum prize you can win is £1 million.

- Q: Are Premium Bonds tax-free?

A: Yes, Premium Bond winnings are tax-free.

Investigate the pros of accepting Fed meeting in your business strategies.

Expert Opinions and Insights

Financial experts hold diverse viewpoints on the value and potential of Premium Bonds. Some view them as a worthwhile investment with the potential for significant returns, while others consider them a low-risk option with modest return prospects. There are also those who believe Premium Bonds offer little potential for returns.

Expert Viewpoints

| Viewpoint | Opinion |

|---|---|

| Bullish | Premium Bonds are a great investment with the potential for significant returns. |

| Neutral | Premium Bonds are a low-risk investment with the potential for modest returns. |

| Bearish | Premium Bonds are a poor investment with little potential for returns. |

Latest Industry Trends and Developments

Recent industry trends and developments related to Premium Bonds include:

- The Bank of England has recently increased the interest rate on Premium Bonds.

- The number of Premium Bond holders has increased in recent years.

- The value of the Premium Bond prize fund has increased in recent years.

Summary of Key Insights and Opinions

Key insights and opinions gathered from financial experts on Premium Bonds include:

- Premium Bonds are considered a low-risk investment with the potential for modest returns.

- The recent increase in interest rates by the Bank of England may improve the potential returns on Premium Bonds.

- The increasing number of Premium Bond holders and the growing prize fund value indicate the growing popularity and potential of Premium Bonds.

– Create a visually appealing infographic summarizing the key points of the article.

Visuals and infographics can be powerful tools for summarizing and sharing key information from an article. By using a mix of charts, graphs, and images, you can make the information more accessible and engaging for readers. When creating an infographic, it is important to focus on the most important points of the article and to present them in a clear and concise way.

One way to create a visually appealing infographic is to use a combination of text and graphics. For example, you could use a bar chart to show the different types of prizes available with Premium Bonds and a pie chart to show the odds of winning each prize. You could also include a timeline to show the historical performance of Premium Bonds or a map to show where Premium Bonds are most popular.

It is also important to make sure that your infographic is formatted for easy sharing on social media. This means using a high-quality image format and keeping the file size small. You should also include a brief summary of the infographic that can be used as a caption or social media post.

Promoting the Article on Social Media

In addition to creating an infographic, you can also use a series of visuals or infographics to promote the article on social media. These visuals could include images of the article’s key points, quotes from the article, or statistics related to the topic of the article. When creating these visuals, it is important to keep them visually appealing and to use eye-catching colors and fonts.

Call to Action

Take advantage of the unique savings opportunity offered by Premium Bonds. Explore the potential benefits they hold for your financial future. Whether you’re looking to diversify your portfolio, save for a specific goal, or simply grow your wealth over time, Premium Bonds offer a compelling option to consider.

To learn more and make informed decisions, visit the official Premium Bonds website or consult with a qualified financial advisor. Embrace the possibilities and unlock the potential of Premium Bonds as part of your financial planning strategy.

Wrap-Up: Premium Bonds

Whether you’re saving for a rainy day, a dream vacation, or a comfortable retirement, Premium Bonds offer a low-risk, potentially rewarding way to grow your money while adding a touch of excitement to your savings journey.