RBA interest rates, a captivating topic that shapes the financial landscape of Australia, is our focus today. Join us as we delve into the intriguing world of central banking, exploring the intricate interplay between interest rates and the economy. Brace yourself for an entertaining and interactive journey!

From the Reserve Bank of Australia’s (RBA) pivotal role to the global economic outlook’s influence, we’ll uncover the secrets behind RBA interest rates and their impact on our daily lives. Get ready to be enlightened, engaged, and perhaps even a little surprised as we navigate this fascinating subject together.

Overview of RBA Interest Rates

The Reserve Bank of Australia (RBA) is Australia’s central bank. It has a primary objective to maintain price stability and contribute to the economic prosperity and welfare of the people of Australia. One of the key tools used by the RBA to achieve these objectives is setting interest rates.

Interest rates are the cost of borrowing money. The RBA sets the official cash rate, which is the interest rate at which banks borrow money from the RBA. This rate influences other interest rates in the economy, such as the interest rates charged by banks on loans to businesses and individuals.

Historical Context

The RBA has been setting interest rates since its establishment in 1959. Over time, interest rates have fluctuated significantly. In the 1980s and early 1990s, interest rates were high, reaching a peak of 17.5% in 1990. Since then, interest rates have generally declined, reaching a record low of 0.1% in 2020.

Factors Influencing RBA Interest Rate Decisions

The Reserve Bank of Australia (RBA) makes interest rate decisions based on a variety of economic indicators and data. These include:

Inflation

Inflation is a key factor in RBA’s interest rate decisions. The RBA targets an inflation rate of 2-3%. If inflation is too high, the RBA may raise interest rates to cool the economy and bring inflation back within its target range. Conversely, if inflation is too low, the RBA may lower interest rates to stimulate economic growth.

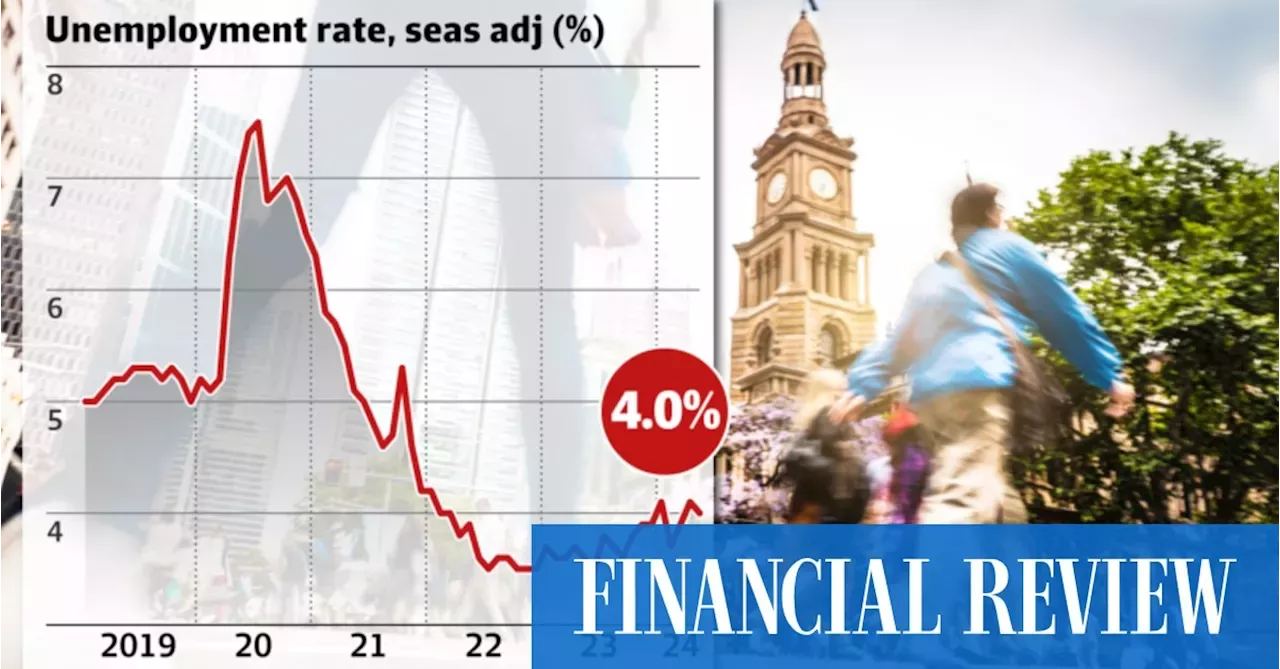

Unemployment

Unemployment is another important factor in RBA’s interest rate decisions. The RBA aims to keep unemployment as low as possible without causing inflation to rise. If unemployment is too high, the RBA may lower interest rates to stimulate job creation. However, if unemployment is too low, the RBA may raise interest rates to prevent inflation from rising.

Economic Growth

Economic growth is another key factor in RBA’s interest rate decisions. The RBA aims to achieve sustainable economic growth without causing inflation to rise. If economic growth is too slow, the RBA may lower interest rates to stimulate growth. However, if economic growth is too fast, the RBA may raise interest rates to prevent inflation from rising.

Other Macroeconomic Factors

In addition to inflation, unemployment, and economic growth, the RBA also considers a number of other macroeconomic factors when making interest rate decisions. These include:

- The global economic outlook

- The exchange rate

- The financial markets

- The housing market

– Analyze the relationship between RBA interest rates and consumer confidence.

Interest rates set by the Reserve Bank of Australia (RBA) have a significant impact on consumer confidence. When interest rates are low, consumers are more likely to borrow money and spend, which can boost economic growth. However, when interest rates are high, consumers are more likely to save money and reduce their spending, which can slow economic growth.

There are a number of reasons why interest rates affect consumer confidence. First, interest rates affect the cost of borrowing money. When interest rates are low, it is cheaper for consumers to borrow money to buy homes, cars, and other goods and services. This can make consumers more likely to make big purchases, which can boost economic growth.

Second, interest rates affect the amount of money that consumers have available to spend. When interest rates are high, consumers have to pay more interest on their debts, which leaves them with less money to spend on other things. This can make consumers more likely to cut back on their spending, which can slow economic growth.

Describe the RBA’s communication strategy and how it influences market expectations.

The Reserve Bank of Australia (RBA) uses a range of communication tools to influence market expectations about interest rates. These tools include:

- Media releases

- Speeches by the Governor and other senior RBA officials

- Statements on Monetary Policy (SoMPs)

- Financial Stability Reviews

- Market briefings

- Research publications

The RBA’s communication strategy is designed to provide market participants with clear and timely information about the Bank’s assessment of the economic outlook and its intentions for monetary policy. This information helps market participants to form expectations about future interest rates, which can influence their investment and lending decisions.

The RBA’s communication strategy has been successful in influencing market expectations. For example, in the lead-up to the RBA’s decision to cut interest rates in May 2019, the Bank’s communication had prepared the market for a rate cut. This helped to reduce market volatility and uncertainty, and it also contributed to a fall in long-term interest rates.

Challenges and opportunities for the RBA in communicating its policy intentions effectively.

The RBA faces a number of challenges in communicating its policy intentions effectively. These challenges include:

- The complexity of the economic outlook

- The need to balance transparency with the need to maintain market stability

- The risk of miscommunication

Despite these challenges, the RBA has a number of opportunities to improve its communication strategy. These opportunities include:

- Using a wider range of communication channels

- Making its communication more accessible to a wider audience

- Improving the coordination of its communication with other central banks

The RBA is committed to improving its communication strategy. The Bank believes that effective communication is essential for maintaining market confidence and stability.

Comparison of RBA Interest Rates to Other Central Banks

The Reserve Bank of Australia (RBA) is responsible for setting interest rates in Australia. However, its policies are not made in isolation. Central banks around the world interact and influence each other’s decisions. In this section, we will compare the RBA’s interest rate policies to those of other major central banks, such as the Federal Reserve and the European Central Bank.

One of the most striking similarities between the RBA and other central banks is their focus on maintaining price stability. All of these institutions have a mandate to keep inflation within a certain target range. For the RBA, the target range is 2-3%. The Federal Reserve has a similar target of 2%, while the European Central Bank aims for inflation “below, but close to, 2%.”

Differences in Policy Approaches

Despite their shared goal of price stability, the RBA, Federal Reserve, and European Central Bank often differ in their policy approaches. One key difference is the way they respond to economic shocks. For example, during the Global Financial Crisis, the Federal Reserve and the European Central Bank both implemented quantitative easing, a policy that involves buying large amounts of government bonds in order to increase the money supply. The RBA, on the other hand, did not implement quantitative easing.

Browse the implementation of Ben Hornby in real-world situations to understand its applications.

Another difference between the RBA and other central banks is the way they communicate with the public. The RBA is known for its relatively transparent and forward-looking communication. The Bank publishes a Statement on Monetary Policy every quarter, which provides detailed information about its economic outlook and its plans for interest rates. The Federal Reserve and the European Central Bank are also transparent in their communication, but they do not provide as much forward guidance as the RBA.

Historical Case Studies of RBA Interest Rate Decisions: RBA Interest Rates

Interest Rate Cut of 2008

In response to the Global Financial Crisis, the RBA cut interest rates by 100 basis points in October 2008. This was the largest single rate cut in the RBA’s history. The decision was made in an effort to stimulate economic growth and prevent a recession.

Key Economic Indicators:

You also can understand valuable knowledge by exploring Marseille.

- GDP growth had slowed to 0.9% in the September quarter.

- The unemployment rate had risen to 5.2%.

- Inflation was below the RBA’s target of 2-3%.

Rationale for the Decision:

The RBA believed that the Global Financial Crisis posed a significant risk to the Australian economy. The rate cut was intended to reduce borrowing costs and encourage businesses to invest and hire more workers.

Impact of the Decision:

The interest rate cut helped to stimulate economic growth. GDP growth rebounded to 2.5% in the December quarter. The unemployment rate fell to 4.8%. Inflation remained below the RBA’s target.

Conclusion:

The interest rate cut of 2008 was a successful example of the RBA using monetary policy to stabilize the economy during a period of financial crisis.

Market Forecasts and Analysis of Future RBA Interest Rates

Market participants and economic analysts constantly monitor and forecast future movements in RBA interest rates. These forecasts are based on various factors, including economic data, central bank statements, and market sentiment. By understanding the market’s expectations for future interest rates, investors can make informed decisions about their investments and financial planning.

Factors Influencing Market Forecasts

- Economic Data: Economic indicators such as GDP growth, inflation, unemployment, and consumer spending provide valuable insights into the health of the economy and can influence the RBA’s interest rate decisions.

- Central Bank Statements: The RBA regularly communicates its views on the economy and interest rates through speeches, press releases, and monetary policy statements. These statements provide guidance to the market about the central bank’s intentions and can shape market expectations.

- Market Sentiment: Investor sentiment and market conditions can also influence interest rate forecasts. For example, a positive outlook for the economy may lead to expectations of higher interest rates, while concerns about a recession could result in forecasts of lower rates.

Potential Implications for the Economy and Financial Markets

Forecasts of future RBA interest rates can have significant implications for the economy and financial markets. For example, if the market anticipates higher interest rates, businesses may delay investments, and consumers may reduce borrowing. Conversely, expectations of lower interest rates can boost economic activity as businesses and individuals become more inclined to borrow and spend.

Financial markets are also affected by interest rate forecasts. Changes in interest rates can impact bond prices, stock valuations, and currency exchange rates. Investors who understand the market’s expectations for future interest rates can adjust their portfolios accordingly.

Impact of RBA Interest Rates on Housing Market

The Reserve Bank of Australia (RBA) interest rates play a significant role in shaping the Australian housing market. Changes in interest rates directly impact housing prices, affordability, and demand, influencing the decisions of both buyers and sellers.

Relationship between RBA Interest Rates and Housing Prices

Interest rates are inversely related to housing prices. When the RBA raises interest rates, the cost of borrowing increases, making it more expensive for potential buyers to secure a mortgage. As a result, demand for housing decreases, leading to a decline in housing prices.

Conversely, when the RBA lowers interest rates, the cost of borrowing decreases, making it more affordable for buyers to enter the market. Increased demand for housing typically leads to higher prices.

Impact on Housing Affordability, RBA interest rates

Interest rates significantly impact housing affordability. Higher interest rates increase monthly mortgage repayments, making it more challenging for households to qualify for a loan or afford a suitable property.

Lower interest rates, on the other hand, improve affordability by reducing mortgage repayments. This allows more households to enter the market and purchase a home.

Historical Case Studies

- 2008 Global Financial Crisis: The RBA raised interest rates sharply to combat inflation, leading to a significant decline in housing prices and a slowdown in the housing market.

- 2020 COVID-19 Pandemic: The RBA slashed interest rates to record lows to support the economy during the pandemic. This led to a surge in demand for housing and a rapid increase in prices.

Impact on Different Housing Types

Interest rate changes affect different types of housing in varying ways.

- Detached Homes: Typically more expensive and sensitive to interest rate changes. Higher rates can lead to a significant decrease in demand and prices.

- Apartments: Generally more affordable and less impacted by interest rate changes. Demand for apartments may remain relatively stable even during periods of higher rates.

- Investment Properties: Interest rate changes can impact rental yields and capital gains. Higher rates may reduce rental returns and make investment properties less attractive.

Impact of RBA Interest Rates on Currency Exchange Rates

The Reserve Bank of Australia’s (RBA) interest rates play a crucial role in determining the value of the Australian dollar (AUD) against other currencies. When interest rates rise in Australia, it becomes more attractive for foreign investors to invest in Australian assets, leading to increased demand for the AUD and an appreciation in its value.

Conversely, when interest rates fall in Australia, foreign investors may be less inclined to invest in Australian assets, resulting in decreased demand for the AUD and a depreciation in its value.

Implications of a Strong or Weak AUD

A strong AUD can have both positive and negative implications for Australia’s economy. On the one hand, it can make imports cheaper, which can benefit consumers and businesses that rely on imported goods. On the other hand, a strong AUD can make Australian exports more expensive, potentially hurting exporters and reducing economic growth.

A weak AUD can have the opposite effects. It can make Australian exports more competitive in international markets, boosting exports and economic growth. However, it can also make imports more expensive, which can put pressure on consumers and businesses that rely on imported goods.

RBA’s Role in Maintaining Financial Stability

The Reserve Bank of Australia (RBA) holds the crucial responsibility of ensuring financial stability within the Australian economy. This involves maintaining a stable financial system, fostering sustainable economic growth, and containing risks that could potentially destabilize the economy. Interest rates serve as a primary tool in achieving these objectives.

Use of Interest Rates

The RBA employs interest rates to influence the availability and cost of credit in the economy. By raising interest rates, the RBA discourages borrowing and spending, which helps curb excessive credit growth and prevent the formation of asset bubbles. Conversely, lowering interest rates stimulates borrowing and spending, providing support to economic activity during periods of weakness.

Role in Preventing Financial Imbalances

Financial imbalances, such as excessive household debt or rapid growth in asset prices, can pose significant risks to the economy. The RBA uses interest rates to mitigate these imbalances. By raising interest rates, the RBA can reduce the attractiveness of borrowing, thereby limiting the accumulation of debt and preventing asset bubbles from forming. Conversely, lowering interest rates can encourage borrowing and spending, helping to offset economic downturns and promote financial stability.

Impact of RBA Interest Rates on Household Debt

The Reserve Bank of Australia (RBA) plays a crucial role in managing household debt levels in the country. Interest rates are one of the primary tools used by the RBA to influence economic activity and inflation.

Higher interest rates make borrowing more expensive, which can lead to a reduction in household debt. This is because higher interest rates increase the cost of servicing debt, leaving households with less disposable income to spend on other goods and services.

Conversely, lower interest rates make borrowing more affordable, which can lead to an increase in household debt. This is because lower interest rates reduce the cost of servicing debt, leaving households with more disposable income to spend on other goods and services.

Risks and Challenges of High Household Debt

High levels of household debt can pose several risks and challenges to the Australian economy. These include:

- Increased financial vulnerability: High levels of household debt can make households more financially vulnerable to economic shocks, such as a loss of income or a rise in interest rates.

- Reduced economic growth: High levels of household debt can reduce economic growth by diverting household spending away from consumption and towards debt repayment.

- Financial instability: High levels of household debt can increase the risk of financial instability in the event of a sharp economic downturn.

Policy Implications

The RBA considers the impact of interest rates on household debt levels when making its monetary policy decisions. The RBA aims to keep interest rates at a level that supports sustainable economic growth while managing the risks associated with high household debt.

The RBA’s policy implications include:

- Using interest rates to manage household debt levels: The RBA can use interest rates to influence household debt levels by making borrowing more or less expensive.

- Promoting financial literacy: The RBA can promote financial literacy to help households make informed decisions about borrowing and managing debt.

- Working with other government agencies: The RBA can work with other government agencies to develop and implement policies that support sustainable household debt levels.

RBA’s Independence and Accountability

The Reserve Bank of Australia (RBA) is an independent central bank responsible for managing Australia’s monetary policy and financial stability. Its independence from political interference and its accountability to the Australian government are crucial for maintaining the bank’s credibility and ensuring its effectiveness in fulfilling its mandate.

Mechanisms and Processes for Independence and Accountability

The RBA’s independence is enshrined in the Reserve Bank Act 1959, which provides the bank with operational autonomy in conducting monetary policy. The RBA is not subject to direct government control or political pressure in its decision-making process.

To ensure accountability, the RBA is required to report regularly to the Australian Parliament and the Treasurer on its activities and performance. The bank’s Annual Report and Statement on Monetary Policy provide detailed information on the RBA’s policy decisions and economic outlook. The RBA also engages in public communication and outreach activities to explain its monetary policy framework and decisions to the public.

Role of the RBA Board

The RBA Board is responsible for setting monetary policy and overseeing the bank’s operations. The Board consists of nine members, including the Governor, Deputy Governor, and seven other members appointed by the Treasurer. The Board members are selected for their expertise in economics, finance, and public policy.

The Board’s independence is further strengthened by the fact that its members are appointed for fixed terms and can only be removed for misconduct or incapacity. This provides the Board with the necessary independence to make decisions free from political or other external pressures.

Examples of Independence and Accountability

In recent years, the RBA has demonstrated its independence and accountability in several ways. For example, the bank has maintained its inflation target of 2-3% despite political pressure to lower interest rates. The RBA has also been transparent in its communication, providing clear explanations of its policy decisions and the reasons behind them.

Challenges and Criticisms

While the RBA’s independence and accountability are generally well-regarded, there have been some challenges and criticisms raised in recent years. Some critics have argued that the RBA’s independence may have led to a lack of accountability, particularly during periods of economic crisis. Others have expressed concerns that the RBA’s close relationship with the financial sector may have influenced its policy decisions.

Table: Key Mechanisms and Processes for RBA Independence and Accountability

| Mechanism/Process | Description |

|—|—|

| Reserve Bank Act 1959 | Provides the RBA with operational autonomy in conducting monetary policy. |

| RBA Board | Responsible for setting monetary policy and overseeing the bank’s operations. |

| Fixed-term appointments for Board members | Ensures the Board’s independence from political or other external pressures. |

| Regular reporting to Parliament and the Treasurer | Provides accountability for the RBA’s activities and performance. |

| Public communication and outreach activities | Explains the RBA’s monetary policy framework and decisions to the public. |

Importance of Independence and Accountability

The independence and accountability of the RBA are essential for maintaining the bank’s credibility and effectiveness. An independent central bank is better able to make decisions based on economic data and analysis, rather than political considerations. Accountability ensures that the RBA is transparent in its decision-making and responsive to the needs of the Australian economy and public.

Global Economic Outlook and Implications for RBA Interest Rates

The global economic outlook plays a crucial role in shaping RBA interest rate decisions. External factors such as global inflation, economic growth, and geopolitical events can significantly influence the RBA’s policy stance.

Strong global economic growth can lead to increased demand for Australian exports, boosting economic activity and potentially putting upward pressure on inflation. This may prompt the RBA to raise interest rates to prevent the economy from overheating.

Global Inflation and its Impact

Global inflation is a key factor that the RBA monitors closely. If global inflation is rising, it can put upward pressure on Australian inflation. To counter this, the RBA may raise interest rates to curb inflationary pressures.

Economic Growth and its Impact

Global economic growth can impact Australian interest rates. If global growth is slowing, it can reduce demand for Australian exports and lead to lower economic activity. This may prompt the RBA to lower interest rates to stimulate the economy.

Geopolitical Events and their Impact

Geopolitical events, such as trade disputes or armed conflicts, can also influence RBA interest rate decisions. These events can create uncertainty and volatility in global markets, which can impact Australia’s economic outlook.

Data and Resources for Tracking RBA Interest Rates

Staying informed about RBA interest rates is crucial for understanding the Australian economy. Numerous reliable data sources and resources can help you track these rates and gain insights into the RBA’s monetary policy decisions.

Key Data Sources

- RBA Website: The RBA’s official website provides up-to-date information on interest rates, monetary policy statements, and economic data.

- Australian Bureau of Statistics (ABS): The ABS publishes key economic indicators such as inflation, unemployment, and GDP growth, which influence RBA interest rate decisions.

- Reserve Bank of Australia Bulletin: This quarterly publication provides in-depth analysis of the Australian economy and the RBA’s monetary policy.

- Financial Markets: Real-time interest rate data and market forecasts can be found on financial news websites and platforms like Bloomberg and Reuters.

Interpreting the Data

Understanding the relationship between RBA interest rates and economic indicators is essential. Higher interest rates generally aim to curb inflation and slow economic growth, while lower rates stimulate economic activity. By tracking these indicators, you can gain insights into the RBA’s assessment of the economy and its likely future actions.

Forecasting Interest Rate Movements

Data analysis can help forecast future interest rate movements. For example, rising inflation may indicate the need for higher rates, while slowing economic growth could lead to rate cuts. Economic commentators and analysts often provide forecasts based on their interpretation of the data.

Tracking RBA Announcements

The RBA typically announces interest rate decisions on the first Tuesday of each month. These announcements are accompanied by statements explaining the RBA’s rationale. By tracking these announcements and interpreting the accompanying statements, you can gain insights into the RBA’s current and future monetary policy stance.

Final Wrap-Up

As we conclude our exploration of RBA interest rates, we hope you’ve gained a deeper understanding of their significance in shaping the Australian economy. From their influence on inflation to their impact on the housing market, interest rates play a crucial role in our financial well-being. Remember, staying informed and engaged with economic issues is essential for navigating the ever-changing financial landscape. We encourage you to continue exploring and learning, and we’re always here if you have any questions. Thank you for joining us on this exciting journey!