State pension, a cornerstone of retirement planning, provides a comprehensive safety net for individuals in their golden years. This guide delves into the intricacies of State pension, exploring eligibility criteria, various types, and strategies for maximizing its benefits.

Eligibility for State pension is determined by factors such as age, National Insurance contributions, and residency. The State Pension age is currently 66, but it is set to rise to 67 in the coming years. To qualify for a full State pension, individuals must have made 35 years of National Insurance contributions.

Overview of State Pension

The State Pension is a government-funded retirement benefit paid to individuals who have reached a certain age and have made sufficient National Insurance contributions throughout their working lives. It is intended to provide a basic level of income support for individuals during their retirement.

The State Pension system has a long history in the United Kingdom, dating back to the late 19th century. It has undergone significant reforms over the years, with the most recent major changes being introduced in 2016.

Learn about more about the process of Jacques Lussier in the field.

Eligibility for State Pension

To be eligible for the State Pension, individuals must meet certain criteria, including:

- Reaching a specific age, currently 66 for both men and women

- Having made sufficient National Insurance contributions during their working lives

- Residing in the United Kingdom for a certain period of time

Individuals can check their eligibility for the State Pension by contacting the Department for Work and Pensions (DWP).

Types of State Pension

There are different types of State Pension available, including:

- Basic State Pension: This is the basic level of State Pension paid to individuals who have made sufficient National Insurance contributions.

- Additional State Pension: This is an additional amount of State Pension that individuals can earn by making additional National Insurance contributions.

- Graduated Retirement Benefit: This is a type of State Pension that was introduced in 1961 and is no longer available to new applicants.

The amount of State Pension an individual receives depends on their individual circumstances, including their age, National Insurance contributions, and whether they have deferred their retirement.

Qualifying for State Pension

To qualify for the State Pension, you must have made enough National Insurance (NI) contributions. There are two main types of NI contributions: Class 1 and Class 2.

Class 1 contributions are paid by employees and the self-employed. Class 2 contributions are paid by the self-employed only.

Qualifying Years

You need to have at least 10 qualifying years to qualify for the State Pension. A qualifying year is a year in which you have paid enough NI contributions to earn a credit. You can earn a maximum of one credit per year.

Age Thresholds

The current state pension age is 66 for both men and women. However, the government has announced plans to increase the state pension age to 67 by 2028, and to 68 by 2046.

Deferring Claiming the State Pension

You can defer claiming the State Pension until you reach the age of 70. This can increase the amount of State Pension you receive, as your pension will be increased by 1% for each year you defer claiming.

However, deferring claiming the State Pension may also affect your entitlement to other benefits, such as Pension Credit.

Key Qualifying Criteria and Age Thresholds

The following table summarizes the key qualifying criteria and age thresholds for the State Pension:

| Criteria | Threshold |

|---|---|

| Qualifying years | 10 |

| State pension age (current) | 66 |

| State pension age (proposed) | 67 (by 2028), 68 (by 2046) |

History of the State Pension

The State Pension was introduced in 1908. It was originally a flat-rate pension paid to all retired people over the age of 70. The pension was increased in 1925 and again in 1946. In 1958, the pension was linked to earnings, and in 1978, the qualifying age for women was reduced from 65 to 60.

The State Pension has undergone a number of changes over the years. In 1995, the pension was privatized, and people were given the option to opt out of the State Pension scheme and invest their NI contributions in a private pension.

In 2010, the government announced plans to increase the state pension age to 66 for both men and women. This change was implemented in 2018.

Calculating State Pension

Calculating the State Pension involves several steps and considerations. It is essential to understand the factors that influence the amount of pension received to plan effectively for retirement.

Steps to Calculate State Pension

- Determine your State Pension age: The age at which you can claim your State Pension depends on your date of birth.

- Check your National Insurance record: You need to have paid enough National Insurance contributions over the years to qualify for a full State Pension.

- Calculate your Qualifying Years: You need 35 qualifying years of National Insurance contributions to receive the full State Pension. Each year you have paid contributions counts as one qualifying year.

- Apply for your State Pension: You can apply for your State Pension up to four months before you reach State Pension age.

Factors Affecting State Pension Amount

The amount of State Pension you receive depends on:

- The number of qualifying years you have.

- Your National Insurance contribution record.

- Whether you have deferred claiming your State Pension.

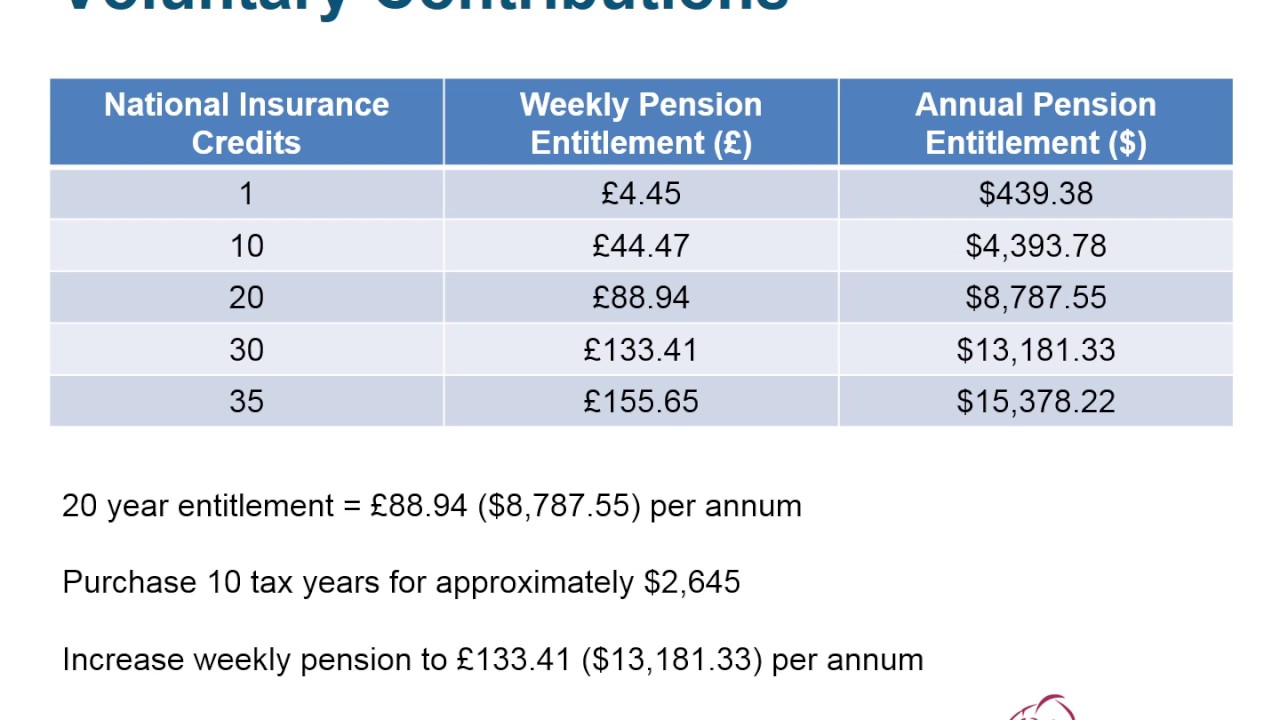

Ways to Increase State Pension

There are several ways to increase your State Pension:

- Pay voluntary National Insurance contributions: If you have gaps in your National Insurance record, you can pay voluntary contributions to fill them.

- Defer claiming your State Pension: For every nine weeks you defer claiming your State Pension, you will receive a 1% increase in the amount you get.

- Work past State Pension age: If you continue to work past State Pension age, you can build up additional qualifying years and increase your State Pension.

State Pension Entitlements

The State Pension provides a foundation of financial support for those who have reached retirement age and made sufficient National Insurance contributions. The State Pension is made up of three main components: the basic State Pension, the additional State Pension, and the new State Pension.

The basic State Pension is a flat-rate payment that is paid to everyone who has reached State Pension age and has made at least 30 years of National Insurance contributions. The additional State Pension is a top-up payment that is paid to those who have made additional National Insurance contributions. The new State Pension is a single-tier pension that replaced the basic State Pension and the additional State Pension for those who reached State Pension age on or after 6 April 2016.

Eligibility Criteria

- To be eligible for the basic State Pension, you must have reached State Pension age and have made at least 30 years of National Insurance contributions.

- To be eligible for the additional State Pension, you must have made additional National Insurance contributions.

- To be eligible for the new State Pension, you must have reached State Pension age on or after 6 April 2016.

Payment Rates

The payment rates for the State Pension vary depending on your age, National Insurance contributions, and whether you are receiving other forms of retirement income.

| Type of State Pension | Payment Rate |

|---|---|

| Basic State Pension | £141.85 per week |

| Additional State Pension | Up to £175.20 per week |

| New State Pension | Up to £185.15 per week |

Tax Implications

The State Pension is taxable, but the amount of tax you pay will depend on your other sources of income.

Changes to State Pension

The State Pension system in the United Kingdom has undergone several changes in recent years, and further changes are proposed for the future. These changes have been made to ensure that the system remains fair and sustainable for both current and future pensioners.

Recent Changes

- The State Pension age has been gradually increasing since 2010 and is currently 66 for both men and women. It is due to reach 67 by 2028.

- The amount of State Pension you receive is based on your National Insurance contributions. The amount of contributions you need to make to qualify for a full State Pension has also been increasing gradually since 2010.

- The State Pension has been uprated by 2.5% each year since 2010, in line with inflation.

Proposed Future Changes

The government has proposed a number of further changes to the State Pension system, which are due to come into effect in the coming years.

- The State Pension age is due to increase to 68 by 2046.

- The amount of State Pension you receive will be based on your average earnings over your lifetime, rather than just your best 35 years.

- The State Pension will be uprated by the higher of inflation or 2.5% each year.

Impact of Changes

The changes to the State Pension system have had a significant impact on both current and future pensioners.

Remember to click Mike Trout to understand more comprehensive aspects of the Mike Trout topic.

- People who are currently reaching State Pension age are receiving a lower State Pension than those who retired a few years ago.

- People who are still working will need to make more National Insurance contributions to qualify for a full State Pension.

- People who are planning to retire in the future will need to save more for their retirement, as they will not be able to rely on the State Pension to provide them with a comfortable income.

State Pension Comparisons

The UK State Pension system is designed to provide a basic level of financial support to individuals who have reached retirement age and have made sufficient contributions to the National Insurance scheme. However, the UK State Pension is not the only system of its kind, and it is important to compare it to similar systems in other countries to understand its strengths and weaknesses.

Retirement Age

The retirement age in the UK is currently 66 for both men and women, and it is set to rise to 67 by 2028. This is similar to the retirement age in many other developed countries, such as France (62), Germany (65), and the United States (66). However, there are some countries with lower retirement ages, such as Italy (64) and Spain (65).

Contribution Requirements

In the UK, individuals must have made at least 10 years of National Insurance contributions to qualify for the full State Pension. This is a relatively low threshold compared to other countries, such as France (42 years) and Germany (35 years). However, the UK State Pension is also relatively low compared to other countries, so the lower contribution requirement may be necessary to ensure that individuals receive a basic level of support.

Benefit Levels

The full State Pension in the UK is currently £185.15 per week. This is a relatively low benefit level compared to other countries, such as France (€1,700 per month) and Germany (€1,500 per month). However, the UK State Pension is intended to be a basic level of support, and many individuals will also have private pensions or other savings to supplement their income in retirement.

Advantages and Disadvantages

The UK State Pension system has a number of advantages, including its low contribution requirements and its simplicity. However, it also has some disadvantages, such as its low benefit levels and its relatively high retirement age. Overall, the UK State Pension system is a relatively basic system that provides a low level of support to individuals in retirement. However, it is important to note that the UK State Pension is only one part of the UK’s retirement income system, and many individuals will also have private pensions or other savings to supplement their income in retirement.

Areas for Improvement

There are a number of areas where the UK State Pension system could be improved. These include:

- Increasing the benefit level to provide a more adequate level of support to individuals in retirement.

- Lowering the retirement age to make it easier for individuals to retire earlier.

- Reducing the contribution requirements to make it easier for individuals to qualify for the full State Pension.

These are just a few of the areas where the UK State Pension system could be improved. By making these changes, the government could help to ensure that individuals have a more secure and comfortable retirement.

State Pension Planning

Planning for your State Pension is crucial to ensure a comfortable retirement. Here’s how you can plan effectively:

Eligibility Criteria: To qualify for the State Pension, you need to have made National Insurance contributions for a minimum number of years. The exact number depends on your date of birth.

State Pension Age: The State Pension age is currently 66 for both men and women. However, it is set to increase to 67 by 2028.

Amount of State Pension: The amount of State Pension you receive depends on your National Insurance contributions and your age when you start claiming. You can check your State Pension forecast online to estimate how much you will receive.

Saving for Retirement

Saving for retirement is essential to supplement your State Pension and ensure financial security. Here are some key considerations:

Impact of Inflation: Inflation can erode the value of your retirement savings over time. Consider investments that can outpace inflation, such as stocks or property.

Benefits of Compound Interest: Compound interest allows your savings to grow exponentially over time. Start saving early to maximize the benefits of compounding.

Types of Retirement Savings Accounts: There are various types of retirement savings accounts available, such as pensions, ISAs, and SIPPs. Choose the one that best suits your needs and circumstances.

Supplementing the State Pension

In addition to your State Pension, you may consider other options to supplement your retirement income:

Private Pensions: Private pensions are offered by employers and provide a tax-efficient way to save for retirement.

Workplace Pensions: Workplace pensions are similar to private pensions but are automatically deducted from your salary.

Personal Pensions: Personal pensions are individual retirement savings accounts that you can set up and manage yourself.

Self-Employment Pensions: Self-employed individuals can set up their own pensions to save for retirement.

Buy-to-Let Properties: Buy-to-let properties can provide rental income in retirement, but they also come with risks and responsibilities.

Equity Release: Equity release allows you to access the value of your home while continuing to live in it, but it can reduce the value of your estate.

State Pension Scams

State Pension scams are fraudulent schemes that target people who are approaching or have reached State Pension age. Scammers may use a variety of tactics to trick people into parting with their money or personal information.

It’s important to be aware of the different types of State Pension scams so that you can spot and avoid them. If you have been targeted by a State Pension scam, it’s important to report it to the authorities.

Types of State Pension Scams

There are many different types of State Pension scams, but some of the most common include:

| Scam type | How to spot it | What to do if you’re targeted |

|---|---|---|

| Phishing scams | Scammers send emails or text messages that look like they are from the Department for Work and Pensions (DWP). They may ask you to click on a link or provide your personal information. | Do not click on any links or provide your personal information. Report the scam to the DWP. |

| Investment scams | Scammers offer to invest your State Pension on your behalf. They may promise high returns, but these investments are often fake or worthless. | Do not invest your State Pension with anyone you do not know and trust. Report the scam to the DWP. |

| Advance fee scams | Scammers ask you to pay a fee in order to receive your State Pension. This is a scam. | Do not pay any fees to receive your State Pension. Report the scam to the DWP. |

Common Phrases Used by Scammers

Scammers often use certain phrases to trick people into parting with their money or personal information. Some of the most common phrases include:

- “You are entitled to a lump sum of money from your State Pension.”

- “We can help you get a higher State Pension.”

- “You need to pay a fee to receive your State Pension.”

- “We have a special offer for you.”

- “This is a limited time offer.”

What to Do if You Have Been Targeted by a State Pension Scam

If you have been targeted by a State Pension scam, it’s important to report it to the authorities. You can report the scam to the DWP by calling 0800 169 0144 or by emailing [email protected].

You can also report the scam to Action Fraud by calling 0300 123 2040 or by visiting the Action Fraud website.

State Pension and Taxation

The State Pension is taxed as income, so the amount of tax you pay will depend on your other income and tax allowances. The current tax rates for the UK are as follows:

- Basic rate: 20%

- Higher rate: 40%

- Additional rate: 45%

If your State Pension is your only source of income, you will not pay any tax on it. However, if you have other income, such as from a part-time job or savings, you may need to pay tax on your State Pension.

The impact of different tax rates on the State Pension is as follows:

- If you are a basic rate taxpayer, you will pay 20% tax on your State Pension.

- If you are a higher rate taxpayer, you will pay 40% tax on your State Pension.

- If you are an additional rate taxpayer, you will pay 45% tax on your State Pension.

There are a number of ways to minimize the tax on your State Pension. These include:

- Making sure you claim all of your tax allowances.

- Deferring your State Pension until you are older.

- Taking your State Pension as a lump sum.

If you are unsure about how much tax you will pay on your State Pension, you can use the HMRC tax calculator: https://www.gov.uk/calculate-your-state-pension

State Pension and Healthcare

The State Pension provides financial support to individuals who have reached retirement age and have paid sufficient National Insurance contributions throughout their working life. In addition to providing financial support, the State Pension also offers certain healthcare benefits to pensioners.

Interaction with the NHS

State Pensioners are entitled to free healthcare services provided by the National Health Service (NHS). This includes access to primary care services, such as GP appointments, as well as hospital treatment and specialist care. State Pensioners are also entitled to free prescriptions for any medication prescribed by an NHS doctor.

Challenges in Accessing Healthcare

Despite the healthcare benefits available to State Pensioners, there are some challenges that they may face in accessing healthcare services. These challenges can include:

- Long waiting times: State Pensioners may experience long waiting times for appointments and treatments, particularly for non-urgent care.

- Transport difficulties: Some State Pensioners may have difficulty accessing healthcare services due to lack of transportation or mobility issues.

- Financial barriers: While healthcare services are free for State Pensioners, some may face financial barriers to accessing care, such as travel costs or the cost of private health insurance.

To address these challenges, the government has implemented various measures, such as increasing funding for the NHS and providing support to State Pensioners with transportation costs. Additionally, there are a number of charities and organizations that provide assistance to State Pensioners in accessing healthcare services.

State Pension and Housing

As State Pensioners navigate retirement, securing suitable housing becomes a crucial consideration. Various options are available, each with its unique advantages and challenges.

Housing Options for State Pensioners

Private Rentals: These offer flexibility and independence, but can be expensive and subject to market fluctuations.

Social Housing: Provided by local authorities or housing associations, social housing offers affordable rent and security of tenure. However, waiting lists can be long, and eligibility criteria apply.

Shared Ownership: This scheme allows individuals to purchase a share of a property, typically 25-75%, while paying rent on the remaining share. It can be a stepping stone towards full homeownership.

Retirement Villages: Designed specifically for older adults, retirement villages offer a range of housing options, communal facilities, and support services. They can provide a sense of community and security, but can be costly.

Financial Support for Housing Costs

State Pensioners facing financial difficulties may be eligible for various forms of support:

Housing Benefit: This means-tested benefit helps low-income individuals with rent payments.

Local Housing Allowance: Similar to Housing Benefit, LHA is paid directly to tenants in the private rental sector.

Discretionary Housing Payments: Local authorities can award these payments to individuals who do not qualify for other housing benefits but are facing exceptional financial hardship.

Challenges in Finding Suitable Housing

State Pensioners may encounter challenges in securing suitable housing, including:

Age Discrimination: Some landlords may be reluctant to rent to older individuals due to perceived health or mobility issues.

Lack of Affordable Housing: The shortage of affordable housing can make it difficult for State Pensioners to find homes within their budget.

Difficulty Accessing Social Housing: Long waiting lists and strict eligibility criteria can limit access to social housing for State Pensioners.

Barriers to Downsizing: Downsizing can be challenging for older individuals due to emotional attachment to their homes, accessibility concerns, and financial implications.

Case Studies of Successful Housing Access

Despite these challenges, many State Pensioners have successfully accessed suitable housing:

– Mrs. Smith: A widow in her 70s, Mrs. Smith downsized to a shared ownership apartment. This allowed her to reduce her housing costs and access support services within the retirement community.

– Mr. Jones: Mr. Jones, a State Pensioner with mobility issues, secured a place in a retirement village. The village provides adapted housing and access to healthcare and social activities, enhancing his independence and well-being.

Planning for Housing Needs in Retirement

State Pensioners can proactively plan for their housing needs by:

Planning for Downsizing: Consider downsizing to a smaller or more accessible property in advance to avoid the challenges of moving later in life.

Saving for Housing Costs: Set aside savings specifically for housing expenses, such as rent, mortgage payments, or home repairs.

Exploring Different Housing Options: Research and compare different housing options, including private rentals, social housing, shared ownership, and retirement villages, to find the best fit for individual needs and circumstances.

State Pension and Social Care

State Pensioners may require social care services as they age. Understanding how the State Pension interacts with these costs is crucial for planning and accessing the necessary support.

Social care services encompass a range of support, including assistance with daily tasks, personal care, and nursing. These services are typically provided by local authorities or private care providers.

Eligibility for Social Care

Eligibility for social care services is determined by an assessment of an individual’s needs and financial situation. Local authorities conduct these assessments to determine the level of support required and whether the individual is eligible for financial assistance.

State Pension and Social Care Costs

The State Pension can affect an individual’s eligibility for financial assistance with social care costs. If the State Pension income exceeds certain thresholds, individuals may be required to contribute towards the cost of their care.

The thresholds vary depending on the type of care required and the individual’s circumstances. For example, in England, individuals with assets over £23,250 may be required to pay for their residential care.

Challenges in Accessing Social Care

State Pensioners may face challenges in accessing social care due to factors such as:

- Limited availability of services: Demand for social care services often exceeds supply, resulting in waiting lists and limited access to appropriate care.

- Financial constraints: The cost of social care can be substantial, and State Pensioners with limited income may struggle to afford the necessary support.

- Complexity of the system: Navigating the social care system can be complex, making it difficult for State Pensioners to understand their eligibility and access the support they need.

State Pension and Bereavement

The loss of a partner can be a challenging time, and State Pensioners may face additional concerns. This section provides information on the support available to those who have lost a partner and explains how the State Pension is affected.

Support for Bereaved State Pensioners

State Pensioners who have lost a partner may be eligible for various forms of support, including:

- Bereavement Support Payment: A one-off, tax-free payment of £2,500 is available to those who have lost a spouse or civil partner. It is not means-tested and is paid regardless of the deceased’s age or the cause of death.

- Widowed Parent’s Allowance: A benefit paid to widowed parents who have children under the age of 16 or who are disabled. It is subject to a means test and is paid at the same rate as Jobseeker’s Allowance.

- Support from charities and organizations: Numerous charities and organizations provide support to widowed and bereaved people. They offer practical assistance, emotional support, and information on available benefits and services.

Impact of Partner’s Death on State Pension

The death of a partner can impact the State Pension in several ways:

- Inheritance: Any inheritance received from the deceased partner may affect the State Pension. In some cases, it may reduce the amount of Pension Credit or other benefits received.

- Survivor’s Pension: If the deceased partner had built up a State Pension, their surviving spouse or civil partner may be eligible for a Survivor’s Pension. This is a weekly payment that is based on the deceased partner’s National Insurance contributions.

- Inheritance Tax: Any inheritance received from the deceased partner may be subject to Inheritance Tax. This can reduce the amount of money available to the surviving spouse or civil partner.

Challenges for Widowed or Bereaved State Pensioners

Widowed or bereaved State Pensioners may face several challenges, including:

- Financial difficulties: The loss of a partner can lead to a significant reduction in household income. This can make it difficult to cover essential expenses and maintain a comfortable standard of living.

- Emotional distress: The loss of a partner can be emotionally devastating. Grief, loneliness, and depression are common challenges faced by widowed or bereaved individuals.

- Practical difficulties: Widowed or bereaved individuals may face practical difficulties, such as managing the household, caring for children, or dealing with legal and financial matters.

Final Summary

Planning for State pension is crucial to ensure a secure retirement. Understanding eligibility criteria, contribution requirements, and potential changes to the system is essential. By exploring the various types of State pension and considering additional retirement savings options, individuals can optimize their financial security in their later years.