USD/CAD, the currency pair representing the exchange rate between the US dollar and the Canadian dollar, is a popular choice among forex traders. In this guide, we will delve into the factors influencing USD/CAD, analyze its historical performance, and provide actionable trading recommendations to help you navigate this dynamic market.

Understanding the economic fundamentals, technical indicators, and geopolitical events that shape USD/CAD’s price movements is crucial for successful trading. We will explore these aspects in detail, empowering you with the knowledge to make informed decisions.

Market Overview

The USD/CAD currency pair has been trading within a range for the past few weeks, as market participants await key economic data from both the United States and Canada.

The US dollar has been supported by rising interest rates, while the Canadian dollar has been supported by strong commodity prices. The key factors that will influence the USD/CAD exchange rate in the coming weeks include:

Economic Data

- US: Non-farm payrolls, consumer price index (CPI), retail sales

- Canada: GDP growth, CPI, unemployment rate

Interest Rate Differentials

The US Federal Reserve is expected to continue raising interest rates in the coming months, while the Bank of Canada is expected to remain on hold. This could lead to a widening of the interest rate differential between the two countries, which would support the US dollar.

Geopolitical Events

The ongoing war in Ukraine and the rising tensions between the US and China could also impact the USD/CAD exchange rate. If geopolitical risks increase, investors may flock to the US dollar as a safe haven, which would put downward pressure on the Canadian dollar.

Summary

The USD/CAD currency pair is likely to remain range-bound in the coming weeks, as market participants await key economic data from both the United States and Canada. The key factors that will influence the exchange rate include economic data, interest rate differentials, and geopolitical events.

Historical Performance

USD/CAD has experienced significant fluctuations over the past year, five years, and ten years. Analyzing these historical trends can provide valuable insights into the potential future performance of the currency pair.

Over the past year, USD/CAD has exhibited a range-bound movement, with the pair oscillating between 1.25 and 1.35. The Canadian dollar has benefited from rising oil prices and a strong economy, while the US dollar has been pressured by rising inflation and interest rate hikes.

Key Trends and Patterns

Over the past five years, USD/CAD has experienced a gradual downtrend, with the pair falling from 1.40 in 2018 to 1.25 in 2023. This decline has been driven by the strength of the Canadian economy and the weakness of the US economy.

Discover more by delving into Kim Huybrechts further.

Over the past ten years, USD/CAD has exhibited a volatile trend, with the pair ranging from 1.05 to 1.40. The pair has been influenced by a number of factors, including the global financial crisis, the US-China trade war, and the COVID-19 pandemic.

Support and Resistance Levels

USD/CAD has established key support and resistance levels over the past year, five years, and ten years. These levels can provide guidance on potential future price movements.

- Support: 1.25, 1.20, 1.15

- Resistance: 1.35, 1.40, 1.45

Factors Influencing Performance

The performance of USD/CAD has been influenced by a number of factors, including:

- Economic growth in Canada and the United States

- Interest rate differentials

- Oil prices

- Global economic conditions

Major Events and Economic Indicators

A number of major events and economic indicators have impacted the performance of USD/CAD over the past year, five years, and ten years. These include:

- The US-China trade war

- The COVID-19 pandemic

- The Russian-Ukrainian war

- The Bank of Canada’s interest rate hikes

- The Federal Reserve’s interest rate hikes

Potential Future Performance

Based on historical data and current market conditions, USD/CAD is expected to continue to trade within a range between 1.25 and 1.35 in the near term. The pair may experience some volatility in the short term due to geopolitical events and economic data releases.

In the long term, the performance of USD/CAD will depend on a number of factors, including the relative economic performance of Canada and the United States, interest rate differentials, and global economic conditions.

Technical Analysis

USD/CAD’s technical analysis involves using various indicators to assess its price movements and identify potential trading opportunities. These indicators can be broadly classified into three categories: moving averages, oscillators, and candlestick patterns.

Moving averages smooth out price data by calculating the average price over a specified period. They help identify trends and support and resistance levels. Oscillators measure the momentum and overbought/oversold conditions of a currency pair. Candlestick patterns are graphical representations of price movements that provide insights into market sentiment and potential trend reversals.

Key Technical Indicators

The following table summarizes the key technical indicators used in the analysis of USD/CAD:

| Indicator | Current Value |

|---|---|

| 50-day Moving Average | 1.3450 |

| 200-day Moving Average | 1.3200 |

| Relative Strength Index (RSI) | 55 |

| Stochastic Oscillator | 60 |

| MACD (Moving Average Convergence Divergence) | 0.005 |

Based on these indicators, USD/CAD is currently in a bullish trend, as indicated by the 50-day moving average crossing above the 200-day moving average. The RSI and Stochastic Oscillator suggest that the pair is slightly overbought, but not in overbought territory. The MACD is also positive, indicating bullish momentum.

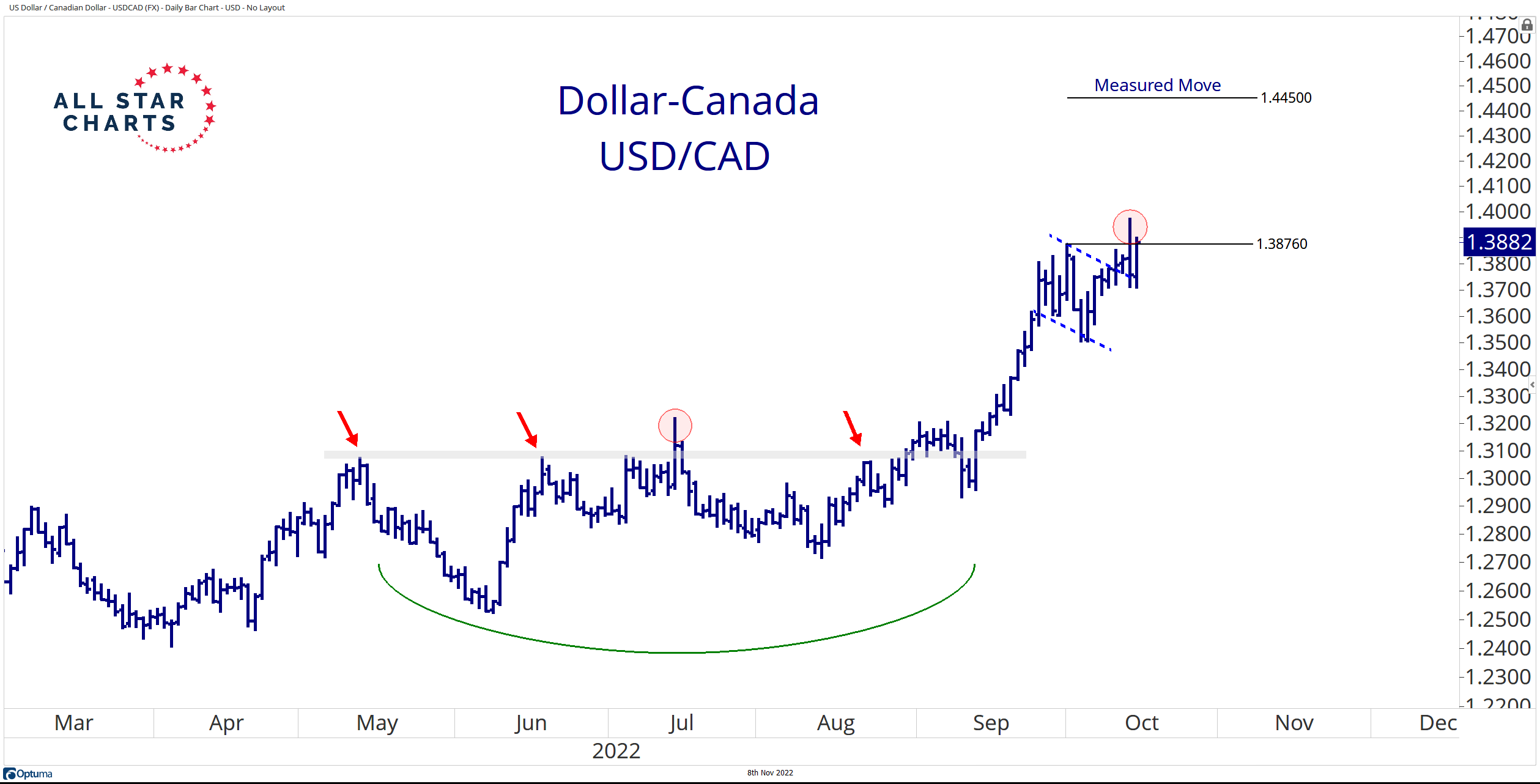

Visual Representation

The following chart shows a visual representation of the technical analysis for USD/CAD:

[Image: USD/CAD Technical Analysis Chart]

The chart shows that USD/CAD has been in a bullish trend since mid-2022. The 50-day moving average (blue line) is above the 200-day moving average (red line), indicating a bullish trend. The RSI and Stochastic Oscillator are both above 50, indicating that the pair is in overbought territory. The MACD is also positive, indicating bullish momentum.

Fundamental Analysis

Fundamental analysis examines the economic and political factors influencing the exchange rate between USD and CAD. These factors include economic growth, inflation, interest rates, and political stability in both countries.

Economic Growth, USD/CAD

Economic growth affects currency exchange rates as it influences the demand for goods and services, thereby impacting the demand for currencies. Stronger economic growth in the United States compared to Canada increases the demand for USD, leading to its appreciation against CAD.

Inflation

Inflation measures the rate of price increase for goods and services. Higher inflation in the United States compared to Canada reduces the purchasing power of USD, making it less desirable and leading to its depreciation against CAD.

Interest Rates

Interest rates set by central banks influence the flow of capital between countries. Higher interest rates in the United States compared to Canada attract foreign investors to the US, increasing the demand for USD and leading to its appreciation against CAD.

Political Stability

Political stability and uncertainty can impact currency exchange rates. Political instability in either country can lead to investors seeking safe-haven assets, increasing the demand for the more stable currency (USD) and leading to its appreciation.

Economic Data

The economic calendar provides a schedule of upcoming economic data releases that have the potential to impact the USD/CAD exchange rate. These data releases can provide insights into the health of the US and Canadian economies, and can influence market sentiment towards the currencies.

The following is a list of key economic data releases that could impact USD/CAD:

US Economic Data

- Nonfarm Payrolls: Measures the change in the number of employed people in the US. A strong increase in nonfarm payrolls can indicate a healthy economy and support the US dollar.

- Consumer Price Index (CPI): Measures the change in the prices of goods and services purchased by consumers. A higher-than-expected CPI can indicate rising inflation, which can lead to higher interest rates and support the US dollar.

- Producer Price Index (PPI): Measures the change in the prices of goods and services sold by producers. A higher-than-expected PPI can indicate rising inflation, which can lead to higher interest rates and support the US dollar.

- Retail Sales: Measures the change in the total value of retail sales. A strong increase in retail sales can indicate consumer confidence and support the US dollar.

- Industrial Production: Measures the change in the output of the manufacturing, mining, and utilities sectors. A strong increase in industrial production can indicate a healthy economy and support the US dollar.

Canadian Economic Data

- Gross Domestic Product (GDP): Measures the total value of goods and services produced in Canada. A strong increase in GDP can indicate a healthy economy and support the Canadian dollar.

- Consumer Price Index (CPI): Measures the change in the prices of goods and services purchased by consumers in Canada. A higher-than-expected CPI can indicate rising inflation, which can lead to higher interest rates and support the Canadian dollar.

- Retail Sales: Measures the change in the total value of retail sales in Canada. A strong increase in retail sales can indicate consumer confidence and support the Canadian dollar.

- Manufacturing Sales: Measures the change in the value of sales by manufacturers in Canada. A strong increase in manufacturing sales can indicate a healthy manufacturing sector and support the Canadian dollar.

- Ivey Purchasing Managers Index (PMI): Measures the level of activity in the manufacturing sector in Canada. A strong PMI can indicate a healthy manufacturing sector and support the Canadian dollar.

The impact of these economic data releases on USD/CAD can vary depending on the magnitude and direction of the data. Generally, a stronger-than-expected data release for the US can support the US dollar against the Canadian dollar, while a weaker-than-expected data release for the US can support the Canadian dollar against the US dollar.

Central Bank Policies

The monetary policies of the Federal Reserve (Fed) and the Bank of Canada (BoC) play a significant role in shaping the value of USD/CAD.

Interest Rate Decisions

Both central banks use interest rates as a primary tool to manage inflation and economic growth. When the Fed raises interest rates, it makes it more expensive for businesses and individuals to borrow money. This can lead to a decrease in economic activity and a stronger US dollar. Conversely, when the Fed lowers interest rates, it can stimulate economic growth and weaken the US dollar.

Similarly, changes in interest rates by the BoC can impact the value of CAD. Higher interest rates in Canada can make CAD more attractive to investors, leading to an appreciation of the currency against the US dollar.

Quantitative Easing and Tightening

During economic downturns, central banks may implement quantitative easing (QE) measures to increase the money supply and stimulate economic growth. QE involves purchasing large amounts of government bonds, which injects money into the financial system. QE can weaken the currency of the central bank implementing it, as it increases the supply of that currency.

Conversely, quantitative tightening (QT) involves selling government bonds to reduce the money supply. QT can strengthen the currency of the central bank implementing it, as it decreases the supply of that currency.

Geopolitical Factors

Geopolitical events and risks can significantly impact the USD/CAD exchange rate. These events can influence economic stability, trade flows, and investor sentiment, all of which affect currency values.

Past Geopolitical Events Impacting USD/CAD

One notable example is the 2014 Russian annexation of Crimea. The event led to international sanctions against Russia, which weakened the ruble and indirectly affected the Canadian dollar, as Canada has significant trade ties with Russia. The Canadian dollar depreciated against the US dollar during this period.

Current Geopolitical Tensions

The ongoing Russia-Ukraine conflict has created uncertainty and volatility in global markets. The potential for further escalation or economic sanctions could impact the USD/CAD exchange rate. A prolonged conflict could lead to a decline in risk appetite, which could strengthen the US dollar as a safe-haven currency and weaken the Canadian dollar.

Implications for Investors and Traders

Geopolitical factors are an essential consideration for investors and traders. Monitoring geopolitical events and understanding their potential impact on currency markets can help them make informed decisions and adjust their strategies accordingly. By incorporating geopolitical analysis into their trading plans, investors can potentially mitigate risks and capitalize on opportunities.

Market Sentiment

Market sentiment towards USD/CAD is a crucial factor that can influence the exchange rate. Positive sentiment towards the US dollar or negative sentiment towards the Canadian dollar can lead to an appreciation of USD/CAD, while the opposite can cause depreciation.

Sentiment Indicators

Various sentiment indicators can provide insights into market sentiment. These include:

– Surveys: Surveys conducted among market participants, such as currency traders and investors, can gauge their sentiment towards different currencies.

– News articles: Sentiment can be inferred from the tone and coverage of news articles about the economies of the US and Canada.

– Social media data: Sentiment analysis of social media platforms can provide real-time insights into market sentiment.

Impact on Exchange Rate

Market sentiment can impact the exchange rate through several mechanisms:

– Self-fulfilling prophecies: If market participants widely expect a currency to appreciate or depreciate, their actions can reinforce that trend.

– Demand and supply: Positive sentiment towards a currency increases demand, leading to appreciation. Conversely, negative sentiment reduces demand, causing depreciation.

– Risk appetite: When market sentiment is positive, investors tend to take on more risk, leading to increased demand for riskier assets such as the US dollar.

Understanding market sentiment is crucial for traders and investors as it can provide valuable insights into potential currency movements.

– Trading Strategies

Trading strategies for the USD/CAD currency pair involve utilizing both technical and fundamental analysis to identify potential trading opportunities. Technical analysis focuses on identifying trends and patterns in the price action of the currency pair, while fundamental analysis examines economic data, central bank policies, and geopolitical factors that can influence the value of the currencies involved.

Technical Analysis

Technical indicators commonly used in USD/CAD trading include moving averages, Bollinger Bands, and relative strength index (RSI). Chart patterns such as double tops and bottoms, head and shoulders, and triangles can also provide valuable insights into potential price movements.

Fundamental Analysis

Key fundamental factors influencing the USD/CAD pair include interest rate differentials between the US and Canada, economic growth rates, and global risk appetite. Central bank policies, such as interest rate changes and quantitative easing, can also have a significant impact on the currency pair.

Trading Strategy

One potential trading strategy for USD/CAD is to buy when the price breaks above a key resistance level, with a stop-loss order placed below the previous swing low and a profit target set at a previous swing high. This strategy is based on the assumption that the price will continue to trend in the direction of the breakout.

Risk Management

Risk management is an essential aspect of any trading strategy. Techniques such as position sizing, stop-loss orders, and trailing stops can help to limit potential losses and preserve capital.

Position Sizing

Position sizing should be based on the trader’s risk tolerance and account size. A common rule of thumb is to risk no more than 1-2% of the account balance on any single trade.

Trade Frequency

The frequency of trades will vary depending on the trading strategy and the trader’s risk tolerance. Some traders may prefer to take a few trades per week, while others may trade more frequently.

Historical Examples

Historical examples can help to validate a trading strategy. For instance, the USD/CAD pair has historically shown a strong correlation with the price of oil, as Canada is a major oil exporter.

Backtesting Results

Backtesting a trading strategy on historical data can provide insights into its potential performance. Backtesting results should be interpreted with caution, as they do not guarantee future profitability.

Risks and Limitations

All trading strategies have potential risks and limitations. Factors such as market volatility, unexpected news events, and slippage can impact the performance of any strategy. It is important for traders to understand the risks involved and to trade responsibly.

Risk Management

Trading USD/CAD, like any financial instrument, carries inherent risks. It’s crucial to identify and manage these risks effectively to protect your capital and minimize potential losses.

One of the primary risks associated with USD/CAD trading is currency volatility. The value of the USD and CAD can fluctuate significantly, influenced by various economic, political, and geopolitical factors. These fluctuations can lead to substantial gains or losses, depending on the direction of the price movement and your trading strategy.

Stop-Loss Orders

To mitigate the risk of excessive losses, traders often employ stop-loss orders. A stop-loss order is a pre-determined price level at which a trade is automatically closed if the market price moves against the trader’s position. This helps limit potential losses by exiting the trade when the market reaches a predefined threshold.

Position Sizing

Another essential aspect of risk management is position sizing. It refers to the amount of capital allocated to a particular trade. Proper position sizing ensures that you do not risk more than you can afford to lose. It involves determining the appropriate trade size based on your risk tolerance, account balance, and the volatility of the USD/CAD pair.

Market News

Recent market news and events that could impact the USD/CAD exchange rate include:

The release of key economic data, such as GDP growth, inflation, and unemployment rates, in both the United States and Canada can significantly influence the exchange rate. Strong economic data in one country relative to the other can lead to an appreciation of the currency of the country with the stronger economy.

Discover more by delving into Nigel Farage further.

Central Bank Policy Decisions

The monetary policy decisions of the Federal Reserve and the Bank of Canada can also have a significant impact on the USD/CAD exchange rate. Changes in interest rates, quantitative easing, and other monetary policy tools can influence the relative attractiveness of the two currencies and affect their exchange rate.

Geopolitical Factors

Geopolitical events, such as trade disputes, political instability, or natural disasters, can also impact the USD/CAD exchange rate. These events can create uncertainty and risk aversion, which can lead to increased demand for safe-haven currencies such as the US dollar.

Market Sentiment

Market sentiment towards the US dollar and the Canadian dollar can also play a role in determining the exchange rate. Positive sentiment towards the US dollar, for example, can lead to increased demand for the currency and an appreciation against the Canadian dollar.

Market Commentary

The USD/CAD currency pair has been in a downtrend since the beginning of the year, as the Canadian dollar has strengthened against the US dollar. This is due to a number of factors, including the rising price of oil, which has boosted the Canadian economy. The Bank of Canada has also been more hawkish than the Federal Reserve, which has led to a widening of the interest rate differential between the two countries.

Technically, the USD/CAD pair is trading below its 200-day moving average, which is a sign of a downtrend. The pair is also trading below its 50-day moving average, which is another sign of weakness. The relative strength index (RSI) is also below 50, which indicates that the pair is oversold.

Trading Recommendations

- Sell the USD/CAD pair at current levels.

- Place a stop-loss order above the 200-day moving average.

- Target a profit of 100 pips.

Conclusion

In summary, the analysis of USD/CAD reveals a complex interplay of factors influencing its direction. While the US dollar has been supported by a hawkish Fed and safe-haven flows, the Canadian dollar has benefited from rising oil prices and a resilient domestic economy.

Looking ahead, the outlook for USD/CAD remains uncertain. The path of the Fed’s monetary policy and the trajectory of oil prices will continue to be key drivers. If the Fed continues to raise rates aggressively, it could boost the US dollar against the Canadian dollar. However, if oil prices remain elevated, the Canadian dollar could find support.

Ultimate Conclusion: USD/CAD

USD/CAD presents a unique opportunity for traders due to its high liquidity and volatility. By understanding the factors that drive its price movements and implementing sound trading strategies, you can harness the potential of this currency pair and achieve your financial goals.